BLUF: Target date funds are an incredibly simple way to get started investing. However, as you approach retirement they may limit your options or not align with your goals if you use them incorrectly.

Sorry for the lack of posts lately ManagingFI family! I’ve been on vacation checking out Alaska using travel rewards, running some ultramarathons and generally enjoying the nice weather. NY weather is rough in the winter so we make the most of it when it’s nice!

J.L. Collins’ book The Simple Path To Wealth mentions using target date funds as a simple and easy way to get investing. But what are you really buying with a target date fund and how do they work?

Beyond understanding how they work, it’s important to understand the pros and cons of these funds. Like most things that are overly simple, there are pros and cons to using target date funds. We’re going to explore why they’re a pretty good option for new investors but you may want to plan on “graduating” from them along the way.

What Are Target Date Funds?

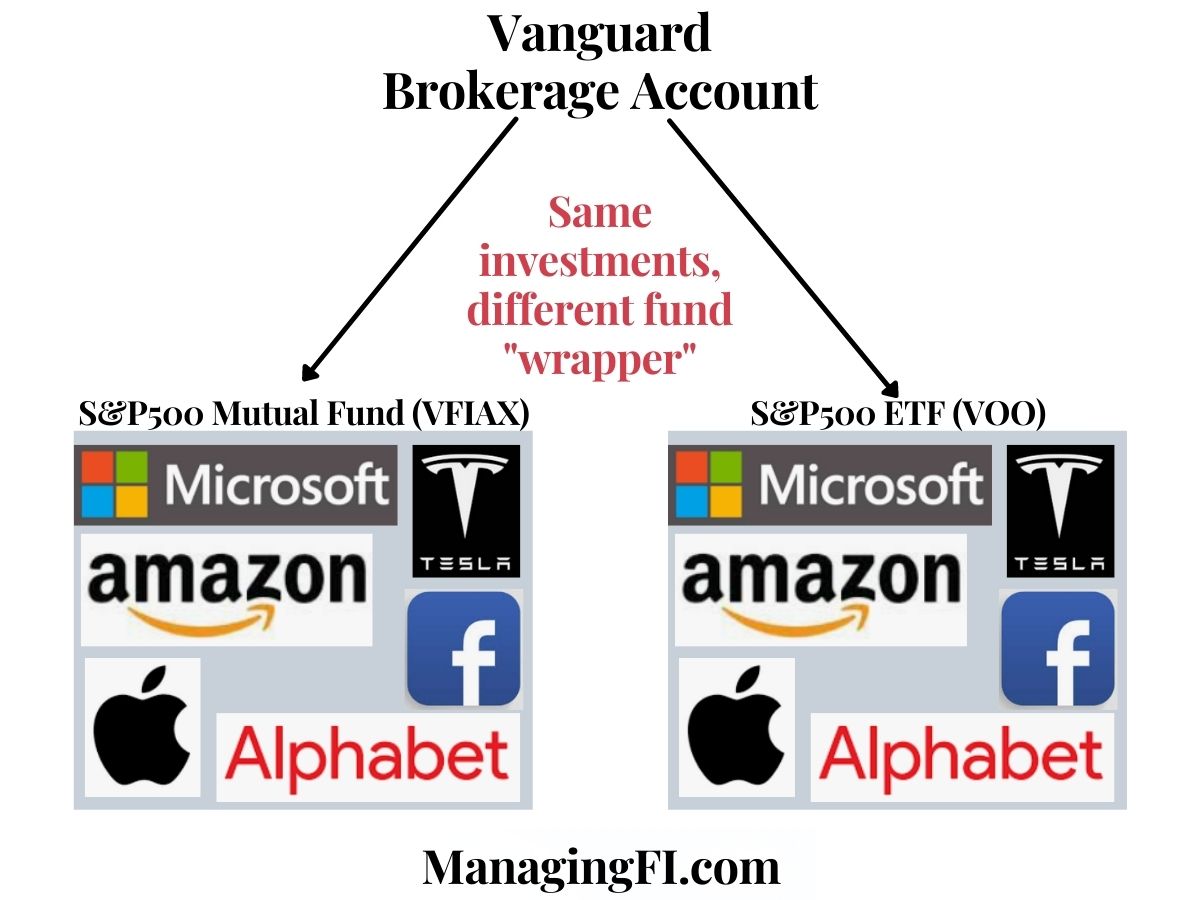

Target date funds are a type of mutual fund or ETF that are intended to be a simple, “all in one” investment option. Not everyone wants to put in the time to learn about asset allocation, stocks and bonds. Target date funds fill that need by offering a single fund to purchase that gives the owner a fully diversified portfolio.

Lets dive into the details of how these target date funds operate.

How Target Date Funds Work

The selling point for a target date fund is simplicity! The investor doesn’t need to know anything more about investing than the date that they want to retire. That’s where the name target date fund comes from. They are mutual funds that you select based on your target retirement date

Selecting A Target Date Fund

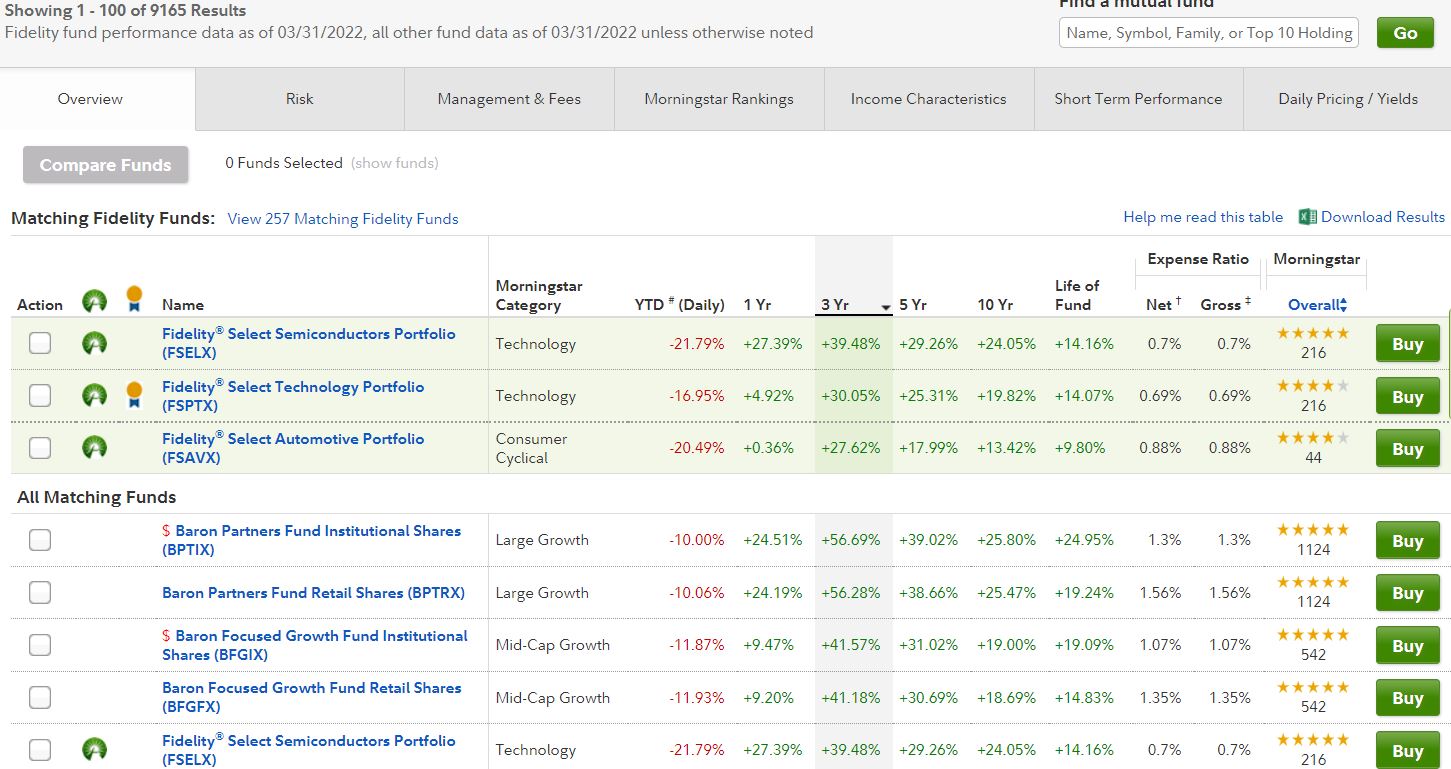

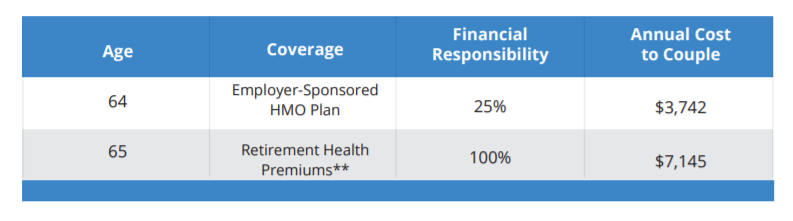

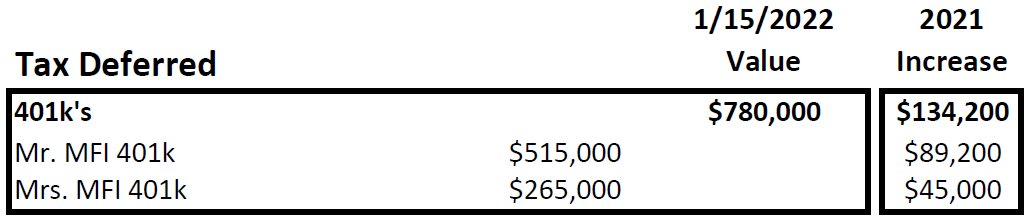

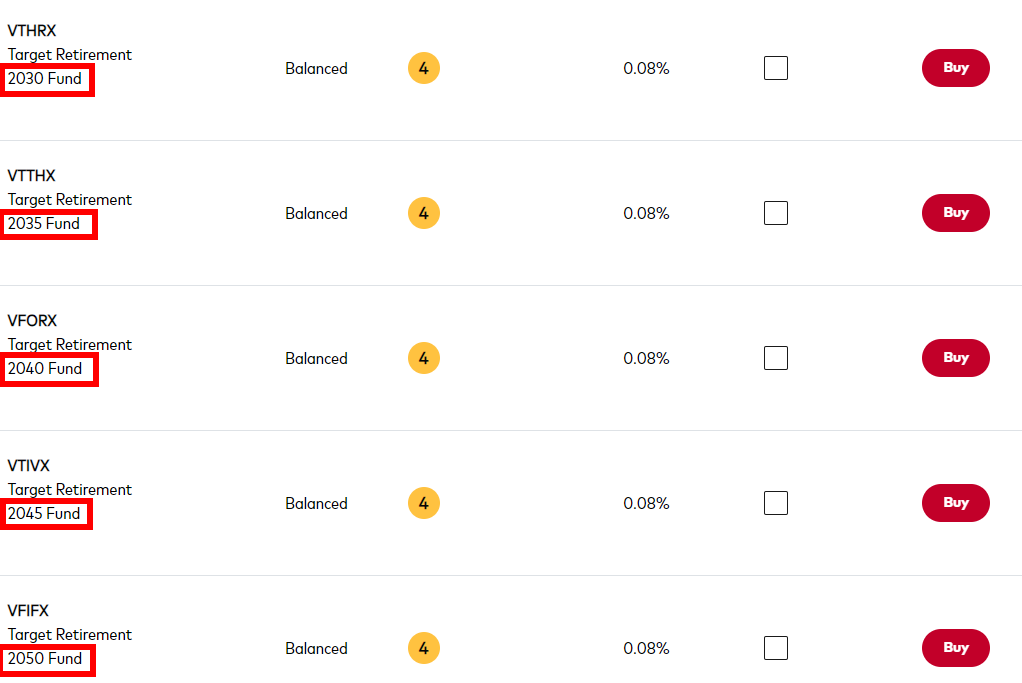

If you go to a target date fund provider like Vanguard you’ll see a number of funds with calendar years in 5 year increments that extend way out into the future. The image below shows only some of those funds from 2030-2050.

The full Vanguard lineup currently includes funds from 2015 (already retired) out to 2065.

To select a fund, you start with the approximate year that you expect to retire. For example, if a 40 year old in 2022 wants to retire at age 65 (25 years away) then they would be retiring in 2047.

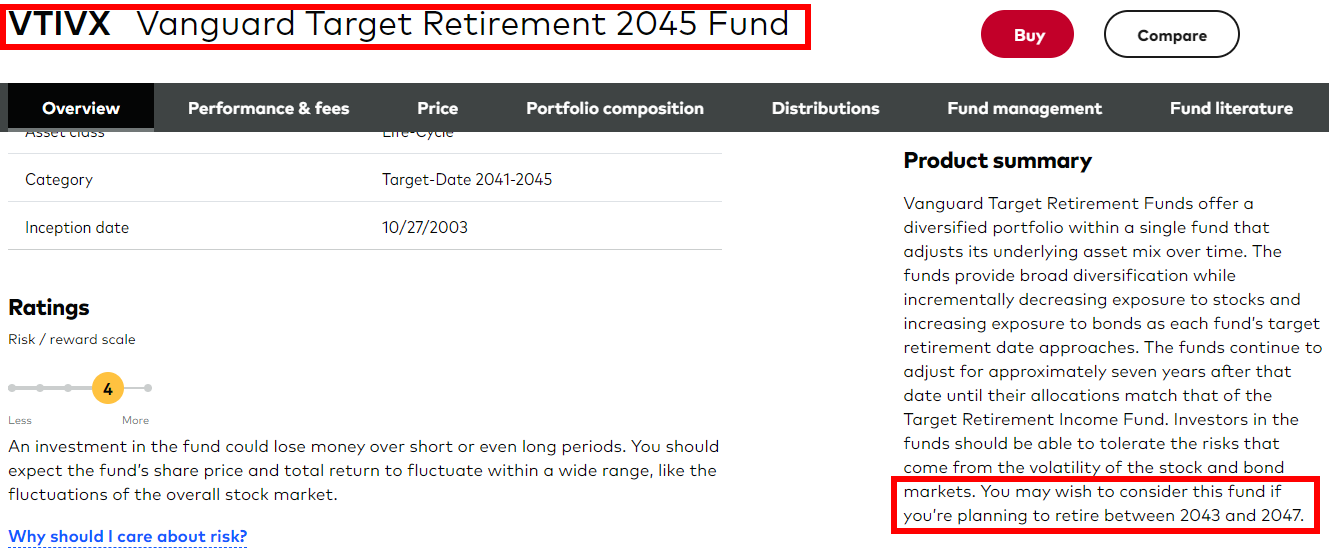

There’s no “2047” fund in this case so you need to pick the date closest to 2047 which is 2045. When you look at the summary of the fund it tells you that it’s for retirement dates between 2043 and 2047. Perfect!

What’s Inside A Target Date Fund?

