BLUF: Budgeting is financial planning at the monthly level. It lets you manage your way through the variability of life while staying on track to hit your long term goals. Don’t let it control your life though. Your plan needs to adapt to life, not the other way around.

Just don’t budget and you don’t have to worry about your spending. End of article! Just kidding, that doesn’t work. A plan to ignore reality only works in the short term before reality comes back to smack you upside the head. Reality can hit pretty hard, too.

I resisted budgeting for a long time. Each year I did a little bit of work at the end the year to summarize my annual spending in Excel. I tried expense tracking in Excel for 3 months since I knew it well and it was painful. Even for me, a lover of spreadsheets. When I found the You Need A Budget (YNAB) product it was a 2 for 1 deal that did both expense tracking and budgeting. I’m the type of person to go all in and give something a try. So I did!

This article is going to cover how I zero based budgeting with YNAB, the benefits that I’ve discovered since I started budgeting and some tips for you as you embark (or continue) on your own budgeting journey.

If you don’t know much about expense tracking I suggest you start with my article on that topic first and then come back here. Expense tracking is the foundation on top of which budgeting is built.

What is a Budget and Budgeting?

A budget in its most basic form is a financial plan over a period of time but most commonly a year in personal finance. This financial plan includes how much we plan to earn, spend and save. Having a plan gives you the day to day flexibility to live life while month to month you have a north star helping to keep you on track to your overall goals.

Budgeting is the process of creating and executing that financial plan. It’s figuring out in advance of money arriving how you plan to save and spend that income. If you’re reading this blog you might very well have some larger financial plans for how you’ll get out of debt, reach FI or just save X amount this year. Budgeting is financial planning but on a smaller scale since it has monthly and annual time horizons.

Zero Based Budgeting

Zero based budgeting is creating a plan for every dollar that comes in via your paycheck or whatever income source you have. It may sound intimidating but with a tool like YNAB it’s much easier. You plan for how those dollars will be assigned for savings, spending that month and larger expenses that will happen in future months. Don’t worry, this will make more sense when I get into some examples.

Tracking Spending vs Budgeting

Sometimes people talk about tracking spending and budgeting as if they are the same thing. They are NOT!

- Tracking Spending – You spend money without any awareness of how much you could spend. You record the transactions and categorize them after the spending is done.

- Budgeting – You have a plan for how your income will be spent before you actually spend the money. As life happens and money is spent you tweak your budget as needed on a month to month basis to try and keep the overall spending for the year to your plan.

Basic Information You Need To Start

One of my goals with this article is show how you can make budgeting work for you and encourage people to give it shot. Before I get into the specifics of how I work a budget on a monthly basis I’m going to go over what you need before you get started yourself.

All of the pieces of information below feed the basic formula of income = savings + expenses. You don’t need to know exact numbers for each area but you do need at least an educated guess.

Calculate Your Annual Income

You need to know roughly how much money you make in a year so that you can make a plan for have much you can realistically save and spend. If you’re a salaried employee that gets paid every 2 weeks then you get 26 paychecks a year. If you get paid $3,000 a paycheck then that’s $3,000 * 26 = $78,000 take home pay a year.

Measure or Estimate Your Annual Expenses

Here is where tracking your expenses or at least doing an annual spending summaries comes into play. You need to know roughly what your expenses are for a year. Not only that, but for each budget area where spending is variable like groceries or entertainment you need to make a guess at what you want to spend per year.

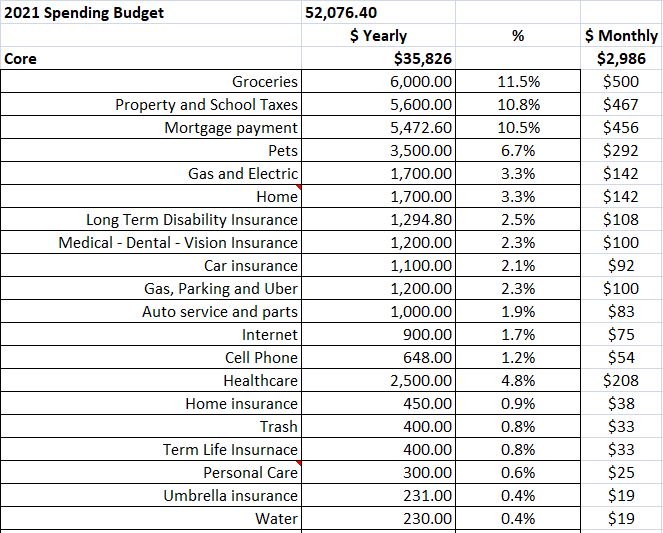

That’s why it’s critical to have expense tracking down first to feed into your budget plan. More details in how to do that in the tracking spending article. In my case my 2021 spending target was $52,000. If you have no idea just get 3 months of data and use that to forecast what a year might look like.

