BLUF: Your credit score can have a substantial financial impact on your life. Many people don’t understand them, pay attention to them or put in the work this one thing that can save them or cost them a lot of money. Putting in the work to increase your credit score can save you a lot of money over a lifetime.

Note: Some links include affiliate referrals and the blog will receive a benefit if you sign up for a service using that link.

What is credit?

Credit is the ability to borrow money or access goods or services with the understanding that you’ll pay later. The creditor is the person or business extending credit to you with the expectation that you pay them back the full amount at a later date including interest. Some common borrowing examples include:

- Store cards (Target)

- Credit cards

- Car loan

- Mortgage loan (home)

- Personal loan

- Boat / Motorcycle / ATV loan

What is a credit report?

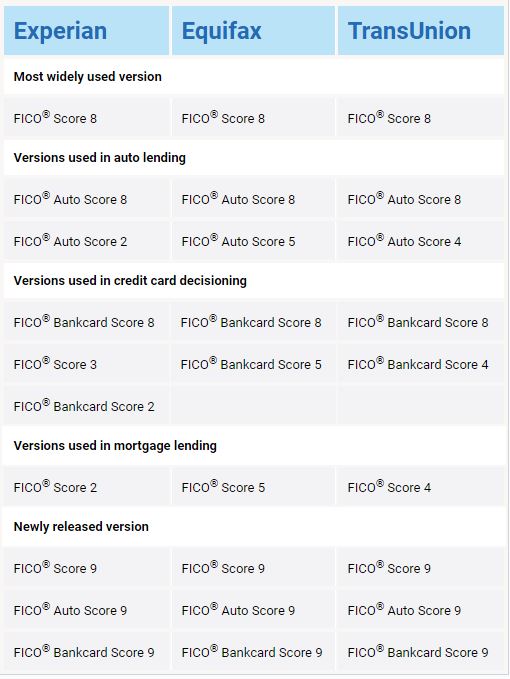

To calculate a credit score, though, you need data. That’s where the three main credit bureaus: Equifax, Experian and Transunion come in. These companies each collect information on all the credit related activity that you have from each lender and compile that data into a credit report. This includes information like account type, payment history, loan balances and available credit.

When you use a credit report service on the internet it’s pulling a credit report from one or multiple of the credit bureaus. All of the information reported to them in that credit report then is used with FICO’s formulas to calculate a credit score.

What is a credit score?

Have you ever loaned a friend money and they didn’t pay you back? Not fun. Creditors that loan money as their business certainly don’t like it either. They needed a way to understand the likelihood that a person will pay back borrowed money so that they could decide whether or not to loan them money. The two main pieces of data used by creditors to extend credit are your income and your credit score.

A credit score is a numerical way to summarize your personal credit risk based on your credit data. The FICO score, originally developed by Fair, Isaac and COmpany in the 1950’s has become the most widely used method for calculating a credit score. FICO scores generally range from 300-850 although some industry specific scores do go up to 900. It isn’t a static formula though as they keep tweaking it and evolving it based on lender needs and consumer behavior.

There is a second type of credit score that exists called the VantageScore that was created in 2006 by the three credit bureaus. The VantageScore 3.0 is very similiar to the FICOScore in that it ranges from 300-850. It uses 6 categories that are similar to the FICOScore 5 categories below but are slightly different in percentage weighting.[12]

In this article I will largely talk to the details of your FICO score although I’ve used some additional screenshots and data from CreditKarma which is using the VantageScore 3.0. The tips and advice for how these scores impact your life and how to improve them still hold regardless of which score is used. If you’d like to read more about the differences between the FICOScore and VantageScore systems you can do so here.

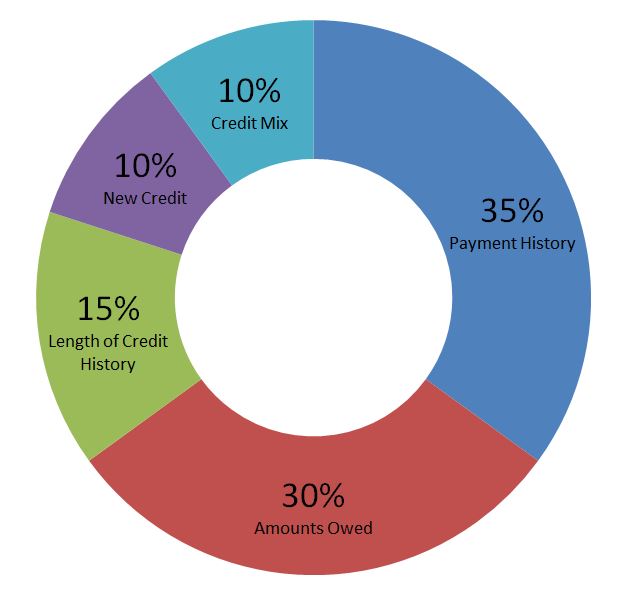

What makes up your credit score?