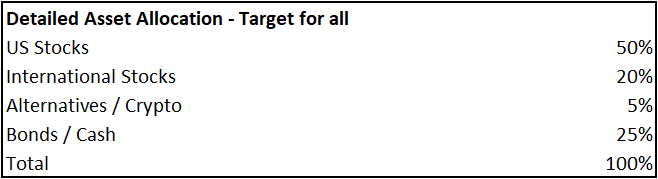

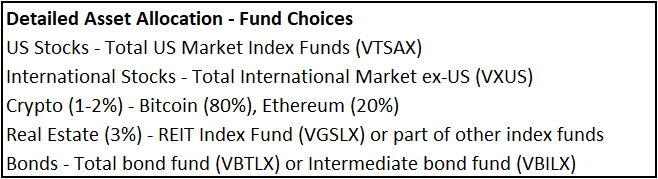

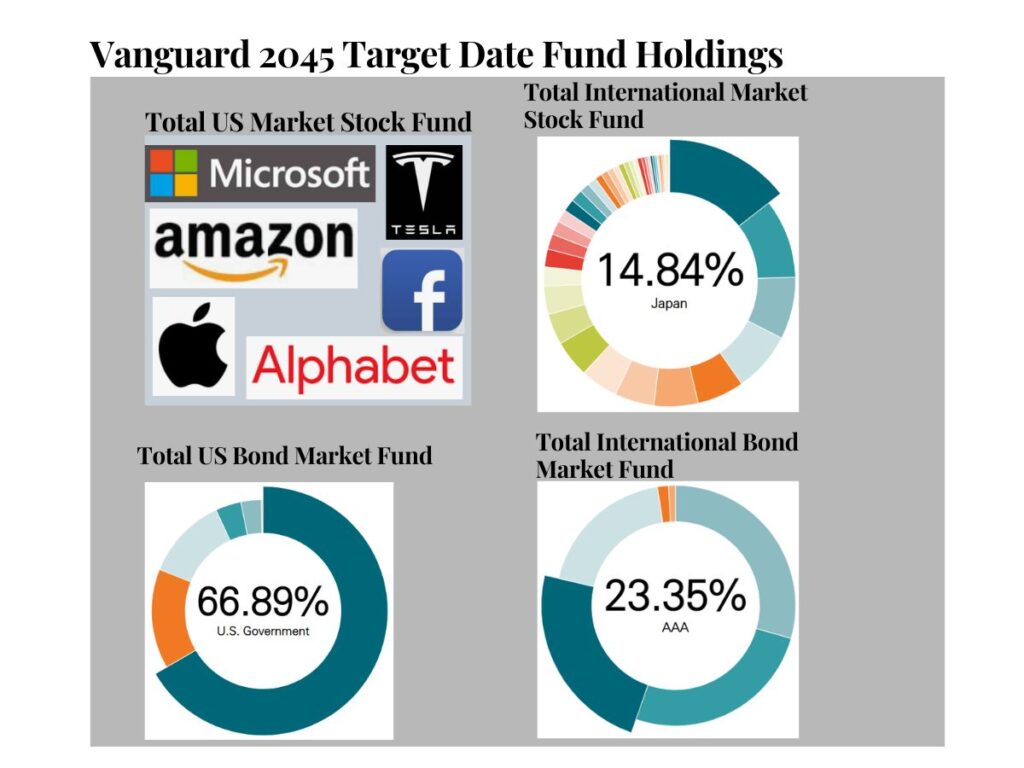

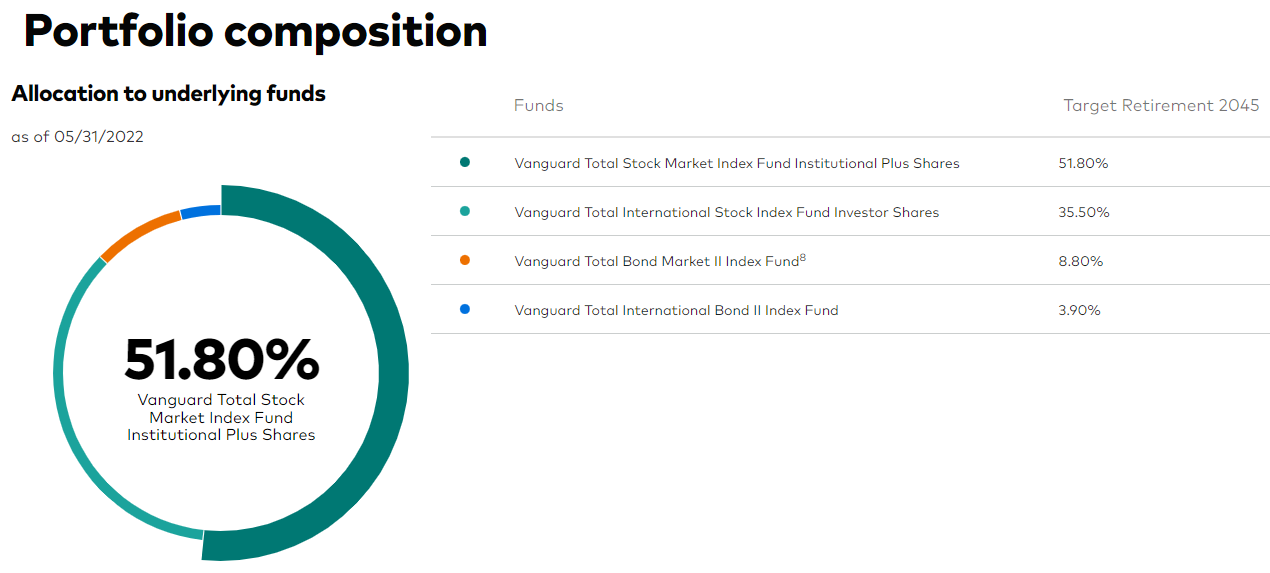

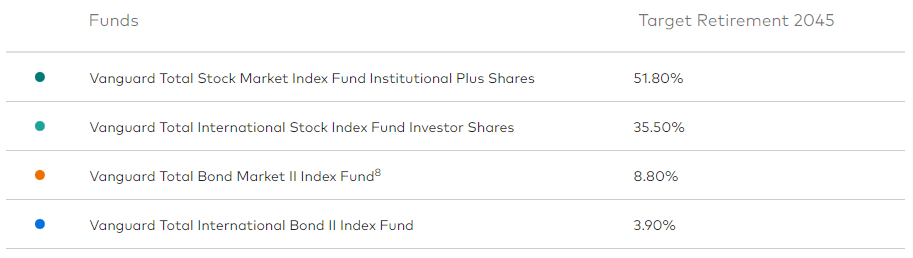

A target date fund is what is known as a fund of funds. That means that a target date mutual fund holds other mutual funds inside of it. Exactly what they hold depends on the fund provider but usually it’s a combination of US stocks, US bonds, International Stocks and US Bonds.

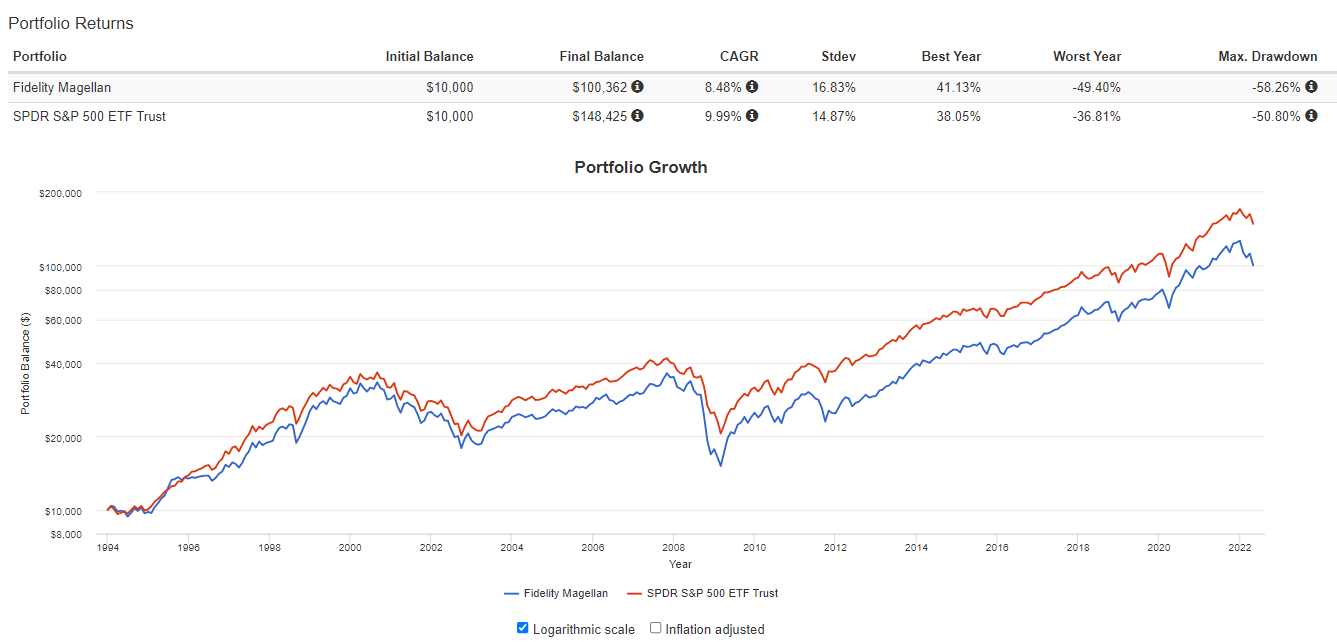

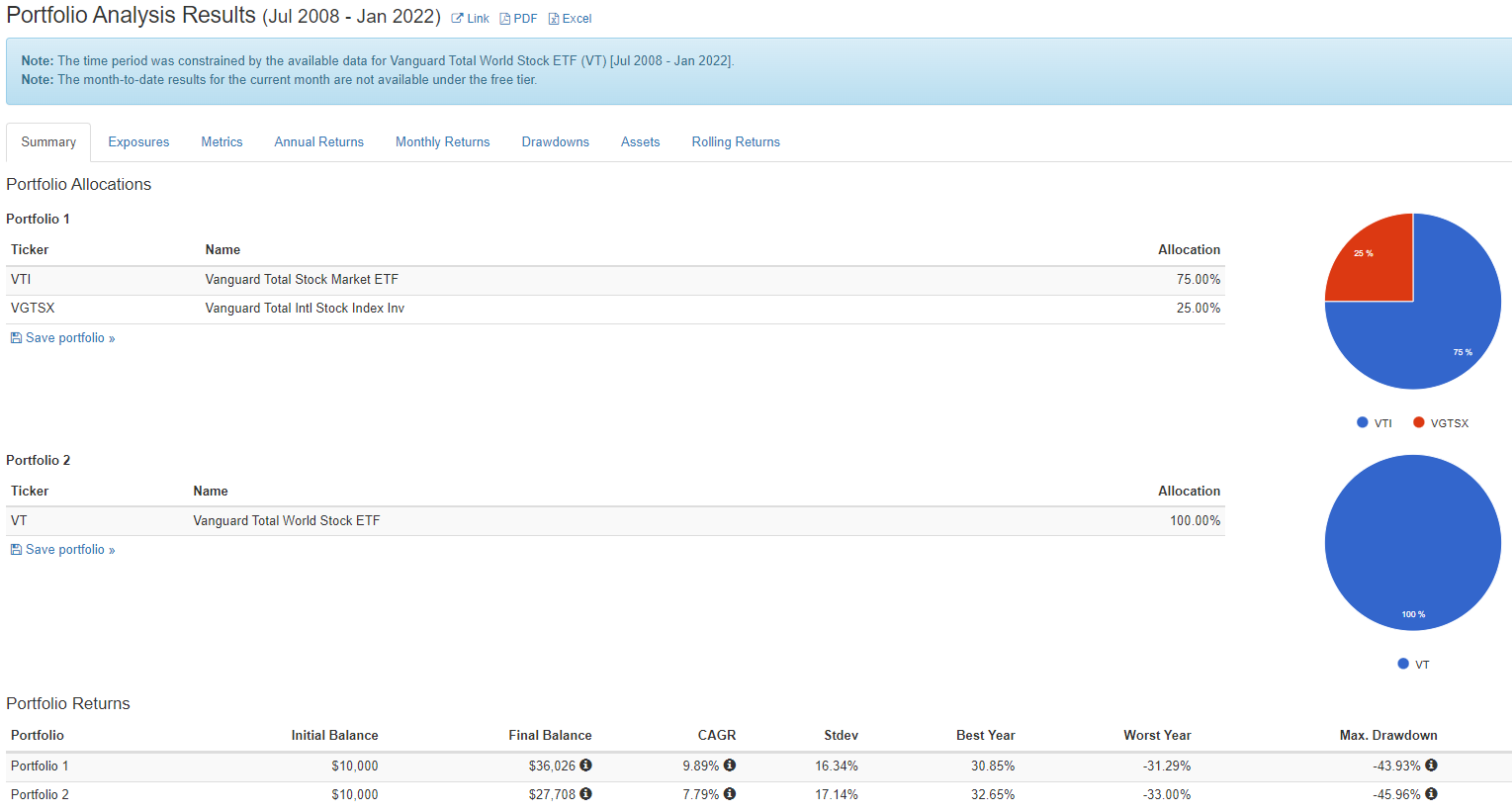

Here’s an example of the Vanguard 2045 target fund which holds the Vanguard version of their funds for each of those four major areas. Note that all the funds inside are low cost index funds that each have a large number of holdings. This one is about 87% stocks, 13% bonds.

Target Date Fund Asset Allocation

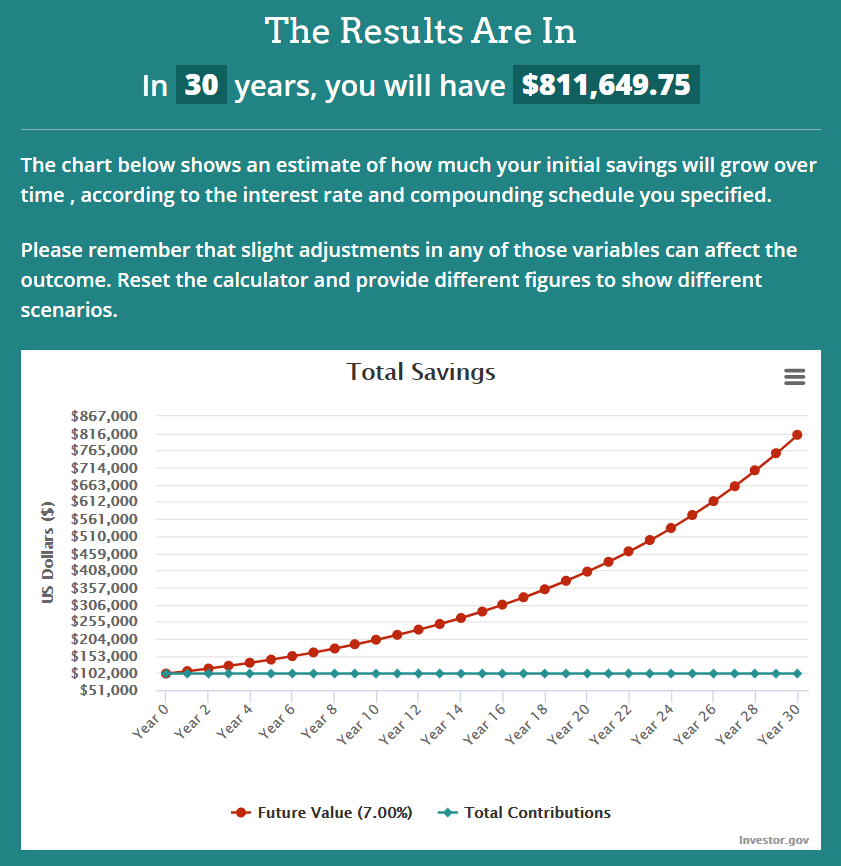

We’ve established that target date funds are a fund of funds holding a wide variety of stocks and bonds. However, the amount of stocks and bonds that is appropriate for an investor changes over time.