The 3 month look with give you the common expenses but make sure you capture all the annual and semi-annual expenses. It’s these infrequent expenses that usuaully surprise people and throw off their spending if they aren’t planned. Taxes (property, school, income), insurance premiums (car, life, umbrella) just to name a few.

Come Up With An Annual Savings Target

Why come up with an annual savings target? It’s far too easy to just spend what you want and try to save the leftovers. I’m a big proponent of the “pay yourself first” approach to saving. Figure out what you can save each month and then setup a system where savings is required to be “paid” just like a bill.

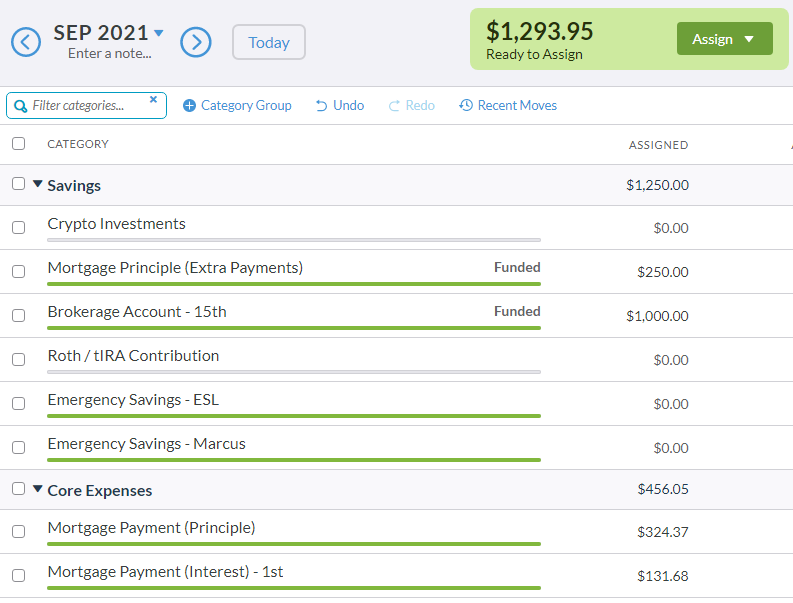

In the image below you’ll see that I even arranged by category groups so that savings comes first. That’s not by accident, it’s to reflect my priorities. When I allocate monthly I go top to bottom and the savings accounts get “paid” first before I move to my core expenses.

Using the example so far, we’re taking home $78,000 in income and have expenses of $52,000. That leaves $26,000 ($78k-$52k) that could be used for savings.

Setting Up Your Budget Plan

I’ll warn you now, getting a budget setup the first time takes some work. It’s the hard part but once you’ve done it the work and time required month to month and year to year is very little.

Defining Budget Categories

This is already done! When you started tracking your spending you defined the buckets that you would use to track that spending. All we do now is use those same exact categories to use for our budget and plan for the spending that will happen in those categories.

Breaking Down Expenses & Saving Monthly

Most budgeting is handled monthly so the first task to project how much you need to plan for each month in that budget category.

The Extra Paycheck “Problem”

The first topic to touch on though isn’t really a problem, but can cause headaches. It’s the fact that budgeting is monthly but paychecks are usually every 1 or 2 weeks. Because of that the frequency of your pay isn’t consistent each month.

In our example of getting paid $3,000 every 2 weeks you will technically take home $78,000 a year. Divided into 12 months that’s $6,500/mo on average. Life isn’t average though. Cash flow wise you’re going to get $6,000/mo for 10 of those months (2 paychecks) and the other 2 months you’ll get $9,000/mo (3 paychecks).

To avoid having a problem on a monthly basis I simply make sure that the targets that I set for my budget monthly fit into the $6,000/mo guaranteed income. When those extra paychecks come they go towards larger annual bills or additional savings.