The exact formula of how a credit score is calculated isn’t public information but what is known are the factors that make up your credit score. I’ll go into the factors in detail using information from FICOscore.com (FICO), myFICO.com (FICO) and CreditKarma.com (Vantage). These factors apply to all credit accounts on your credit report.

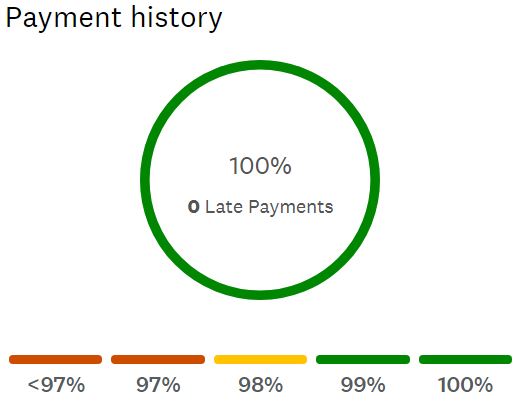

Payment History (35% of the credit score)

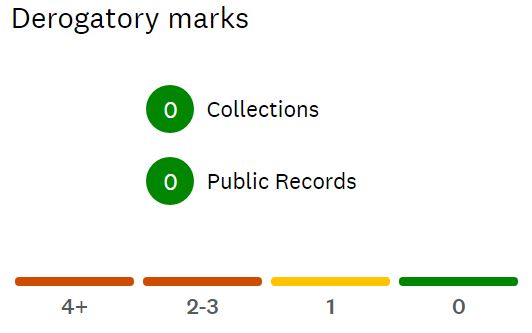

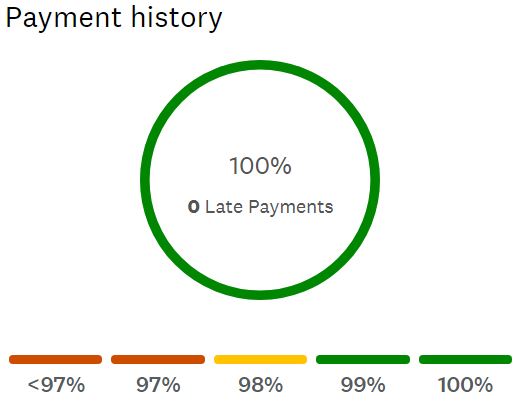

Payment history is whether you make payments on time or late each month. The lateness of the payment matters as well and are bucketized as either 30, 60 or 90 days late with each step being a bigger hit to your score. Typically after 90 days late the next step is going to collections where it becomes a derogatory mark.

How much could it impact your score being late? “With a FICO® Score of 780 (on a scale of 300-850), being just 30 days late on a payment could drop your score to between 670 and 690, according to FICO. If your score was 680, having a payment reported as 30 days late could drop your score to between 600 and 620 according to FICO.” [3] Ouch!

CreditKarma.com shows this view as a percentage of on time payments. If you had a single credit card for 10 years then you’d have 120 payments. If you had just 2 late payments in that time then (120-2) / 120 = 98.3% on time payments which is already in the yellow. It doesn’t take much to impact your score so it’s best to avoid any late payments.

Derogatory marks such as a bill that goes to collections, a bankruptcy, tax lien and civil judgements. Even a single derogatory mark is high impact and the worst part is that they can stay on your credit report for 7-10 years!

If you thought late payments had a negative impact on your score, hang onto your hat for the impact of a bankruptcy. “Bankruptcy could have an even bigger impact, according to FICO, potentially dropping a FICO® Score of 780 to between 540 and 560, while a 680 score could fall to between 530 and 550.” [3]

It is important to note that a late payment or a derogatory mark does negatively impact your score immediately, but that score impact starts to fade over time if you don’t have any other bad marks.