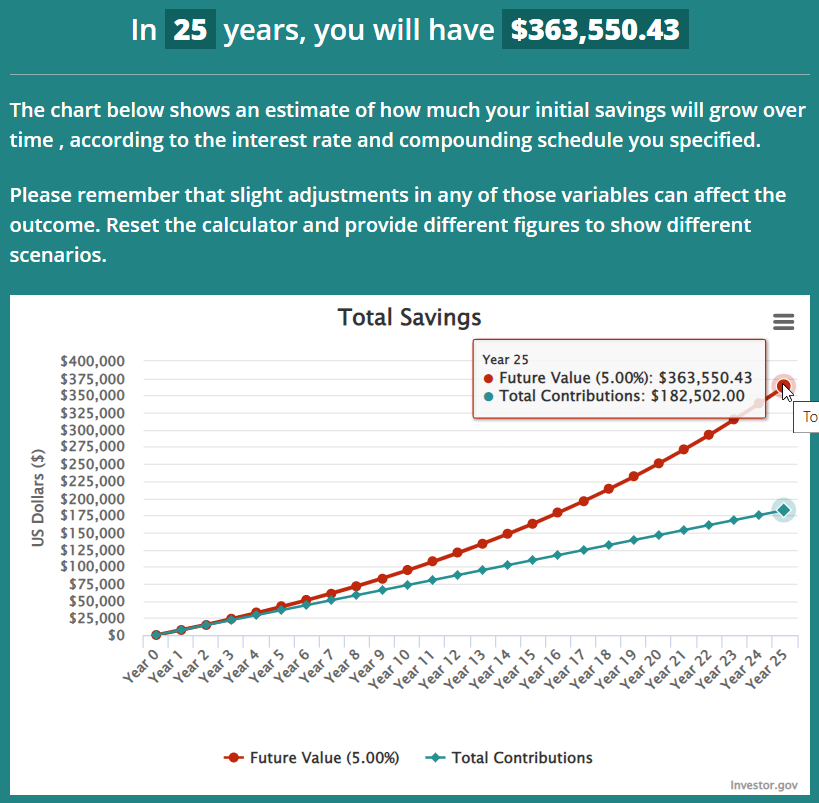

When you have many years until retirement, it’s appropriate to hold more stocks and few bonds. As you get close to retirement and need to use the money, that allocation should grow more conservative with stocks decreasing and bonds increasing.

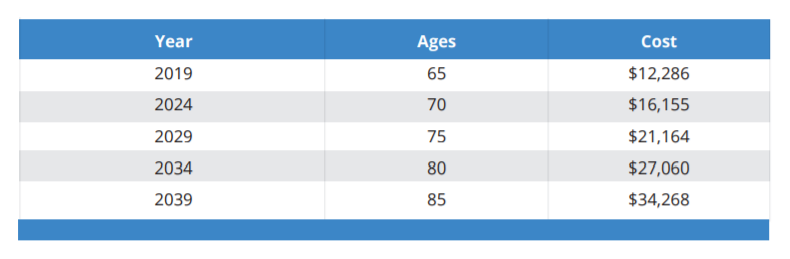

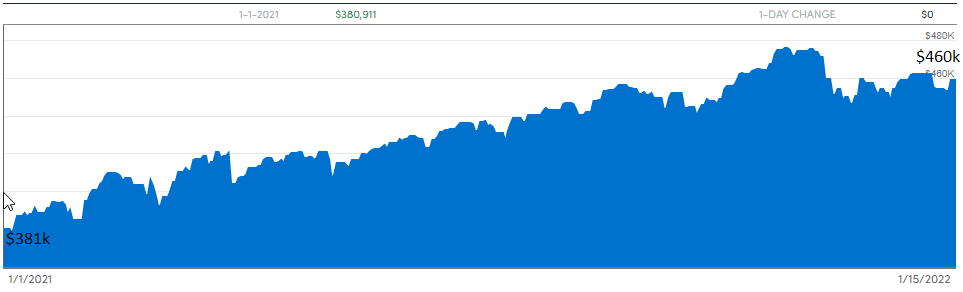

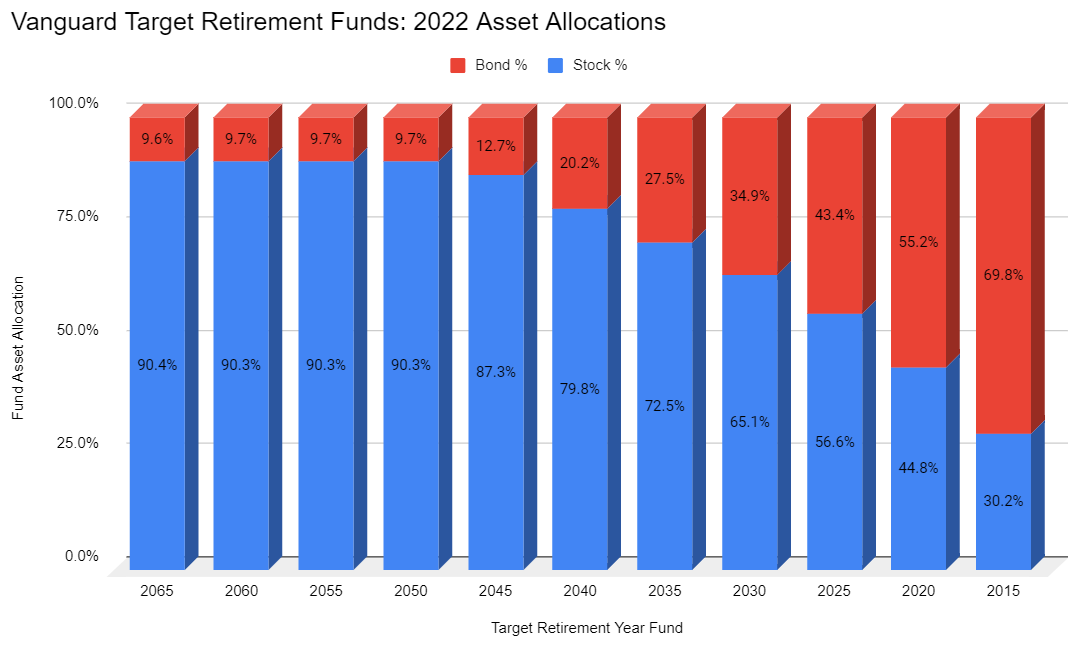

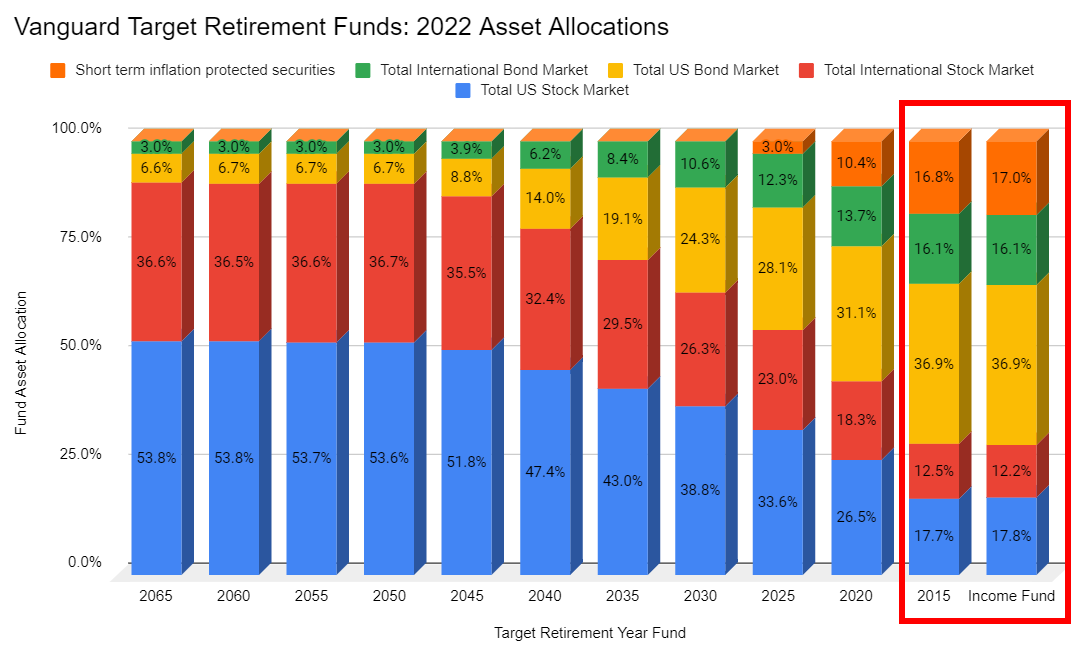

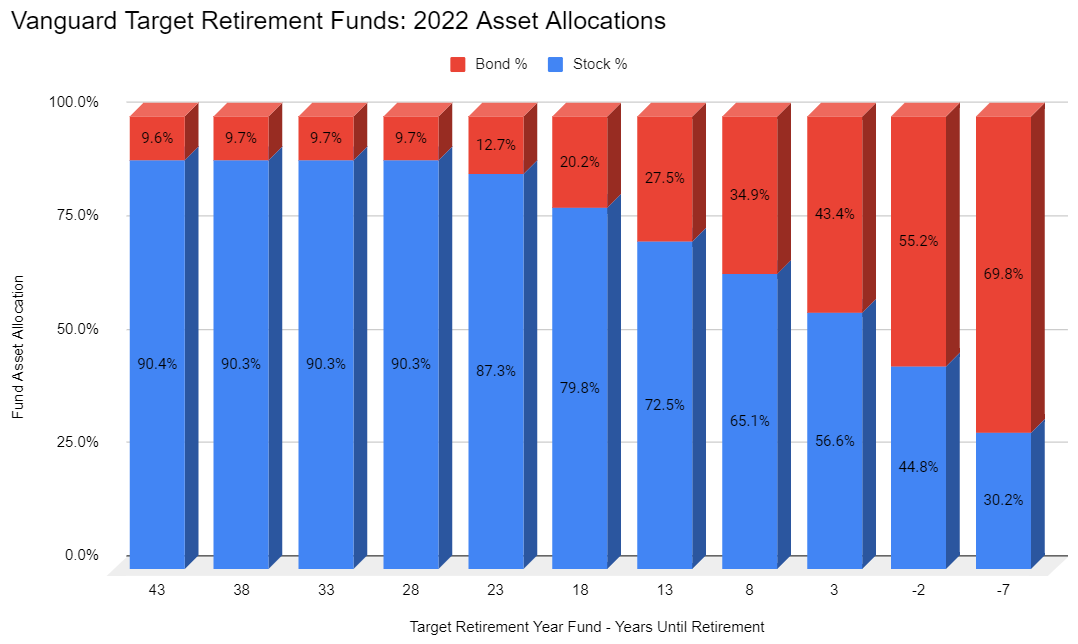

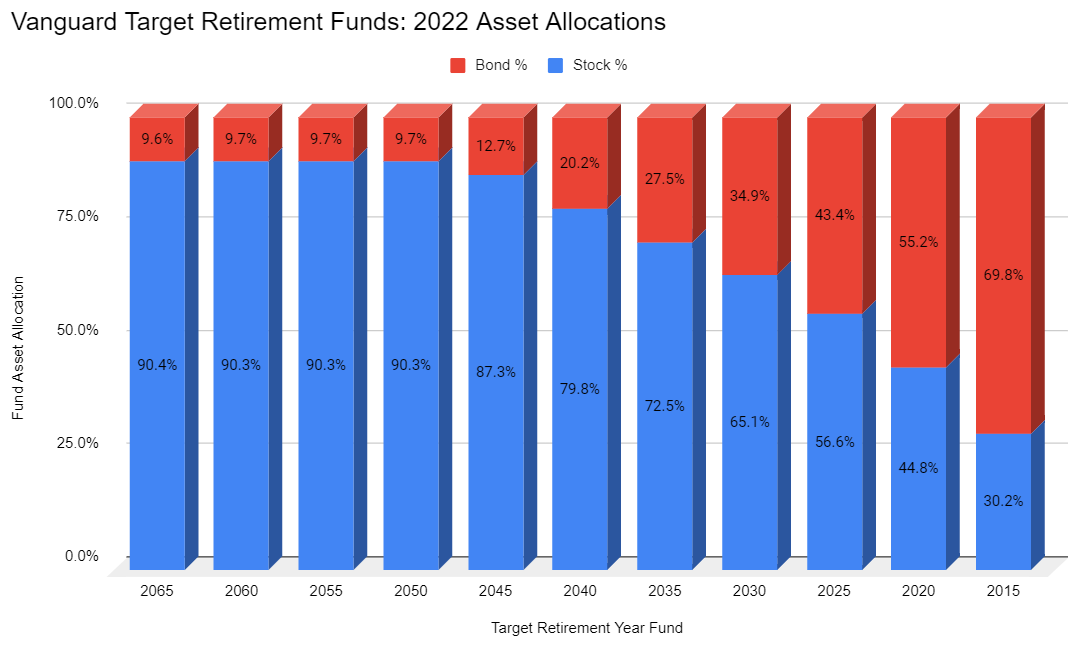

And, that’s exactly what a target date fund does automagically for you. You own a single fund and progressively over time the fund changes the asset allocation to be appropriate. This can be seen by looking at all the target date funds from 2065 to 2015.