Breaking Down Expenses

I’m a big spreadsheet guy so I used that to figure out my 2021 budget. Using my expenses from 2020 as a guide for what was reasonable I came up with a yearly target for each category and then let the spreadsheet calculate the monthly equivalent. If you want to make the numbers easier make sure your yearly expense values are easily divisible by 12 or you’ll end up with odd monthly values. Ex. Round $1150/yr to $1200/yr so that it’s $100/mo instead of $95.833333333333333333333333333333333333.

It’s important to do this with ALL expenses. One place where people often mess up with their budget is to not include annual expenses because they aren’t a consistent bill. My taxes, for example, are $5,600 a year but are

Breaking Down Savings

You rinse and repeat the same process with savings goals which should be easier because there are usually few buckets to deal with. For example, if you want to max out your IRA for the year that’s $6,000 or $500/mo.

Setting Your Plan On Autopilot with YNAB

You now know how much you need to save and spend monthly in each category to stick to your budget. Time to put those details into YNAB so that each month you don’t need to remember what your goals are supposed to be.

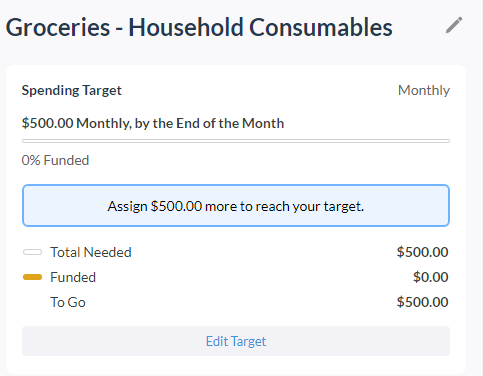

Setting Spending Targets

Things like groceries are expenses that happen each month but the exact amount spent is going to vary. YNAB lets you input a target spending amount and will remind me to save $500 each month for groceries and other household consumables (toilet paper, paper towels, shampoo). If you allocate $500 to groceries and only spend $450 that month, YNAB will roll over the extra $50 to the next months grocery budget. You can either budget another $500 to build some buffer or only budget $450 more instead of the usual $500.

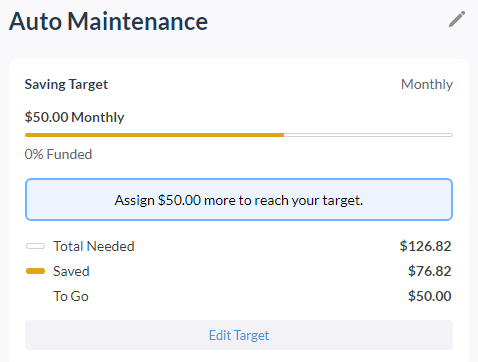

Sinking Funds / Monthly Savings Targets

If you have infrequent expenses like auto repairs you need to plan for those as well. A sinking fund is a temporary savings bucket to be used for expected future spending like car maintenance. It won’t happen every month, but you’ll need the money at some point. I plan for $600/yr so that’s $50/mo.

YNAB has a savings target option which expects you to save a target amount each month. This is what you’ll use for both sinking funds and savings goals.

Saving For Big Bills / Goals

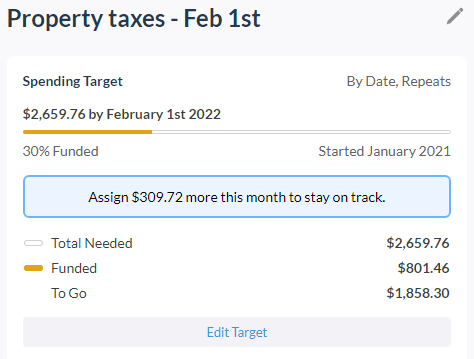

Budgeting for big, long term expenses and goals can be the most challenging. YNAB makes this easy by letting you set a dollar amount and a date that you need the money. Then, it calculates how much you need to budget that month to stay on track towards that savings goals.

For example, my property taxes are once a year in February and are a big bill. YNAB has calculated that I need $309.72/mo from now until then to hit that goal. If an unexpected bill came up and I couldn’t save for this one month it would automatically recalculate the new monthly amount for me.