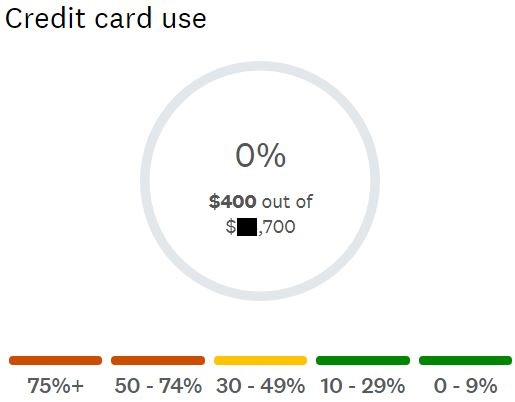

Amounts Owed (30% of the credit score)

There are 5 different factors that FICO uses in the amounts owed category that feed into the 30% weighting:

- The amount owed on all accounts – Even if you pay off your cards in full you’ll almost always show as having a balance on your credit report. This is just the timing of when the balance is reported compared with your payoff date.

- The amount owed on different account types – The type of account like an installment loan for a car is viewed differently than a revolving credit account like a credit card.

- How many of your accounts have balances – If all of your cards have a balance you appear to be higher risk than a borrower with mostly zero balances.

- How much is owed on an installment loan compared with the original loan – If you take a $200,000 mortgage your credit score will improve as you go from a balance of $200,000 (100%) to $160,000 (80%)

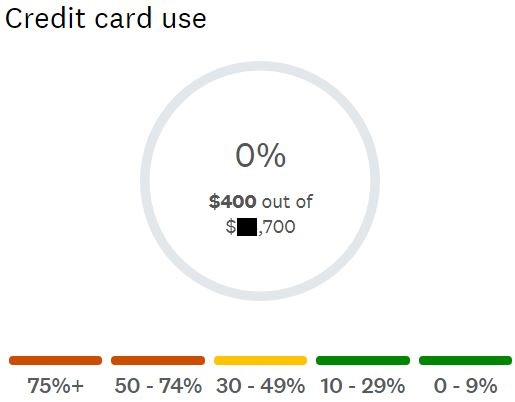

- Credit card usage ratio – This is the total balances / total available credit. Just like with #1 your credit report likely won’t show a zero balance even if you pay off your cards in full because of the timing of reporting the balances. Example – if you owe $500 on a $2,000 limit card and $1,000 on a $15,000 limit card then your usage would be $1,500 / $17,000 or 8.8%. [4]

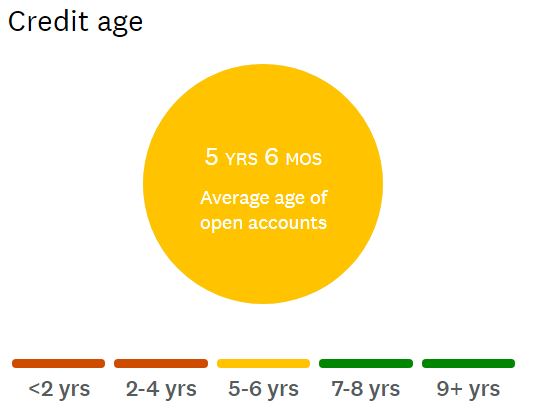

Length of Credit History (15% of the credit score)

The length of your credit history deals with the age of the credit accounts on your credit report. Very logically, the longer you’ve had lines of credit and shown responsible use of them, the lower the risk you are to a lender. There are three things that the FICO score takes into account in this category:

- How long your credit accounts have been open including the age of your oldest account, the age of your newest account, and an average age of all your accounts.

- How long specific credit accounts have been open.

- How long it has been since the account has been used.[5]