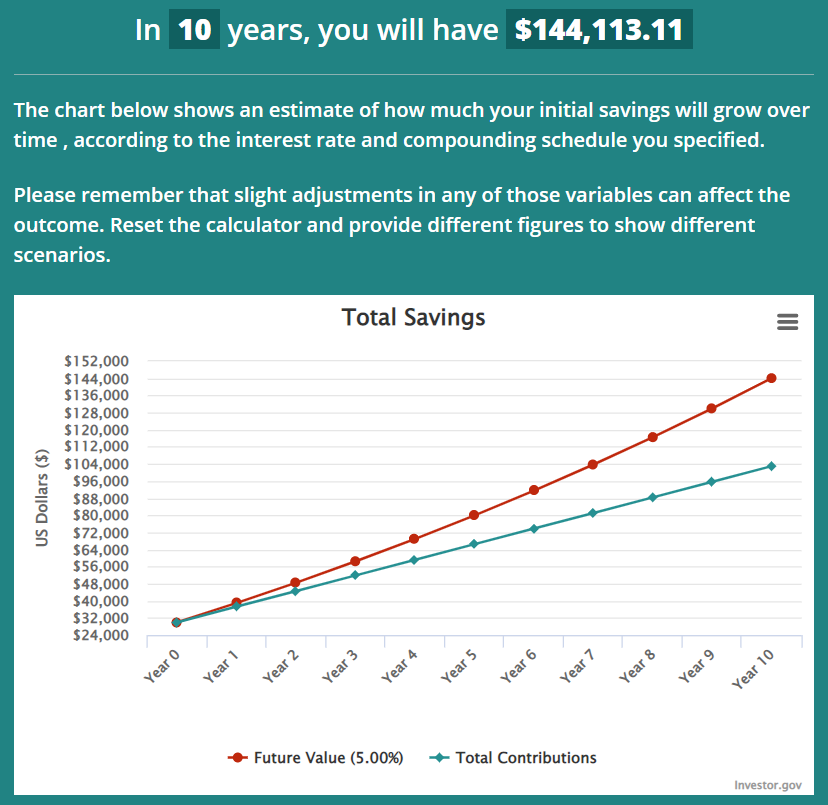

If your retirement date is out in 2065 you’re 43 years from retirement and have a long time horizon. You’re generally focused on growth and not as worried about volatility so the fund is 90% stocks, 10% bonds. It stays that way until the funds get ~25 years from the retirement date.

From there we see each fund slowly decrease it’s stock allocation and increase it’s bond allocation. This hits a roughly 50/50 portfolio at your retirement and then finally bottoms out at a 30% stock, 70% bond / TIPS allocation.

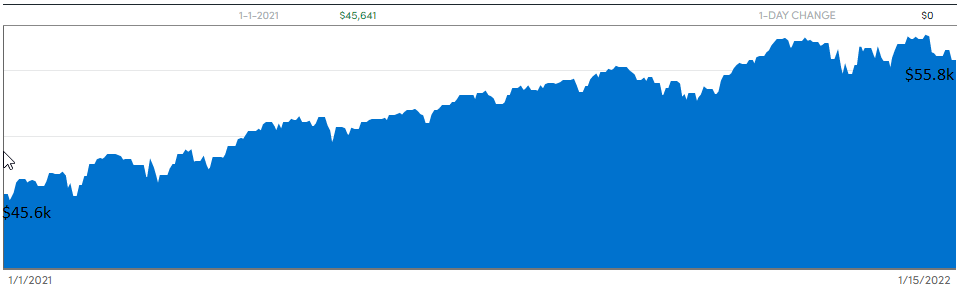

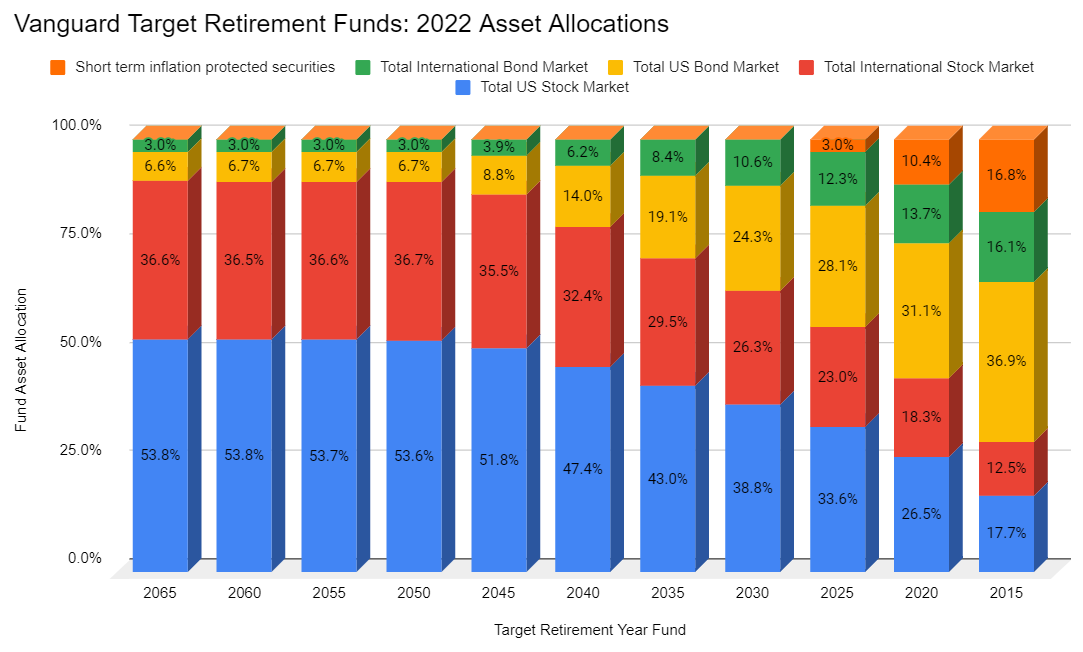

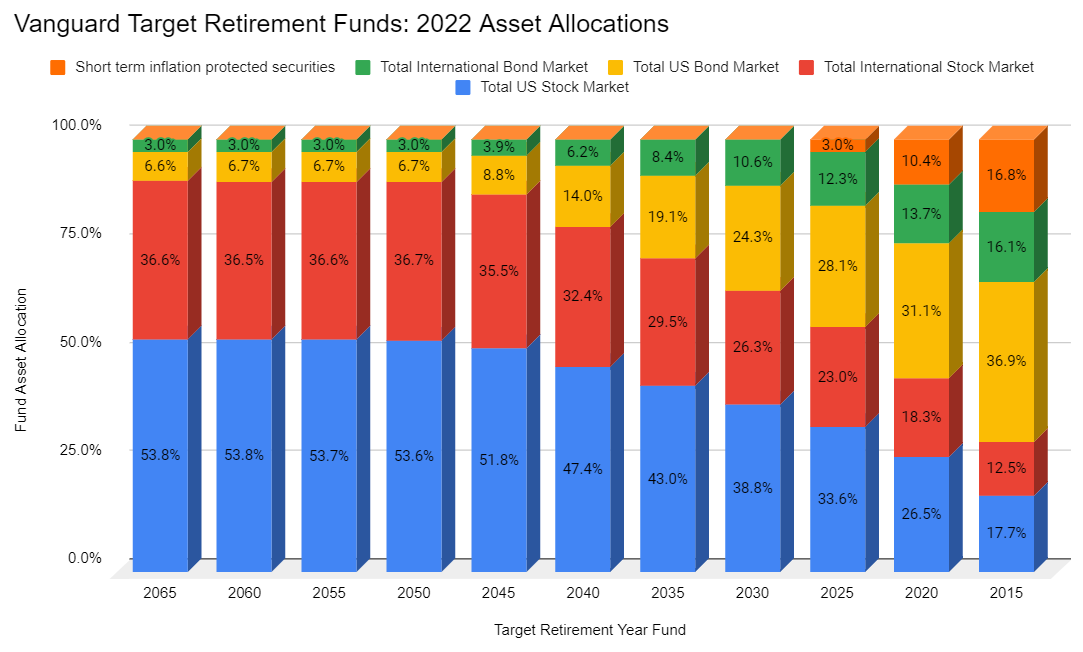

Here’s a more detailed view of what each target date fund holds inside of it. It’s a bit biased towards US stocks and bonds but does include international stocks and bonds.

One other thing to note is that Vanguard does start to add in inflation protected securities as you approach and are in retirement. You see that show up in the 2025 -> 2015 target date funds in the orange blocks.

What Happens After Your Retirement Date?

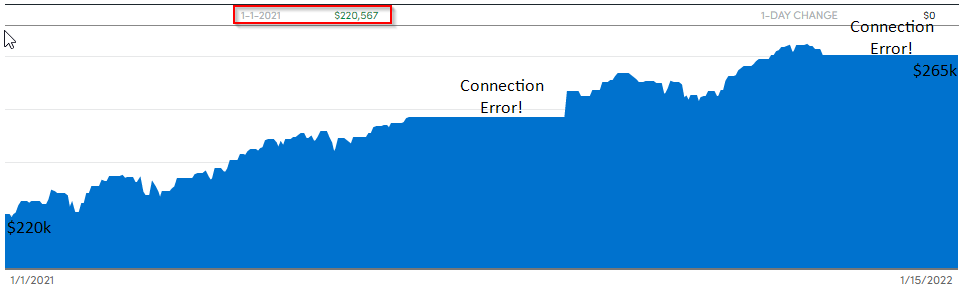

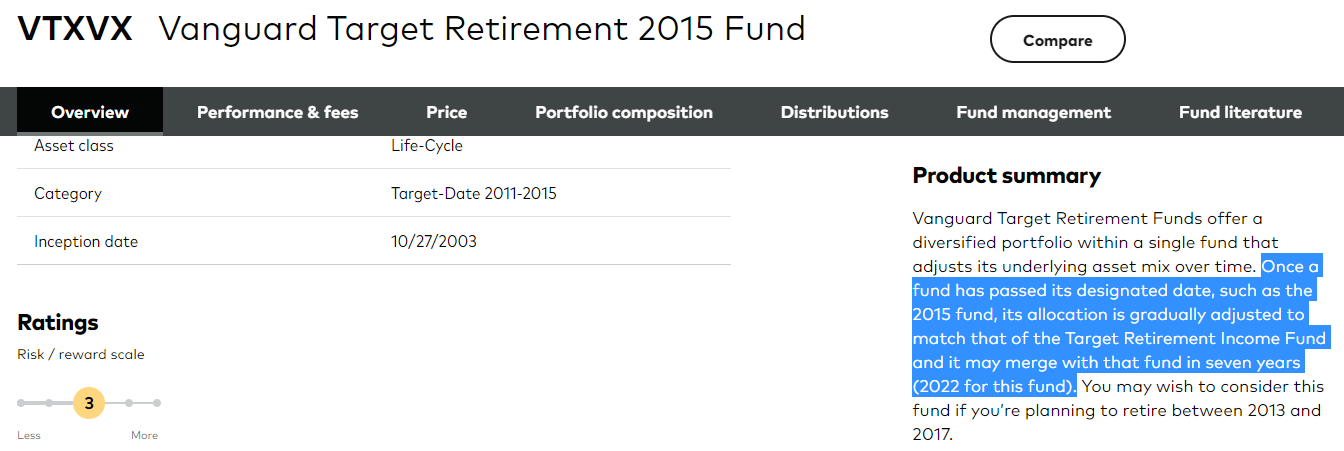

Looking at the previous charts you can see that there is no 2005 or 2010 target date funds. What happens after you reach the target retirement date? As always, read up on the particular fund. See below for the details on the Vanguard 2015 target date fund.

Seven years after the target date fund has passed its retirement year, they merge the target date fund into the retirement income mutual fund which has a fixed allocation going forward. By that seven year point the two funds had the same asset allocation anyway so there’s no impact to the investor.

This is easy to see in chart form when looking at what the 2015 fund and the income fund hold. The fund manager has progressively changed the 2015 allocation over time so that the two are very close to holding the same things. In the next year the two funds will be merged and next year there will be no 2015 target date fund.

If you look at the details of your particular target date fund it should explain what happens over time.

Target Date Funds In The Accumulation Phase

Now that we’ve established what target date funds are and how they work, lets talk about the pros and cons of using them in the accumulation phase. Accumulation phase being the time when you’re still contributing to your investment accounts instead of drawing down on them.

Positive – Requires Little Investing Knowledge

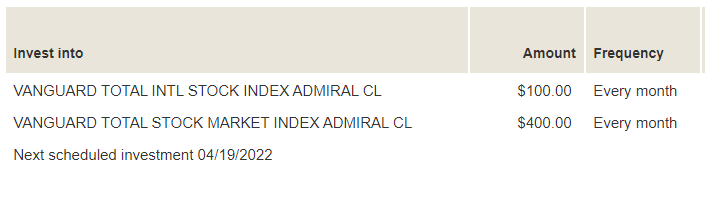

A target date fund is about as simple as it gets when it comes to investing. You pick the date that you want to retire, select the right fund based on that date and set your investments to buy 100% of that one fund.

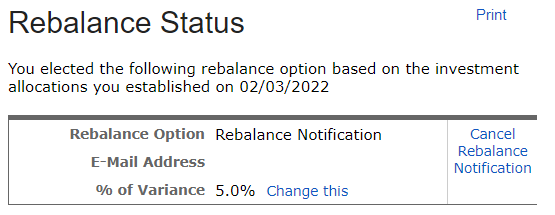

Positive – No Rebalancing Required

If your portfolio has multiple funds inside of it then you need to rebalance periodically to keep your desired asset allocation. This is not the case if you hold a single fund!

For example, if you want a 60% stock, 40% bond allocation holding a stock fund and bond fund then you need to rebalance periodically. Over time, that stock fund will likely grow and make your allocation 70% stock, 30% bonds. You would need to sell stocks and buy bonds to return to a 60% / 40% allocation.

In holding a target date fund exclusively there’s nothing to rebalance. You hold 100% of that target date fund. Within the target fund there’s a percentage held of each fund.

One job of the fund manager is to keep the fund holdings at the target percentages in as tax efficient manner as possible. They do all the buying and selling, you just hold the fund.

Positive – Great Diversification

Investing can be very volatile and diversification is key to making sure that you aren’t overly exposed to one particular country, or asset class. Buying one target date fund provides a massive amount of diversification.

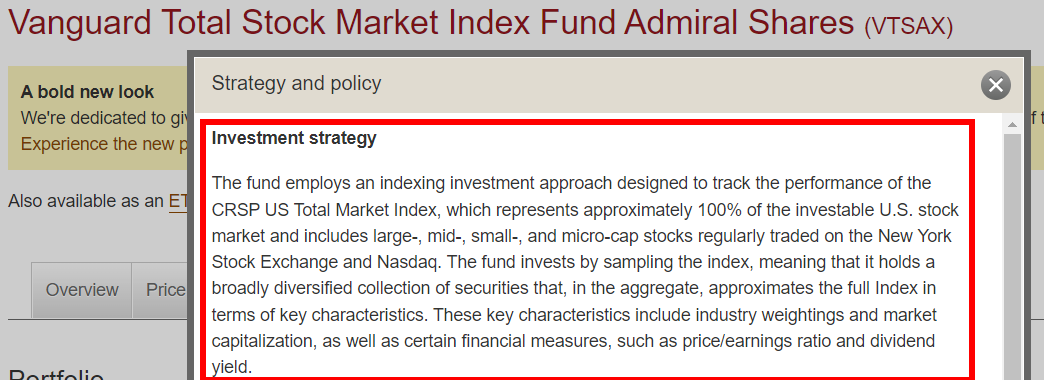

All of Vanguards target date funds hold four main index funds and some add a fifth fund when close to retirement. Each of these index funds hold a lot of individual securities!