Monthly Budgeting In Action with YNAB

Having a plan is great, but life happens and nothing goes to plan. Life is messy and your spending will never align exactly to your plan. I think this is a point of frustration that causes some to give up on budgeting. Hang in there! To me this is where having a good tool like YNAB can let you roll with the punches and stay on track. Did you see what I did there? 😉

Overview

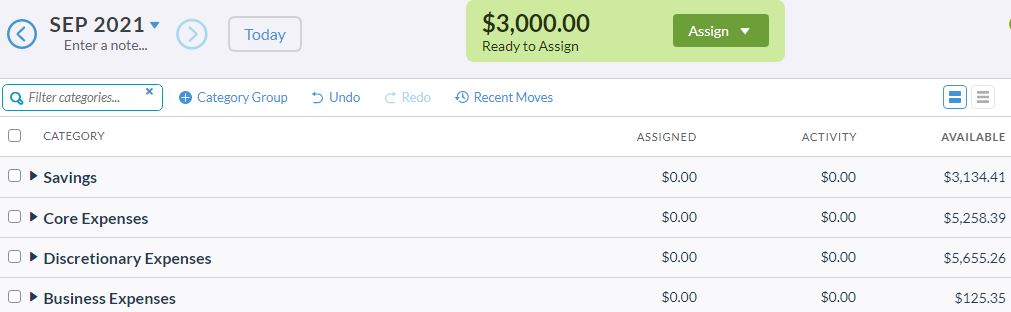

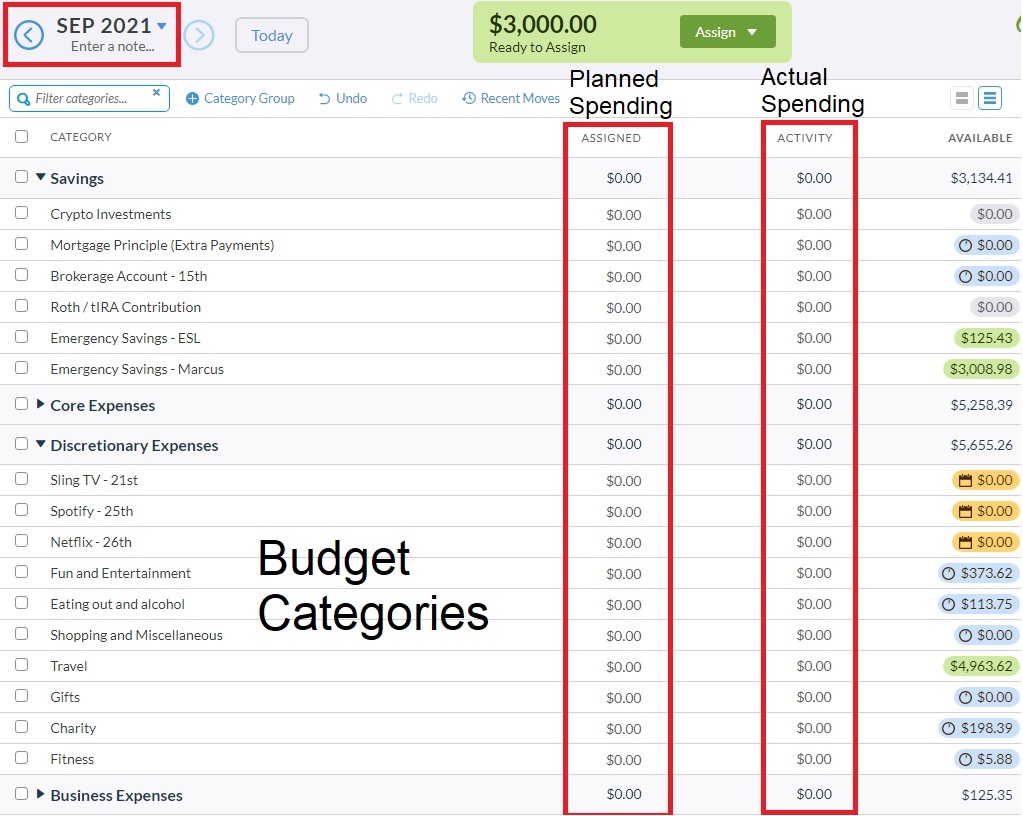

Zero based budgeting means that when you get paid it’s time to give those dollars a job. In the example below we were paid $3,000 and those dollars need to be assigned for our planned expenses in September. “Planned Spending”, also called Assigned, is how much you want to budget towards each category for that month. Actual spending tracks the real spending that occurred.

As I assign dollars it subtracts them from the “ready to assign” bucket automatically. If categories have funding goals then as I hit that goal YNAB will tell met that I’ve fully funded that category for the month.