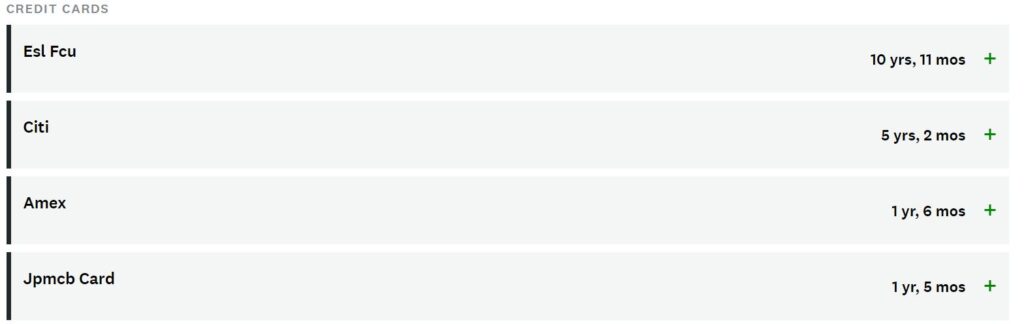

CreditKarma shows you information on the average age of open accounts which is doing just that – averaging the time each account has been open across all of your open accounts. 7-8 years on average is the start of the good area for a VantageScore 3.0 so as you can see this kind of thing takes time. This is one reason why it’s bad to close old accounts if you aren’t using them. It could substantially drop the average age of your credit.

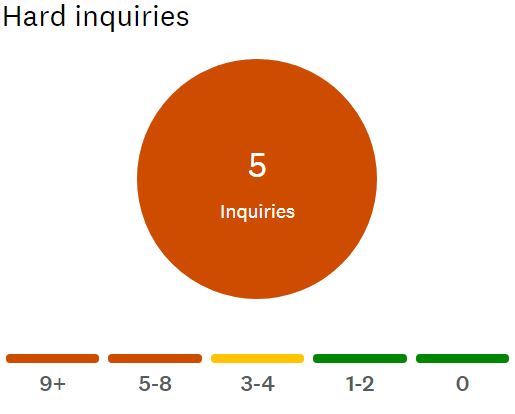

New Credit (10% of the credit score)

When you attempt to open up a line of credit there is what’s known as a hard inquiry to your credit report. These hard inquiries stay on your report for two years although only one year is used to calculate your FICO score.[6] There are three main items that FICO looks at in the new credit category:

- The number of new accounts that you have.

- How many recent inquiries you have – this is anytime that a lender requests your credit score or report. When this is done to open an account it’s known as a hard inquiry and is more impactful on your credit score. A soft inquiry on the other hand does not impact your credit score. Soft inquiries include things like checking your credit score personally, getting a copy of your credit report and getting pre-approval from a lender for credit.[7]

- The time since opening up your last new account – borrowers who open many new accounts in a short period of time are higher risk.[6]

Hard inquires stay on your credit report for a little more than two years. Their impact on your score is still minor and that impact also decreases over time.[7]

Credit Mix (10% of the credit score)

Credit mix refers to the different types of credit accounts that you may have on your account. There are two main types of accounts:

- Revolving credit accounts – these are accounts with an established credit limit that you can reuse and make payments on. Examples include credit cards, retail store cards, gas station cards and even a home equity line of credit (HELOC).

- Installment loan – a fixed balance is paid off progressively over time. Examples include a car loan, mortgage loan, student loan, furniture loan, boat loan and motorcycle loan.

I wouldn’t create new loans just to satisfy the mix the accounts here being that it’s only worth 10%. To me this is just something to be aware of as a low credit impact.

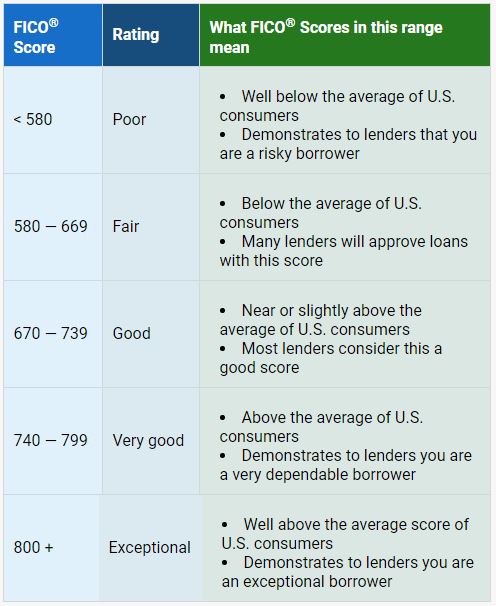

What credit score is good?

That’s how credit scores work, but what is a good credit score? The table below is a good general guideline for what each score means for a FICOScore.

To qualify for the best credit card offers you often need at least 690. In the mortgage example down the article the top rate is achieved at a 760 FICO score. Once you’re in the upper 700’s you can feel pretty confident that your score is good enough to get the best rate.