Here’s a list of what you get by buying a single Vanguard target date fund:

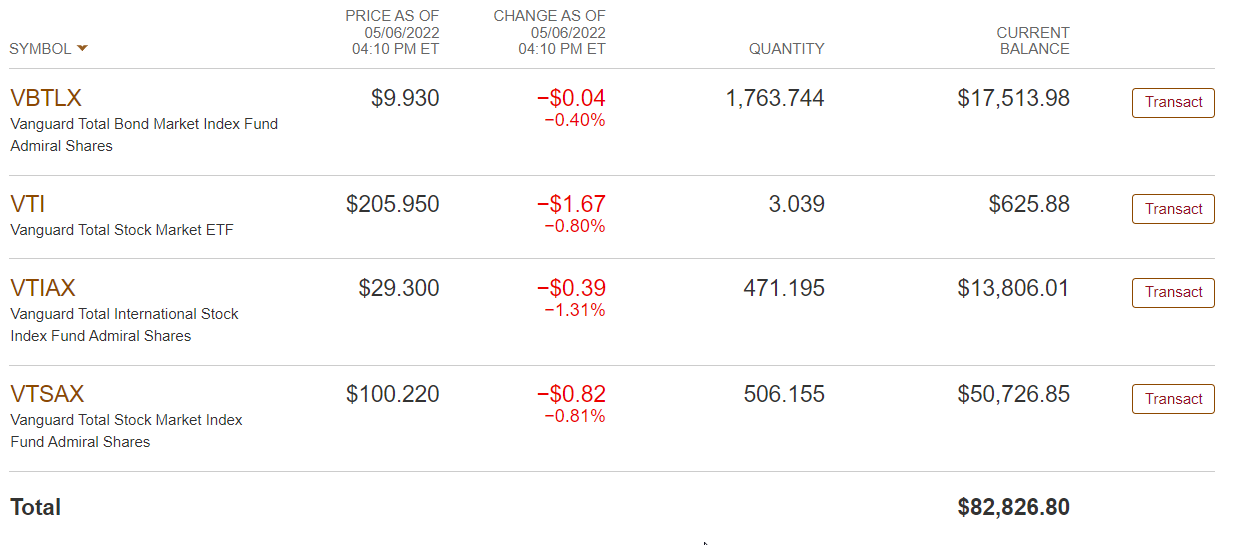

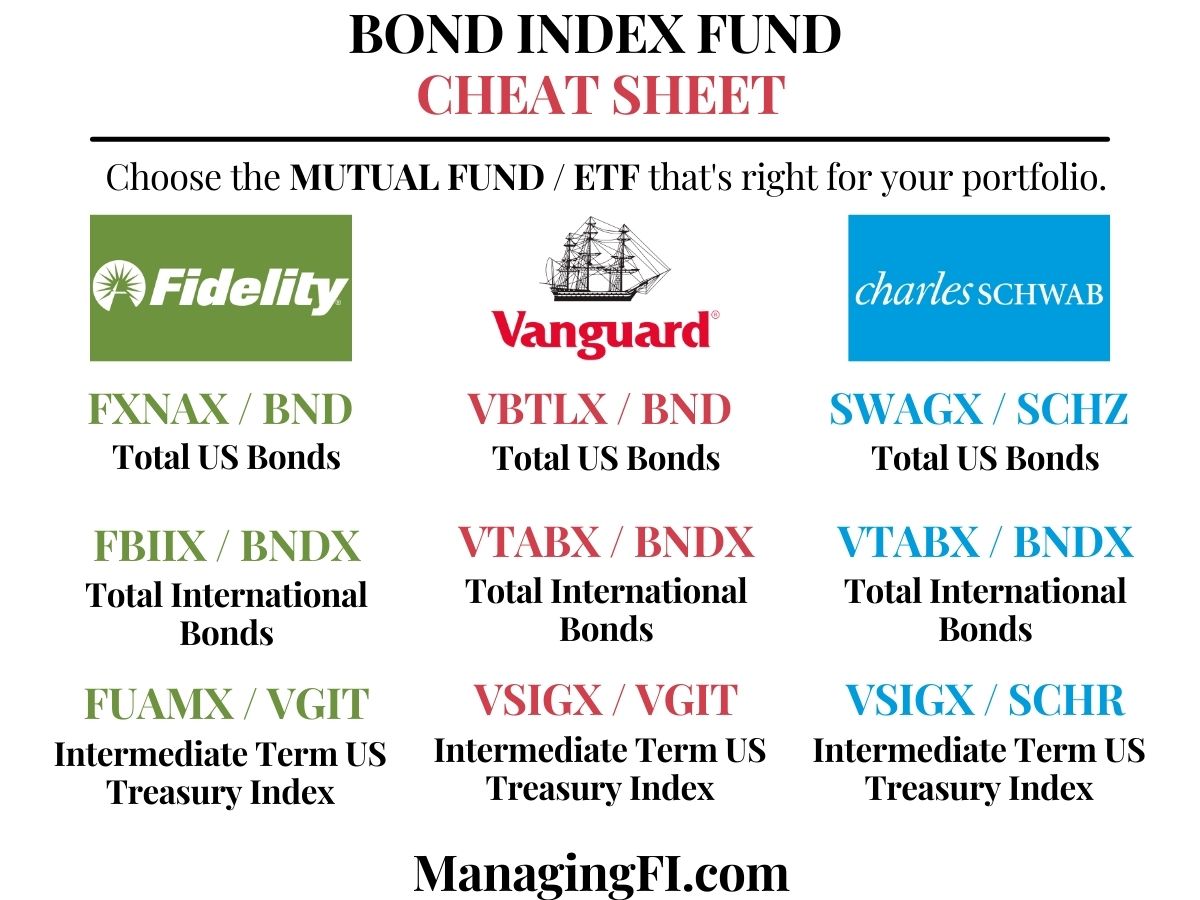

- Vanguard Total Stock Market Index Fund – Owns 4,100 US stocks in large, medium and small capitalization companies.

- Vanguard Total International Stock Index Fund – Owns 7,781 non-US stocks in the major developed and emerging markets.

- Vanguard Total Bond Market II Index Fund – Owns 9,922 individual bonds invested in U.S. Treasury, investment-grade corporate, mortgage-backed, and asset-backed securities.

- Vanguard Total International Bond II Index Fund – Owns 7,014 non-US investment grade bonds in the major developed and emerging markets.

That single target date fund purchase gives you diversification across 11,881 different stocks and 16,936 different bonds worldwide!