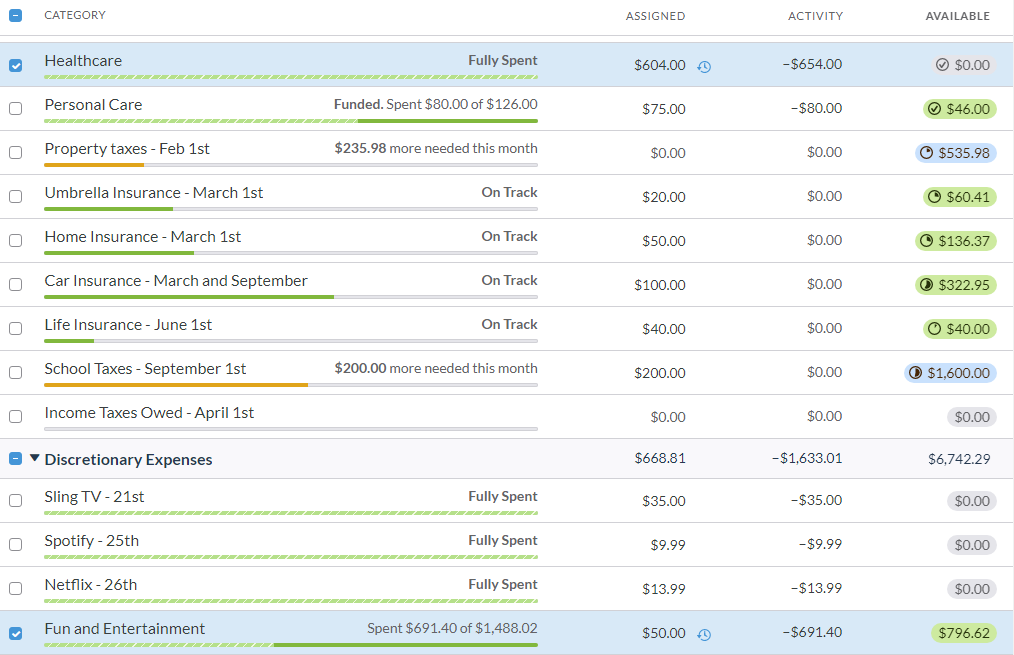

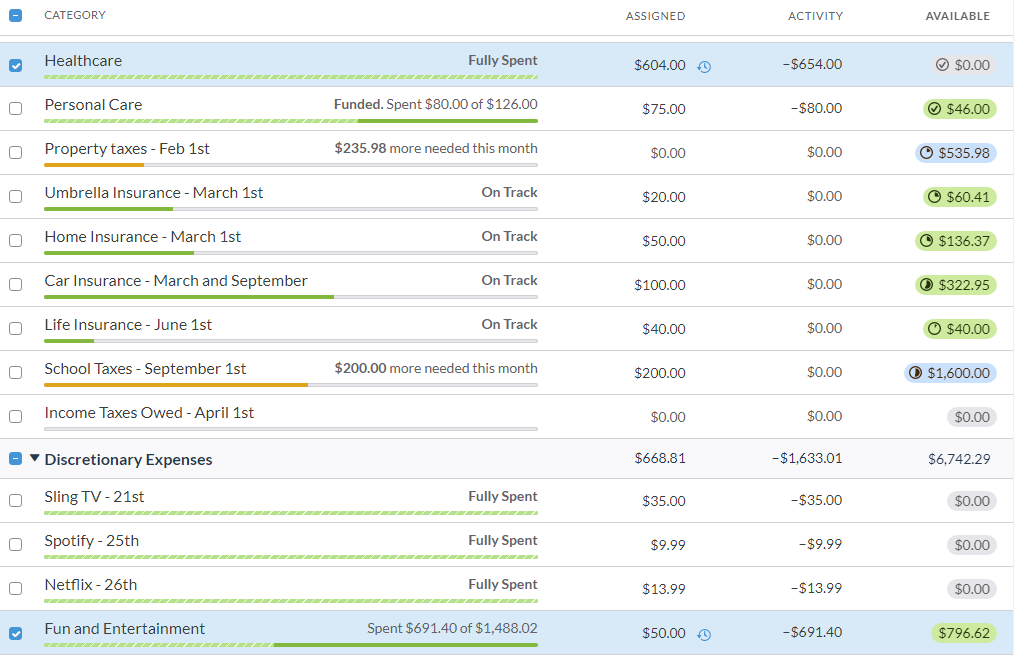

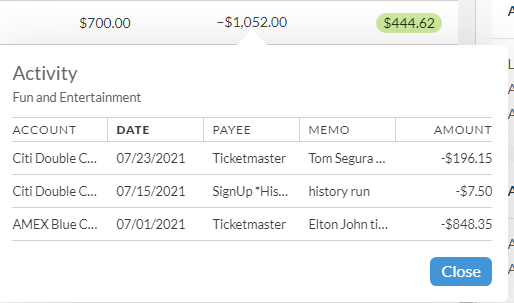

An example of rolling with the punches. Usually I budget $250/mo for fun and entertainment. In June I had a big healthcare bill ($654) that was unexpected. As a result I only budgeted $50 to fun and entertainment that month as I needed the $200 to cover my healthcare.

Because I had been saving $250/mo previously in my fun budget and not using it I had a lot in the fun sinking fund. I spent $691 for fun in June, only allocated $50 in new budget money to the pot and still had $796.62 available to spend. That’s the power of sinking funds, planning ahead (budgeting) and having software like YNAB to let you adjust on the fly.

Other budgeting methods

There are a LOT of budgeting options out there that are well covered in other articles so I’ll let you explore those on your own if you don’t like zero based budgeting. One of our favorite finance shows forces people to use cash in jars to manage their money. That’s also zero based budgeting but in a very rudimentary way. YNAB is essentially a fancy digital jar system that works across all bank accounts and credit cards.

Benefits of Budgeting:

There are some benefits of budgeting that I’ve noticed along the way that I wanted to share.

Stress Reduction

Having a budget with all these little sinking funds for infrequent expenses reduces the worry that I’m not going to have the money if something pops up. These little sinking fund buffers also make it easier to cover one area that might blow up unexpectedly in a month without having to go into debt or my emergency fund. I just shift spending from one area to another.

Satisfaction of Hitting Little Goals

There’s some odd satisfaction that I get from assigning money to each category every month and seeing YNAB tell me that I’m “Funded” or “On Track” with my plan. It reinforces to me that I have a plan and I can check the box because I hit the plan for that month.

No Guilt About Spending Money

One area where frugal people sometimes struggle is that they have guilt about spending money. I think budgeting helps with that guilt in that once the money is in the budget it’s a part of my plan to spend it. In July I spent $1,045 on Elton John and Tom Segura tickets. It fit into my budget so even though they’re the most expensive tickets I’ve ever purchased I didn’t feel guilty one bit. Okay, the $700 in cash back rewards that I used helped too.