How a credit score impacts your life:

Okay, enough going on and on about how credit scores work. Why should I care? How does this impact my life? Well, your credit score follows you forever and is used in an increasing number of ways because it’s an easy assessment of risk based on your consumer behaviors. Here are examples of life situations when your credit score and/or report are used:

- To qualify for a loan – Fairly obvious but your credit score is a big part of being approved or denied for a loan. Each lender has their own standards for risk and if your score is too low many lenders will deny you.

- To determine the interest rate offered on any loan – if you are approved for a loan, the rate that you pay is HIGHLY dependent on your credit score. See the mortgage example in the next section. This translates into a low credit score costing you a lot of money over the course of your life.

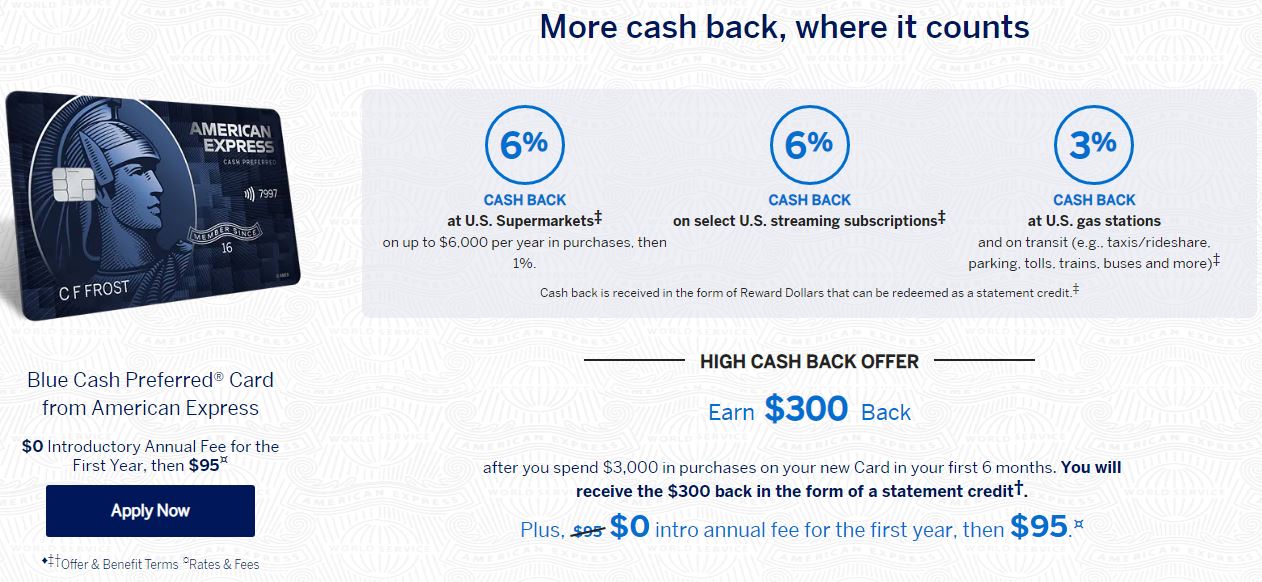

- To get approved for the most lucrative credit cards – who doesn’t love cash back and travel rewards? Unfortunately only high credit scores are eligible for the best cards. If you don’t have at least a 700 score you can’t get the best cards.

- To rent a place to live – Landlords sometimes check your credit. A landlord isn’t extending credit but they do need to be paid monthly just like an installment loan. They want low risk tenants that will pay reliably. They may not rent to you or ask for a larger security deposit. Foreclosures and evictions show up on a credit report which could be grounds to deny your application.

- To get insurance – insurance premiums are payments and insurance companies they want their money. You could receive higher rates or be denied if you credit report shows a poor payment history.

- To get a new job – they need written permission but prospective employers can request a copy of your credit report. Some jobs require the use of company credit cards and they want to ensure that the applicant will be able to both get approved for a credit card if needed and is also trustworthy in their use of that card.