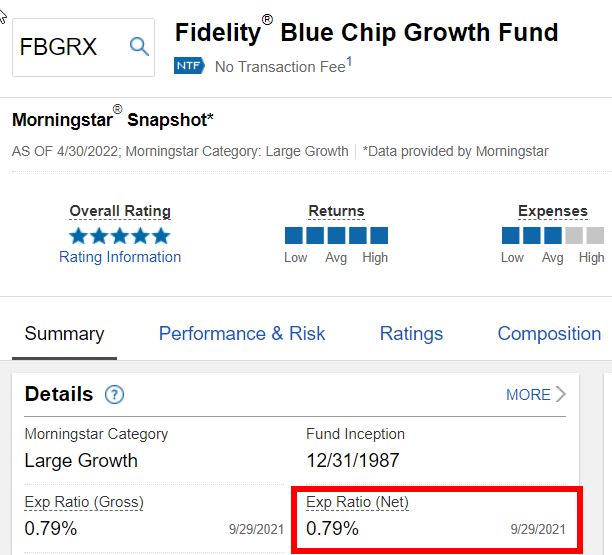

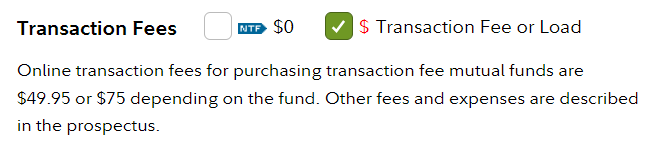

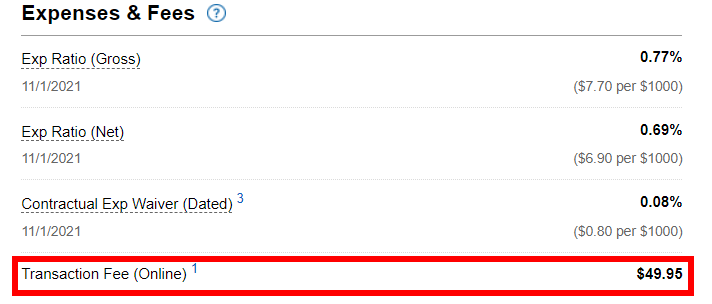

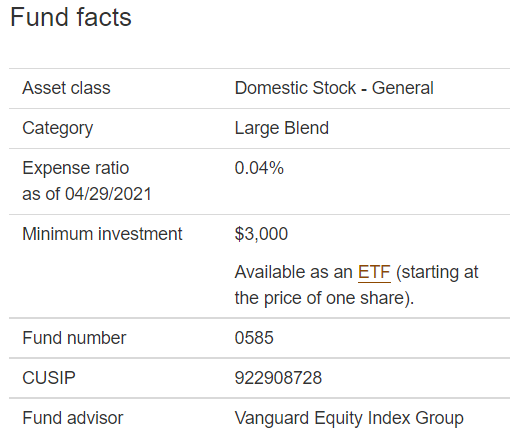

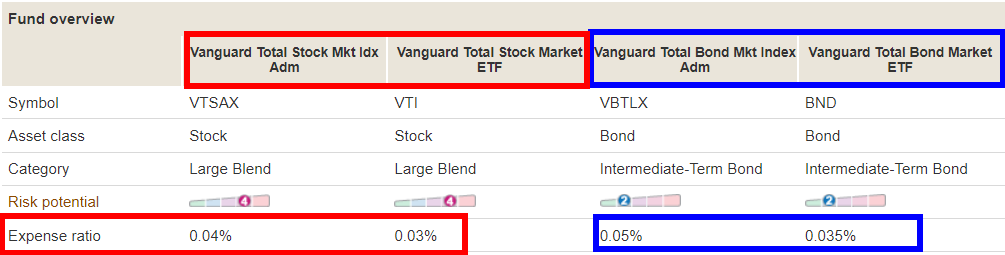

Positive – Low Fees

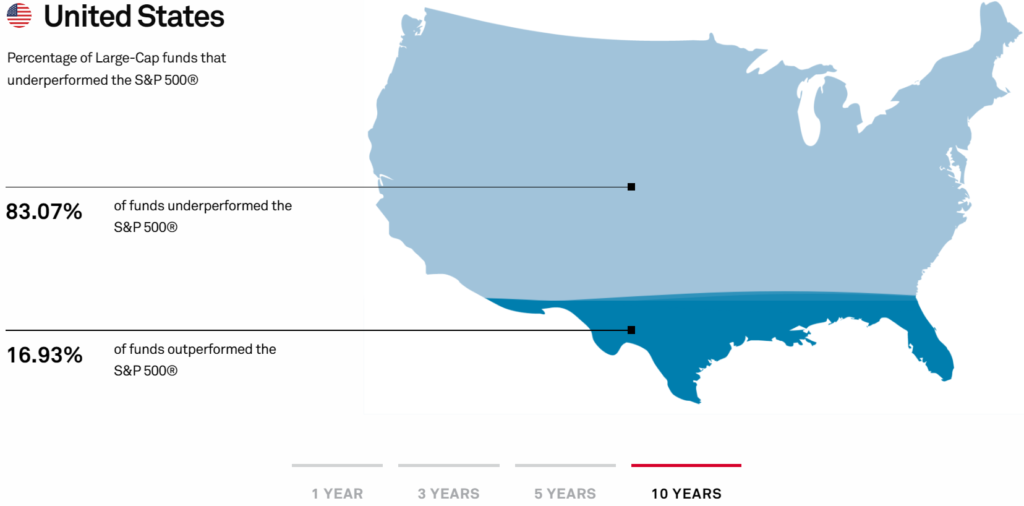

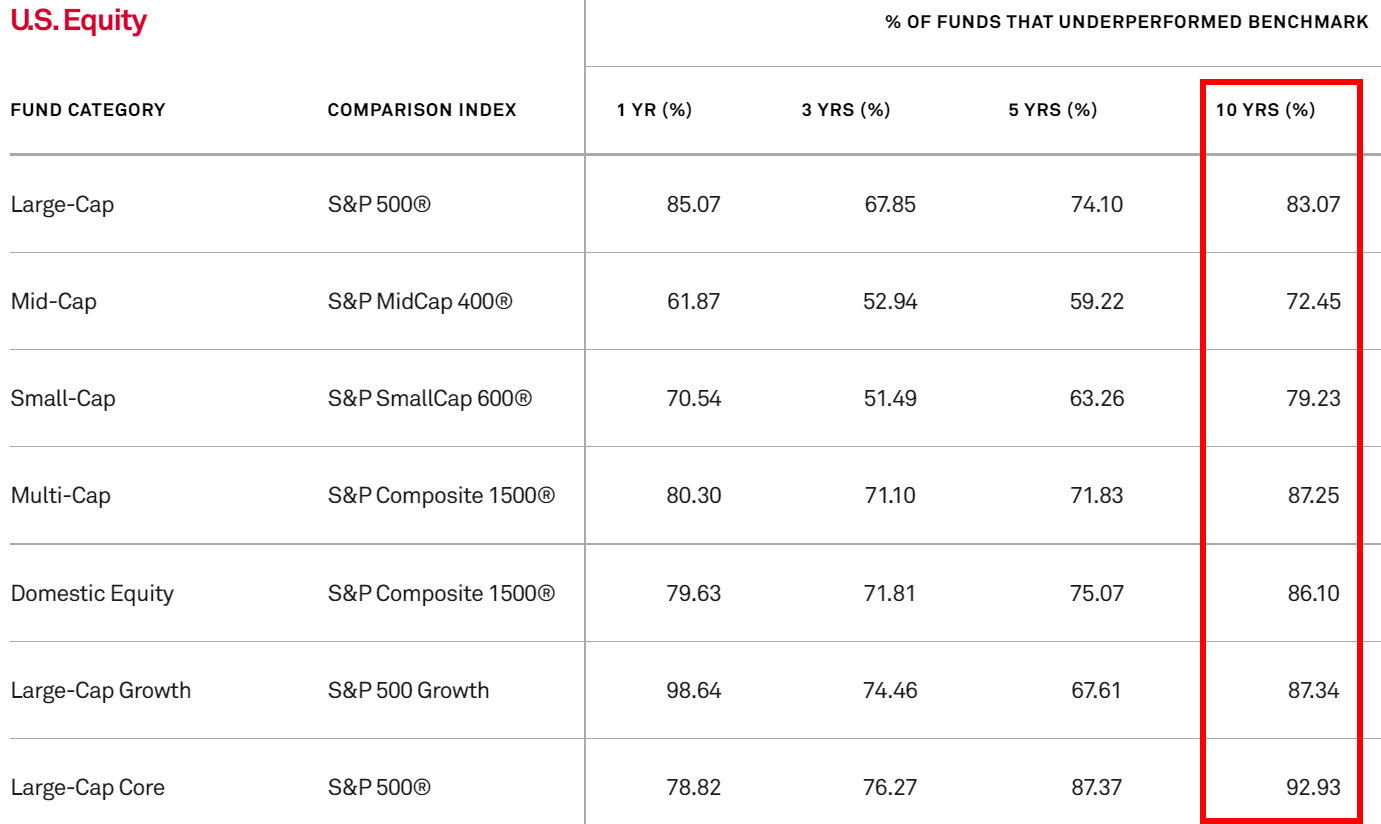

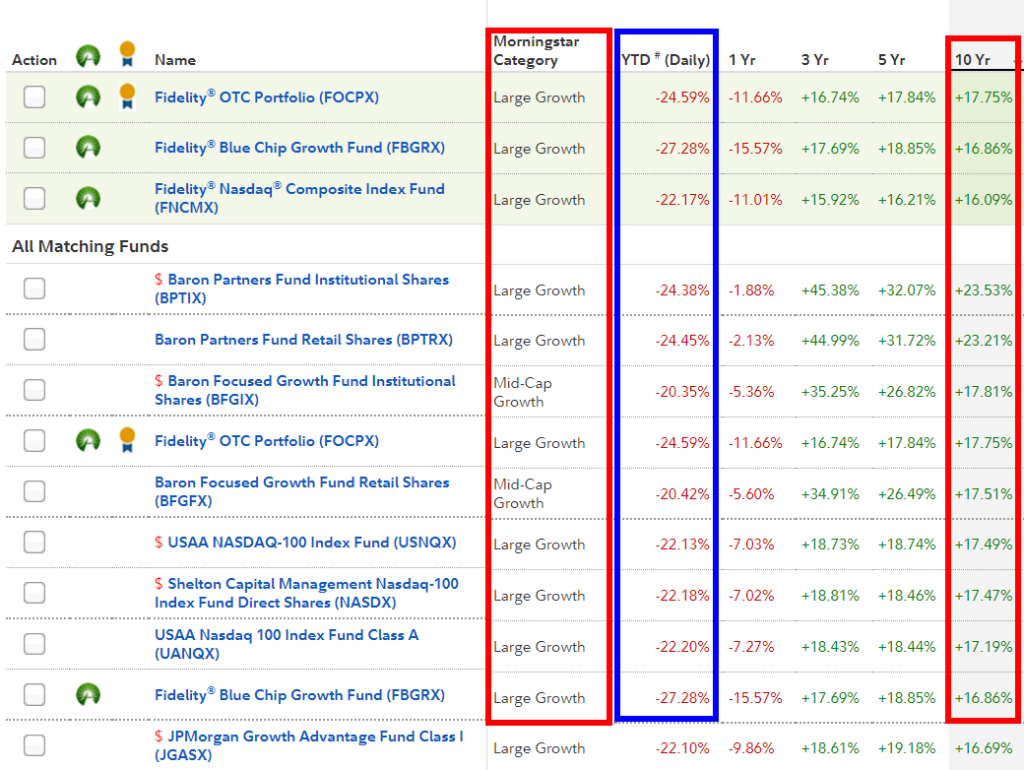

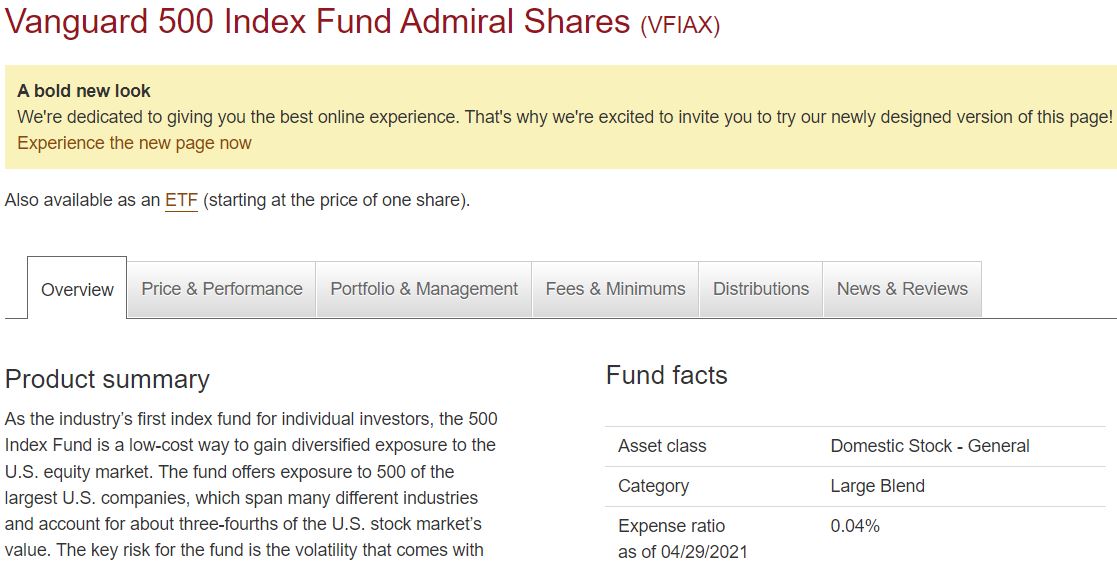

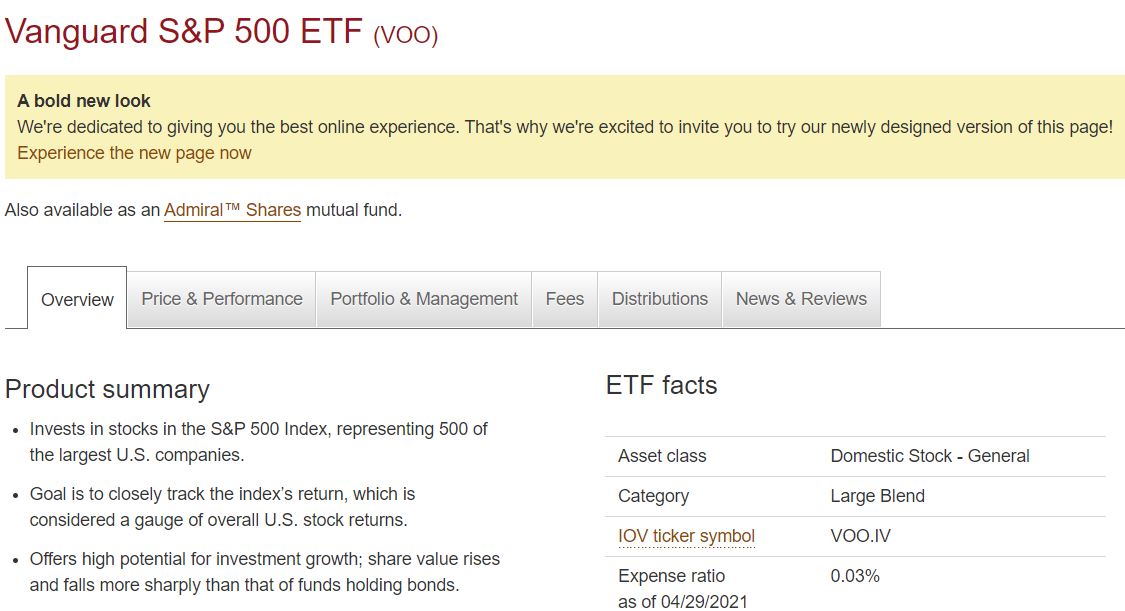

Target date funds are a mutual fund that holds other mutual funds inside of it. This is often referred to as a “fund of funds”. Most commonly, as is the case for Vanguard, the target date fund holds low cost index funds inside of it.

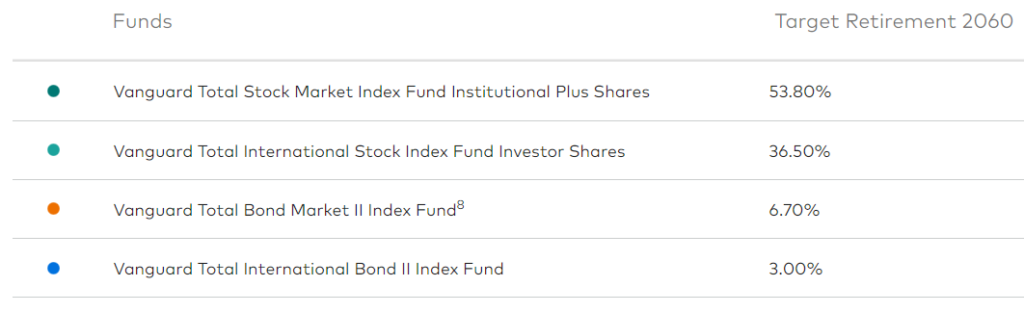

You can see that the 2060 target date fund holds four different index funds inside of it. Not only that, but it holds the institutional versions of the funds where possible which has even lower expense ratios.

The result? A very low expense ratio of 0.08% for a fund of funds. Said another way, it only costs you $80 per year per $100,000 invested to hold all these funds. Cheap!

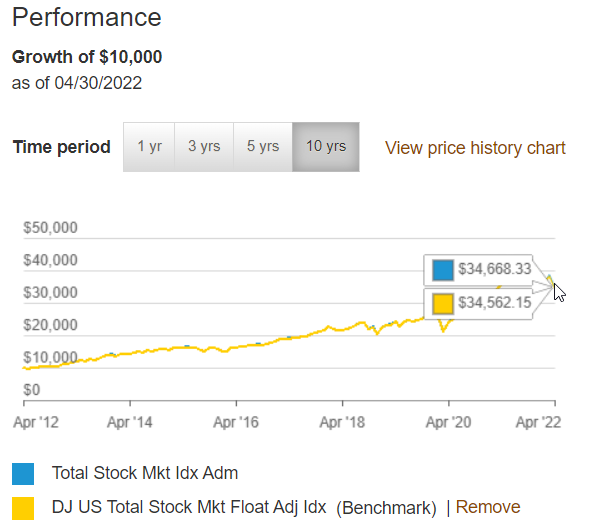

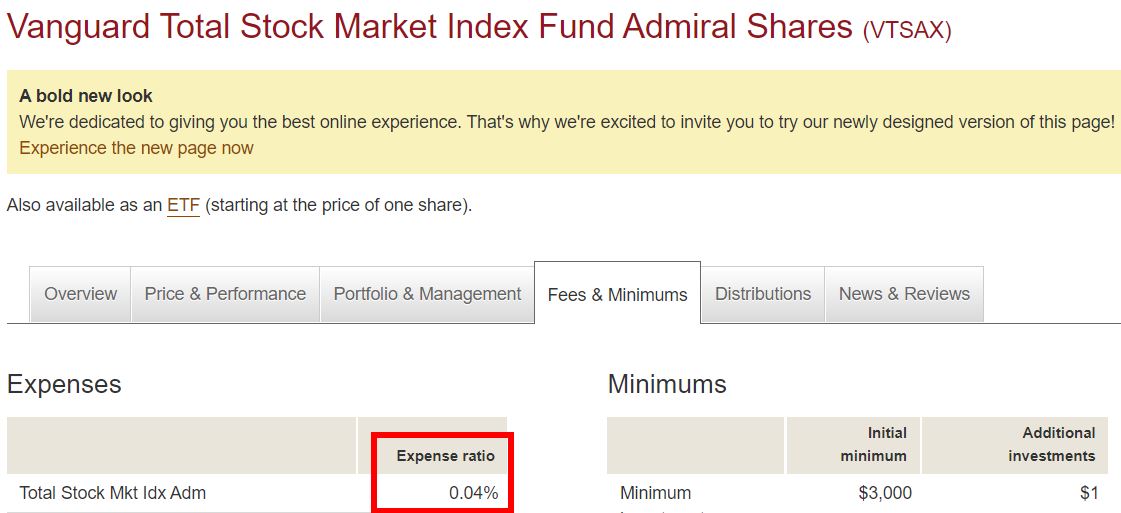

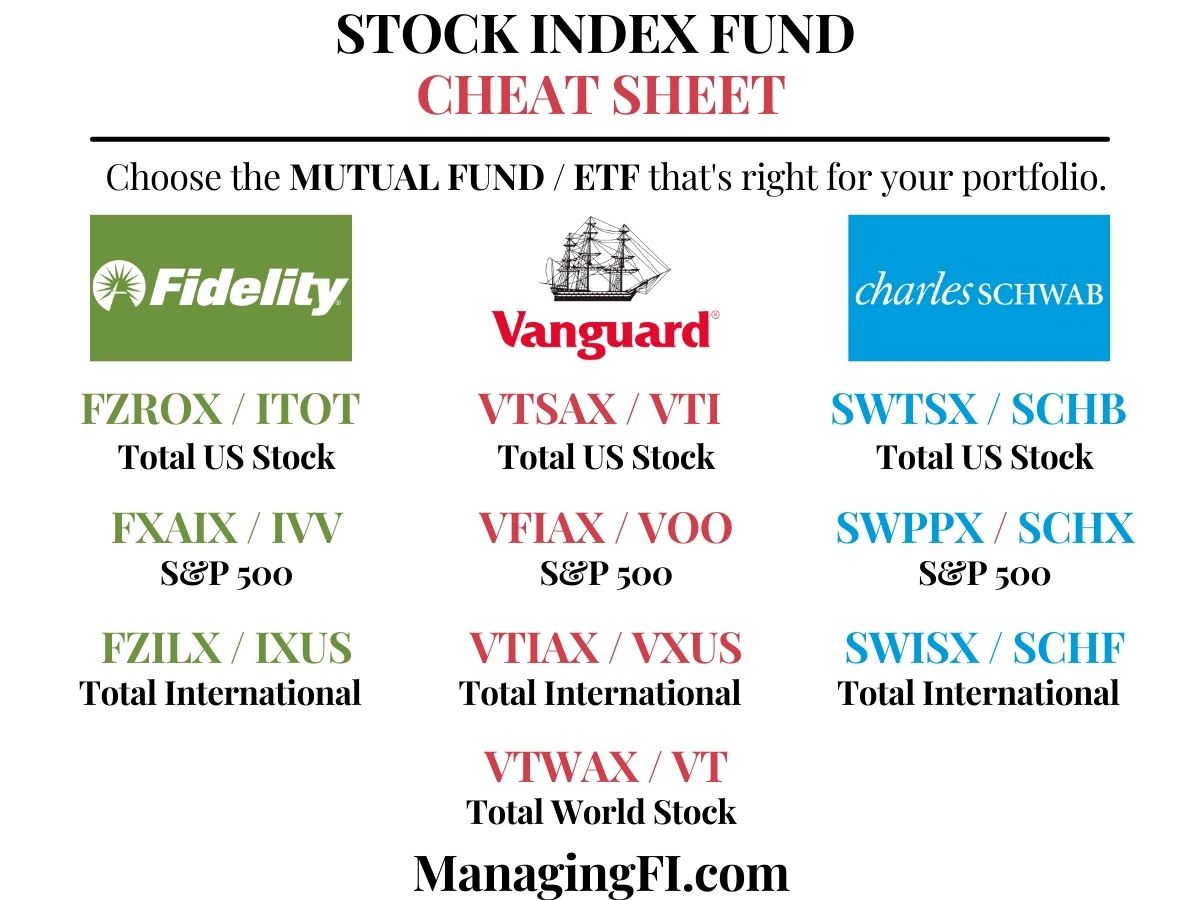

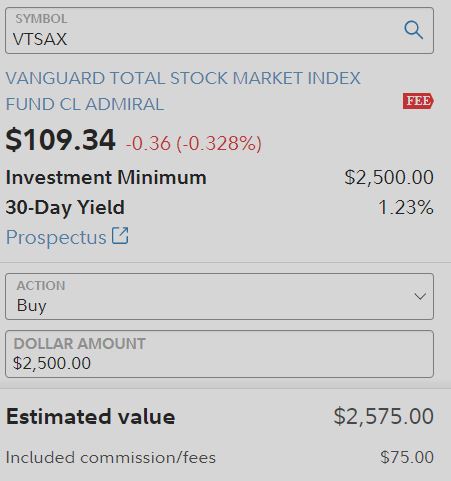

You are paying a slight premium for the one fund solution. Here are the expense ratios for the individual funds that you could buy as a retail investor:

- VTSAX – Total US stock market index – 0.04%

- VTIAX – Total International stock market index – 0.11%

- VBTLX – Total US bond market index – 0.05%

- VTABX – Total International Bond Market Index – 0.11%

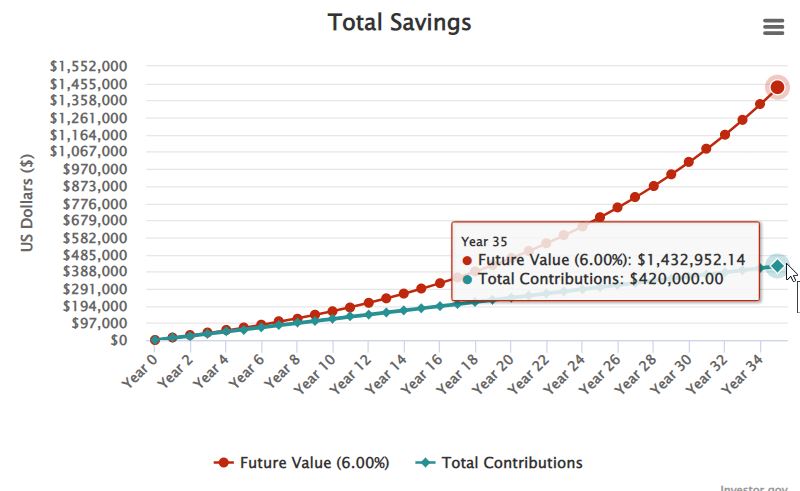

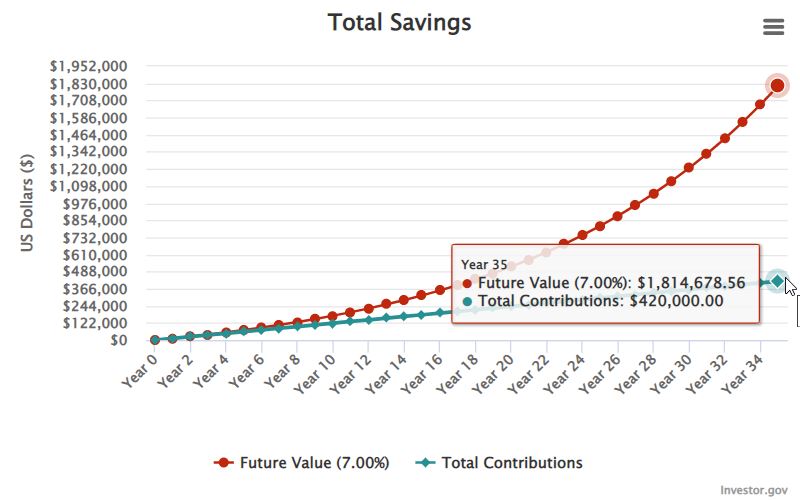

If you held the 2060 target date fund percentages as individual funds you would pay a 0.069% expense ratio. Said another way you’re paying an extra $11/yr on $100,000 invested to own the target date fund instead of the individual investments (ignoring tax impacts).

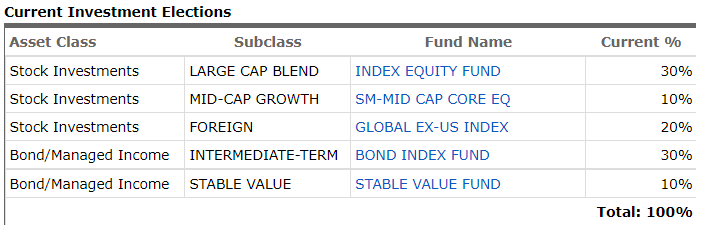

Negative – Doesn’t Consider Your Risk Tolerance

The downside to many convenient, simplified solutions is that they don’t consider your unique situation. In the case of risk, target date funds have a certain asset allocation by age and don’t consider your personal risk tolerance.

For target date funds targeting people that are 25+ years from retirement, they are going to be aggressive with a 90% stock, 10% bond allocation.

But, can YOU handle the level of risk and volatility that comes with that asset allocation? Everyone is different. A 25 year old could take the Vanguard investor questionnaire and only be able to handle a 60/40 portfolio based on the results.

If they choose the target date fund based on the retirement date and it’s too aggressive they could become scared and sell during a market downturn. The 90/10 portfolio might be too much risk for THEM.

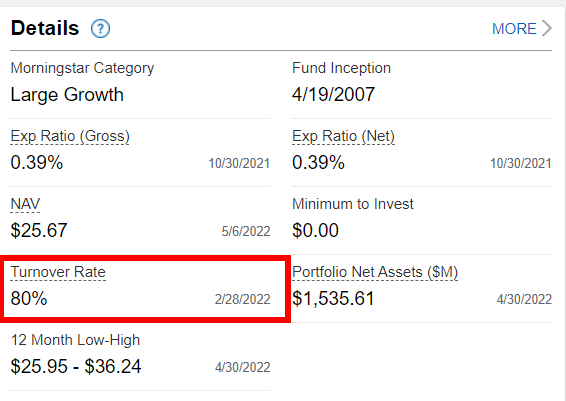

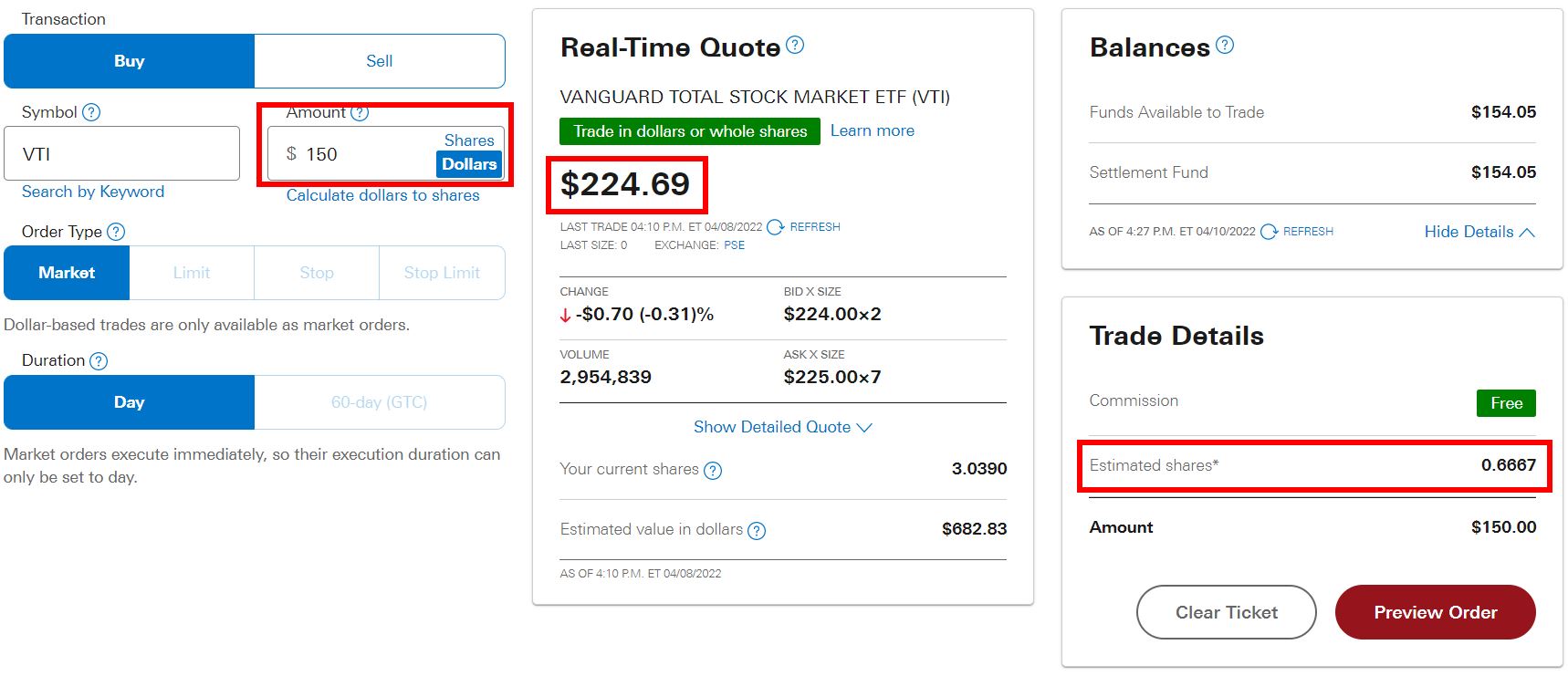

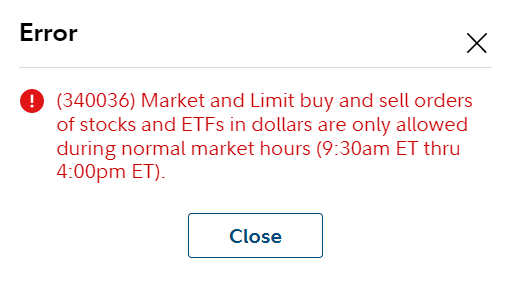

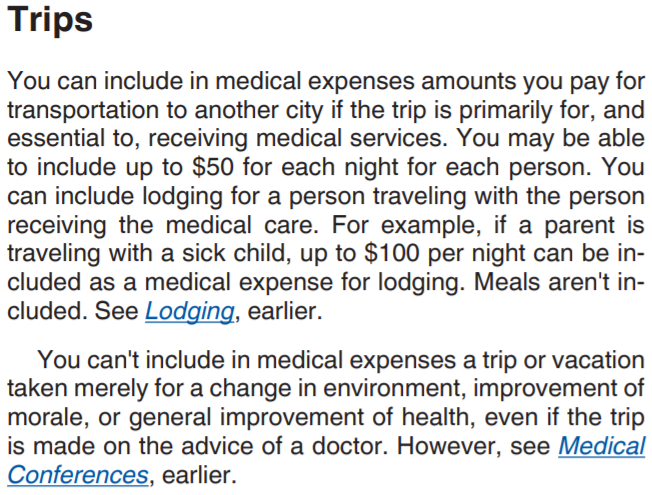

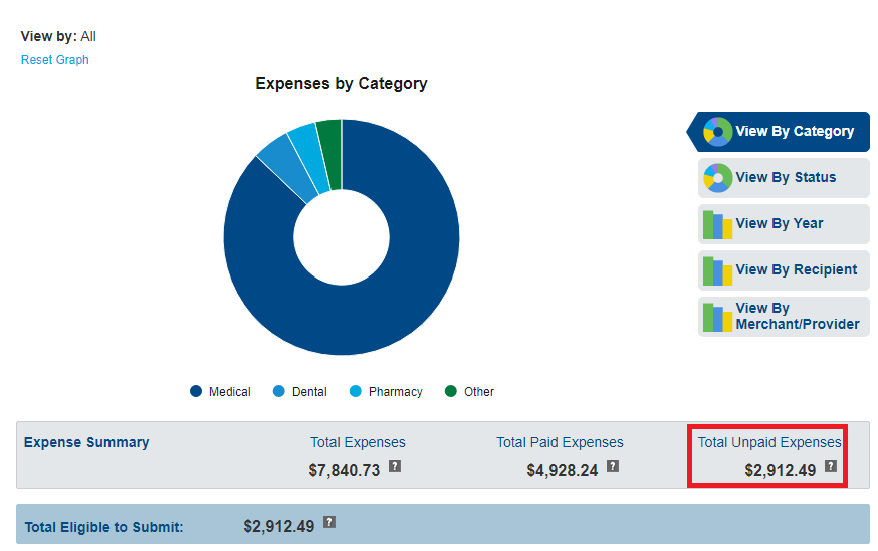

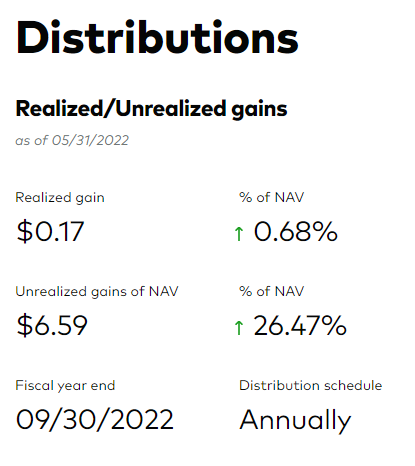

Negative – Tax Consequences If Held In A Taxable Account

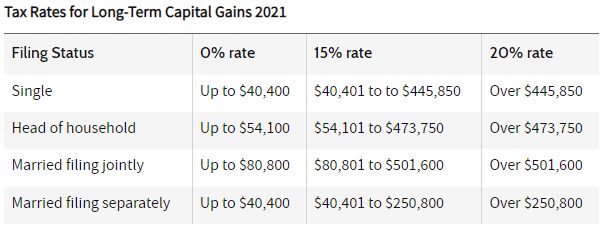

Automatic allocation adjustment by age is great but it doesn’t come without a cost: taxes. This adjustment happens very slowly and over time but it’s usually unavoidable to sell one asset to buy another without paying capital gains taxes at some point.

The fund manager will do their best to minimize the taxes but they won’t be avoidable over the long term. This is really true of any portfolio in a taxable account where you will change the asset allocation as you approach retirement.