Less Worry About Stolen Accounts

With YNAB I see all the spending, real time. I don’t worry about a card being stolen because I’ll see a fraudulent charge as soon as YNAB imports it. I no longer have to look at credit card statements to make sure everything looks right a month after I spend the money.

Advice When Budgeting

- Don’t choose an overly aggressive budget to start. Choose something that you know you can work within without deprivation. Worst thing you can do is get frustrated and quit because you can’t make the numbers work. For example, my spending budget is $52,000 for the year but I have an extra $3k of unplanned income in case something comes up. I think leaving a buffer of 5-10% of your annual budget as unassigned money helps you psychologically to deal with surprises. If no surprise expenses happen then you just have extra savings.

- Life is unpredictable, expect your budget to flex and change. Have a plan to start but don’t be afraid to adjust that spending plan as the year goes on. Maybe you’ve found a way to save on your food budget and can lower that target. Maybe you’ve picked up a new great hobby that you love but costs $100/mo. DO IT, just make it work with your budget. Whatever you do, don’t be a slave to your budget.

- Don’t worry about chasing perfection. If something doesn’t quite balance perfectly or some expense is unaccounted for don’t let it worry you. If it’s a small dollar amount that’s in the noise, leave it in the noise and don’t worry about it. It isn’t worth your time to chase perfection.

- Don’t budget for the extra paychecks month to month. I covered this earlier, but if you get paid 2x a month most of the time don’t plan on those extra paychecks into your normal monthly plan.

Action Plan:

- If you haven’t started tracking your spending and want to budget, start there first!

- Estimate your annual expenses, income and savings goals and then break that down into monthly amounts.

- Use a program like YNAB to create budget categories and assign amounts that you’ll be targeting. Build slack into your budget, especially if you haven’t done this before.

- Start tracking to your budget! Don’t be hard on yourself if you were way off with some estimates and have to change your plan. Your plan needs to adapt to your life, not the other way around.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.