- To get utilities setup – yet another payment that a utility company wants made. You could be forced to provide a security deposit if you have bad credit.[9]

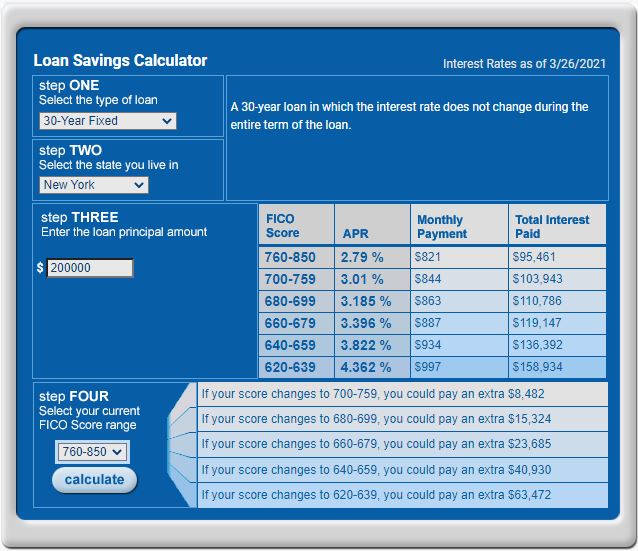

Credit score impact on a mortgage

Here’s a great example of why you should care about your credit score. Even if you came from the Dave Ramsey camp and don’t believe in credit cards, chances are you’ll have a mortgage at some point in your life. In the example below the different between a 760 credit score and a 639 credit score is $166/mo and $63,472 more paid in interest over the life of the loan! You pay $63,472 extra and get absolutely nothing in return. It’s purely a tax on a higher risk borrower because you’re more likely to default based on your credit score. [10]

Tips for increasing your credit score:

- Improving Length of Credit History: Stop closing accounts! This may seem counter intuitive but it can actually damage your credit score to close old accounts. Why? The length of your credit history will decrease if you close a very old account. Even if you don’t use a card anymore keep it open and put one or two charges a year on it to ensure the lender doesn’t close the account for inactivity. If the card has an annual fee see if you can do a product change.

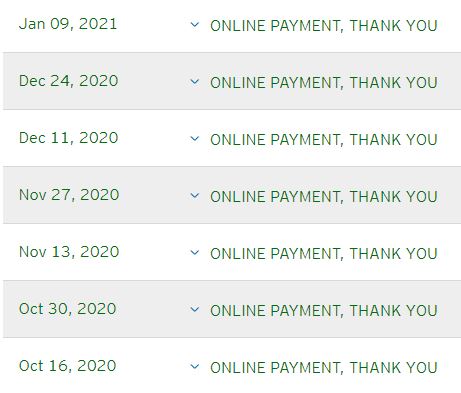

- Improving Payment History: Did you know that you don’t need to have a payment due to register an on-time payment with the credit bureau? The screenshot below is the payment history for a credit card that I use once a year to keep it active.

- Improving Length of Credit History & Payment History: Add overdraft protection to your checking account. My overdraft protection shows up as a loan on my credit history. It’s the oldest thing on my credit report! That’s an easy way to build credit.

- Improving Payment History: Make your payments FAR in advance of the bill. Why screw around waiting until the last minute and risk a problem that could give you a late payment? I pay my credit card balances in full every two weeks on the day that I get paid. Just because the credit card company gives you an extra month doesn’t mean you have to wait until a statement is issued to pay your card.

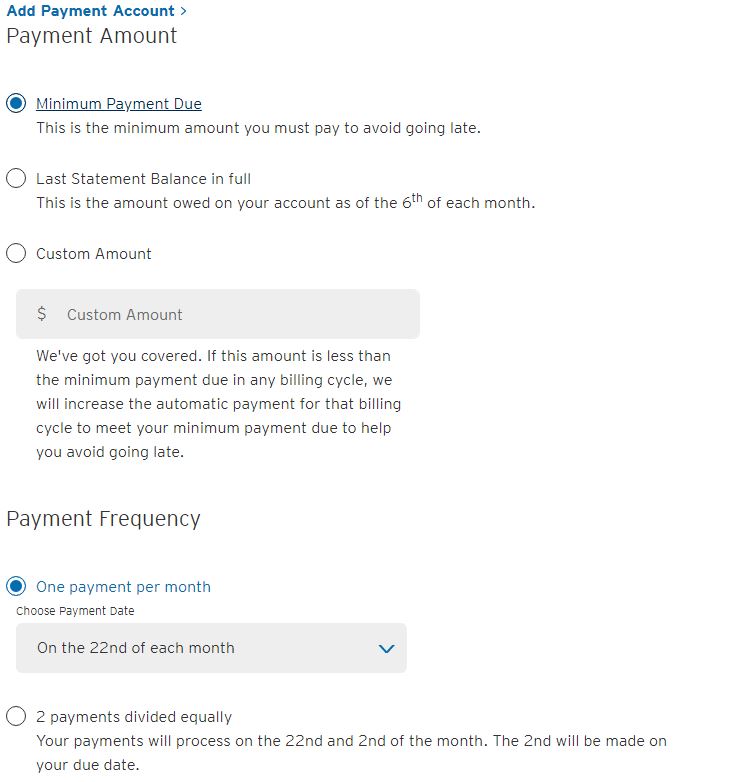

- Improving Payment History: Turn on autopay for your credit cards for the minimum payment due as a backup. Then you know you’ll never be late. You can still pay your cards on whatever schedule you want manually. I have autopay turned on even though I pay my cards every two weeks. Screenshot below showing the wide variety of autopay options.

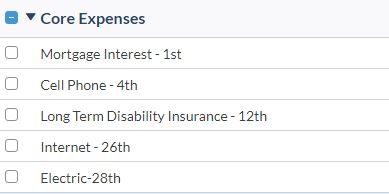

- Improve payment history: Have a system to ensure you never miss a payment. Create a payment schedule for bills so you know what bill is due on what day. I do this in YNAB by writing the due date next to each bill.

Improve Amounts Owed: This seems counter intuitive but open up another credit card. If you have a $3,000 balance on a $5,000 limit then you’re using 60% of your available credit. If you open another $5,000 limit card then your usage drops to 30% instantly. This is why credit card rewards can actually increase your credit score. Amount owed has a 30% impact on your credit score while new accounts have a 10% impact. The positive impact of reducing amounts owed with a new card outweighs the the temporary hit of a hard credit inquiry.

- Improve Payment History: Open additional credit card accounts to reduce the impact of a late payment. More accounts = more payments which will more quickly lessen the impact of a missed payment. If you have a single card with 1 late payment in 1 year you have 11/12 or 92% on time payments. If you keep that same card for another year you have 23/24 on time payments or 96%. Still in the red. However, if you opened a second card for year 2 then you’d have 35/36 or 97% on time payments. If you opened a second and third card in year 2 you’d have 47/48 or 98% on time payments. You recover faster.

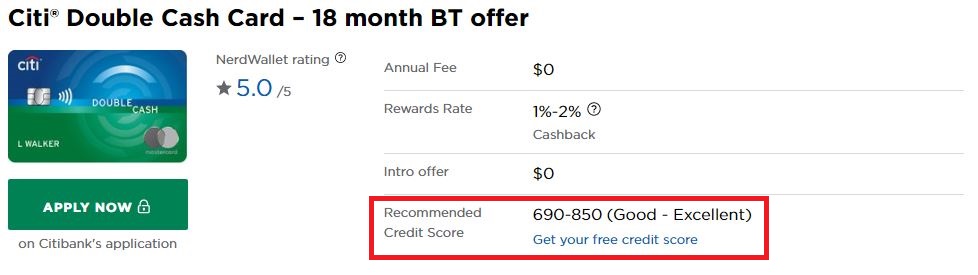

- Figure out the ideal credit score range to be approved for credit before applying. Hard inquiries ding your credit score so do you homework first. For example, Nerdwallet.com gives you a recommended credit score range in order to be approved for a card.

Tips for establishing credit from scratch:

How do you build credit when nobody will extend you credit…because you have no credit history? It’s a cruel catch-22 situation. Here are some ideas to build a credit history if you’re just starting out:

- Apply for an overdraft line of credit on your local bank checking account. This establishes a long term loan and if you have a savings account with cash in it this is low risk to the lender. Ask far a small amount as any amount will build credit.

- Ask to be an authorized user on a relative or friends credit card. Even if they never hand you the physical credit card it’s still building your credit. That would be one way to make their risk zero (you don’t have a card to charge their account) and it’s still building your credit.

- Get a secured credit card. These are credit cards where you put up cash as collateral. For example, they’ll make you provide $500 if your credit limit is $500 to ensure there’s no risk to the lender.

Action Steps:

- Get a free copy of your credit report and credit score from a site like CreditKarma.com.

- Review your credit report closely. Does anything look wrong?

- If you have any errors contact the credit bureau (Transunion, Equifax, etc) and request that it’s fixed.

- Take action from the tips section!

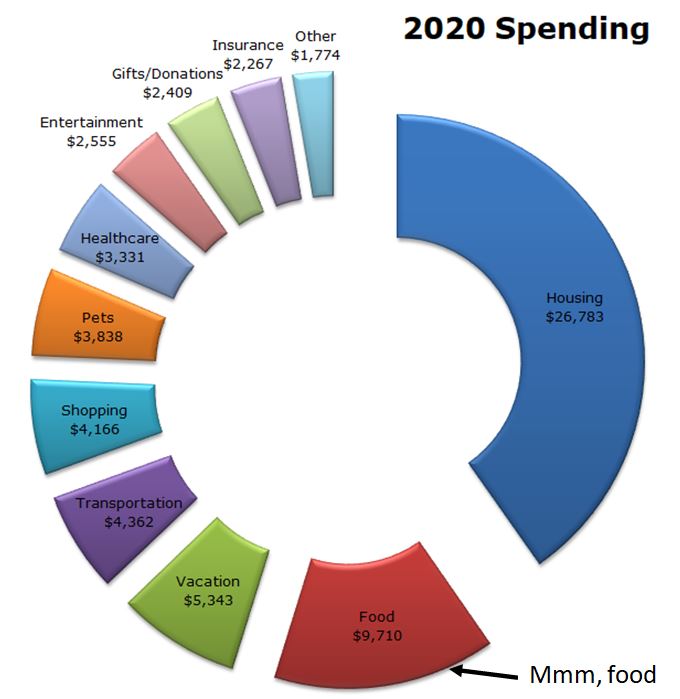

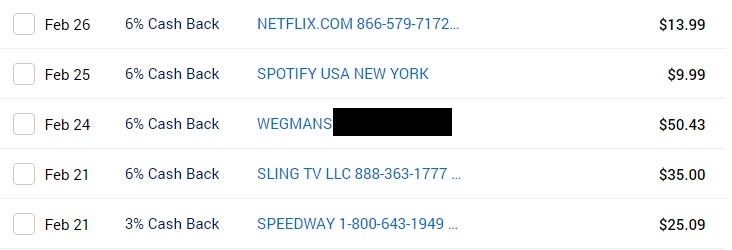

- Take advantage if you have great credit with credit card rewards. I save $265/yr buying groceries with a card that requires excellent credit.

- If you’ve increased your credit score drastically since opening up lines of credit call and ask them to reduce your APR. Refinance installment loans to lower rates.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.

How have you improved your credit score? Did you learn something new? Did you take action and improve your score? Comment below!

Article Sources:

- FICOScore. Do I have more than one FICO score? https://www.ficoscore.com/faq. Accessed March 27th, 2021.

- FICOScore. YOUR CREDIT DECISIONS HAVE A DIRECT IMPACT ON YOUR SCORES https://www.ficoscore.com/education#CreditDecisions. Accessed March 27th, 2021.

- CreditKarma. Payment history: What it is, and why it matters to your credit. https://www.creditkarma.com/advice/i/payment-history-credit-report. Accessed March 27th, 2021.

- myFICO. What is Amounts Owed? https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed March 28th, 2021.

- myFICO. What is the Length of Your Credit History? https://www.myfico.com/credit-education/credit-scores/length-of-credit-history. Accessed March 28th, 2021.

- myFICO. What is New Credit? https://www.myfico.com/credit-education/credit-scores/new-credit. Accessed March 28th, 2021.

- Experian. Hard vs. Soft Inquiries on Your Credit Report. https://www.experian.com/blogs/ask-experian/credit-education/report-basics/hard-vs-soft-inquiries-on-your-credit-report/ Accessed March 28th, 2021.

- myFICO. What Does Credit Mix Mean? https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed March 28th, 2021.

- thebalance. People Who Check Your Credit https://www.thebalance.com/people-who-check-credit-report-960517. Accessed March 28th, 2021.

- myFICO Loan Savings Calculator. https://www.myfico.com/credit-education/calculators/loan-savings-calculator/ Accessed March 28th, 2021.

- FICOScore. What is a good FICO Score? https://www.ficoscore.com/faq. Accessed March 28th, 2021.

- VantageScore. VantageScore 3.0 White Paper. https://vantagescore.com/pdfs/VantageScore3-0_WhitePaper.pdf. Accessed March 29th, 2021