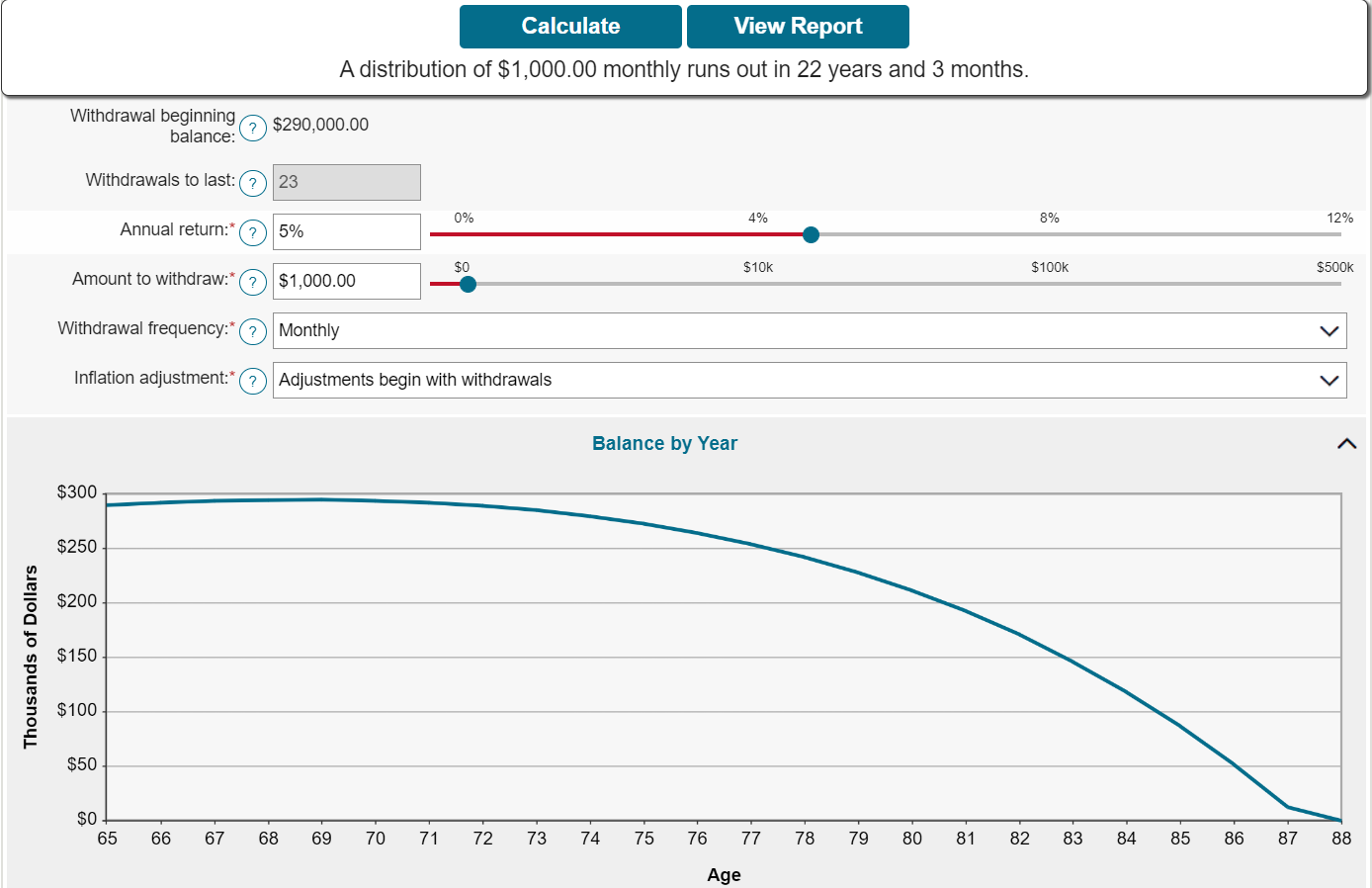

For example, here is the taxation on the Vanguard 2045 fund through the first five months of 2022. The realized gains are 0.68% of Net Asset Value (NAV).

If you had $1M invested and these were the gains for the year then:

Capital Gain = $1M * 0.0068 (0.68%) = $6,800.

If these were all long term capital gains (LTCG) and you were in the 15% LTCG bracket then you would pay:

Taxes due = $6,800 * 15% = $1,020 or 0.1% of your investment amount.

Since it’s ideal to be able to control our taxation it’s preferrable to hold target date funds in a tax advantaged retirement account (401k, 403b, 457, TSP, IRA, Roth). In that case no taxes are generated by the selling activity an you don’t have to worry about taxation until you withdraw money.

Target Date Funds Approaching And In Retirement (Drawdown)

As much as we’d like the retirement drawdown phase to be as simple as the accumulation phase, it’s just not. Here are some things to consider with target date funds in the retirement drawdown phase of life. This is the phase where we are actively living off of our money and need to sell retirement assets.

Positives That Don’t Change In The Drawdown Phase

There are some positive aspects of target date funds that don’t change in the drawdown phase. These are as follows:

- Still doesn’t require a lot of investing knowledge

- Still no rebalancing required

- Great diversification

- Low fees

Possible Negatives In The Drawdown Phase

As you could have guessed, it’s not all sunshine and rainbows when it comes to target date funds in the drawdown phase. There are more moving parts and the simplicity that was so attractive in the accumulation phase needs to be managed in the drawdown phase.

In the drawdown phase target date funds limit your options and may require special adjustments based on your personal situation and goals.

Negative – Can’t Set Your Asset Allocation Near Retirement

The largest sequence of return we risk we face is on the day we retire. Our assets are the largest and a market drop on that day could have a very substantial impact.

Target date funds do aim to get you towards a 50/50 allocation by your retirement (including some TIPS).

However, you don’t have control of exactly which assets you hold and in what percentages.

You can artificially alter this by selling the target date fund and buying a different one. For example, if your retirement date was 2025 then selling that and buying a 2040 fund would be change you from a 57/43 allocation to a more aggressive 80/20 allocation.

If your retirement date was 2025 then selling that and buying a 2020 fund would be change you from a 57/43 allocation to a more conservative 45/55 allocation.

Selling in a taxable account would create taxable events, though, so that’s not a great option if held there.

Obviously there’s also no ability to own something completely different than what’s in a target date fund. You can’t avoid holding corporate bonds by having a government bond fund instead of a total bond market fund.

Negative – No Ability To Tax Loss Harvest

If you are holding a separate stock and bond funds in a taxable account you have the ability to sell them during a downturn and buy different funds to realize a capital loss. If holding a target date fund the fund will rebalance but will not change investments to realize a loss.

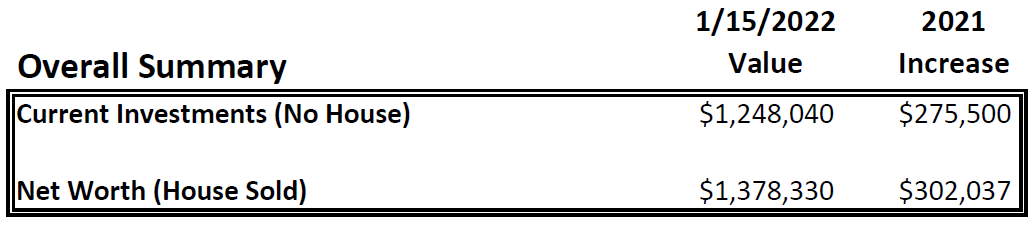

Negative – Doesn’t Consider Legacy Goals

The asset allocation for a pot of money needs to align with the timeline and purpose of that money. If 2025 is your retirement date and you choose the corresponding target date fund then it’s going to adjust the asset allocation as if you need the money in 2025.

However, what if you never intend to use that money? If that money is for inheritance and generational wealth then you don’t need the money in 2025. Keep it in a 2025 fund and your asset allocation will become far too conservative for those legacy goals. You’d be better off with a fixed asset allocation that wouldn’t change over time on you.

Negative? – No Ability To Sell Specifics Assets

The simplicity of target date funds means that it’s all or nothing with a fund of funds. You can only sell shares of the entire fund which sells all the stocks and bonds inside of it.

Here’s an example.

Your $1M worth of target date funds is holding a 50/50 stock/bond allocation at the time ($500k/$500k). That $500k of stock drops 50% to $250k with a bear market and the bonds go up $50k to $550k. The fund is going to rebalance internally to $400k stock, $400k bonds. Selling the fund shares will then sell both stock and bonds in proportion to give you your money.

If the money was held as separate stock and bond funds you could opt to sell just the bond fund and leave the equities alone to recover. I’m not sure if this would have an appreciable impact on taxation or performance but I generally prefer more control over less.

Target Date Fund Suggestions

In summary, target date funds are great option for new investors and investors that value simplicity over control. Here are some suggestions for how to most effectively implement target date funds if they’re your investment of choice.

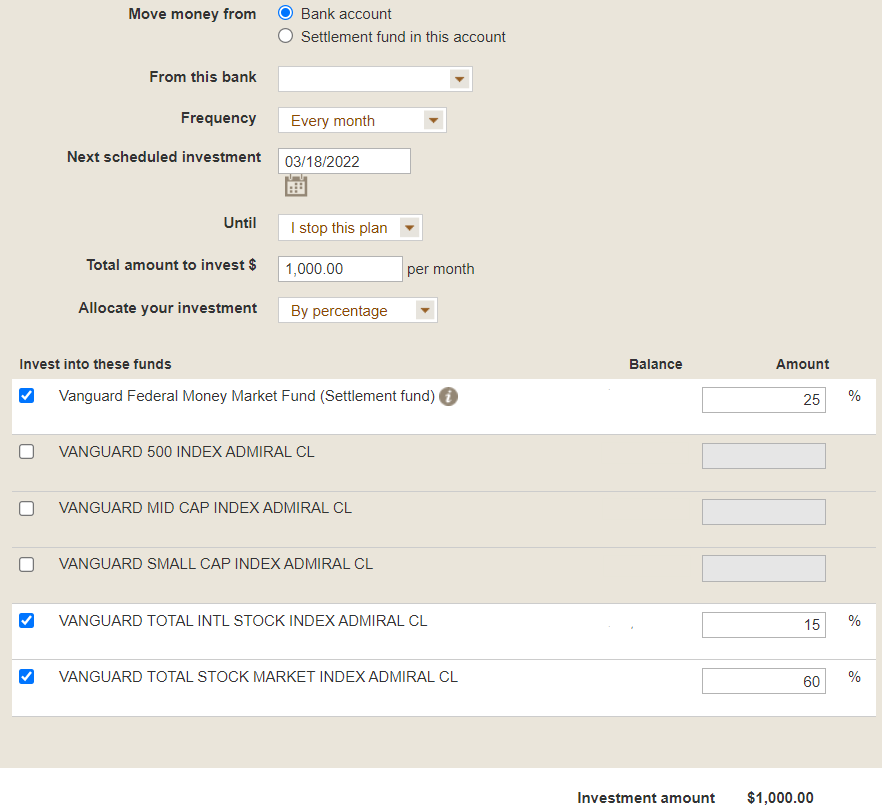

Stick To Target Date Funds Inside Of Retirement Accounts (401k, IRA, Roth versions)

Forced taxable events due to shifting asset allocations over time is probably the biggest downside to target date funds. By holding them only in retirement accounts then you shield yourself from taxable events. Additionally, it makes it easy to “graduate” to an asset allocation using individual funds in the future without causing taxable events.

Compare Your Risk Tolerance With A Target Date Fund Before Investing

One of the worst outcomes for a new investor is to lose more money than they can handle and be scared away from investing forever. It’s important to take a risk tolerance questionnaire like the Vanguard investor questionnaire and then compare the results with the recommended target date fund.

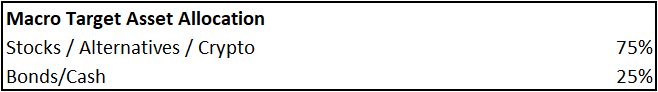

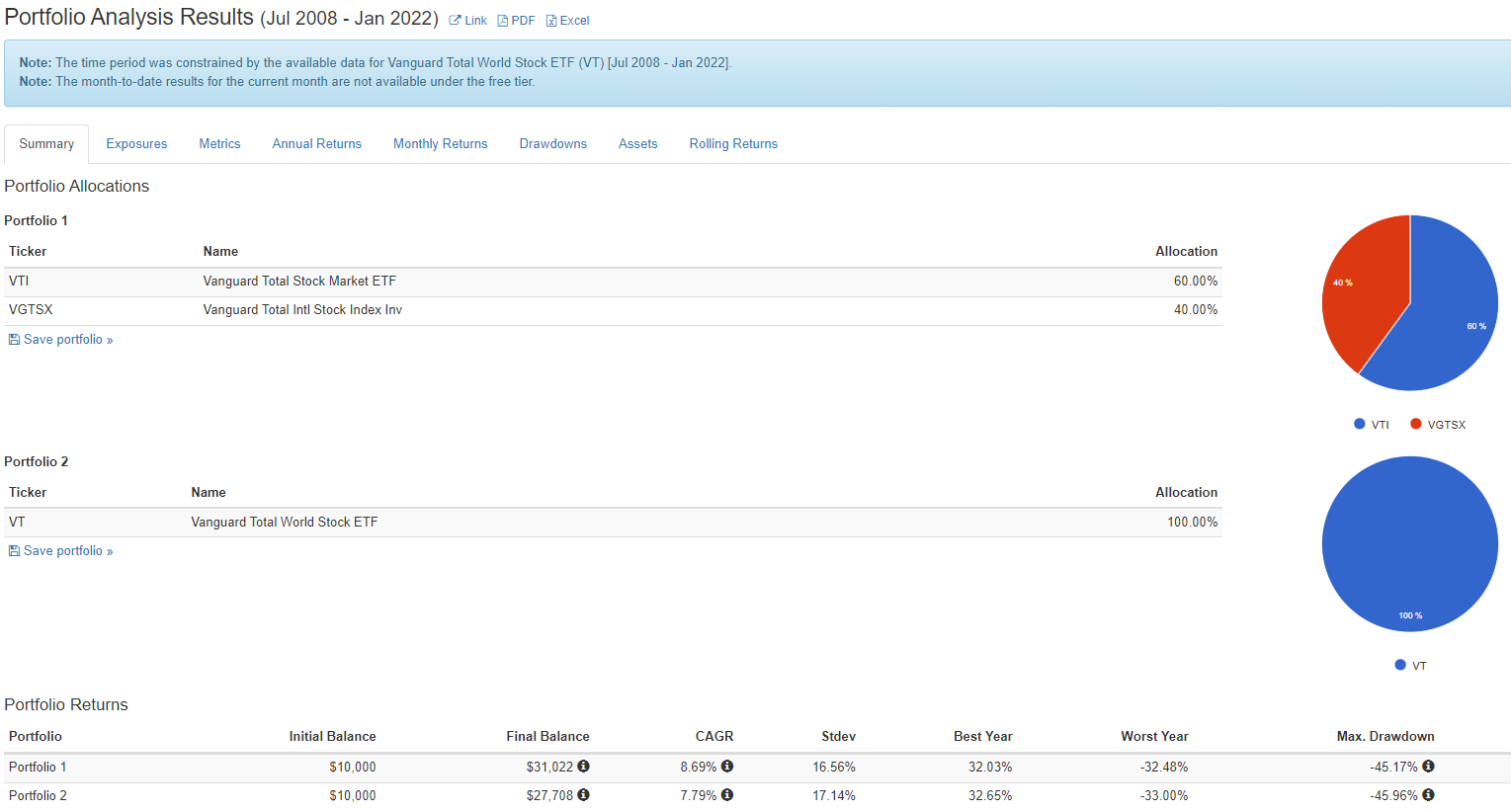

If the questionnaire recommends a 70/30 maximum allocation then a target date fund that invests with a 90/10 allocation might be too much risk. If a bear market hits those losses could be more than you can handle. In that situation you may be better off replicating a target date fund but using percentages that align with your personal risk tolerance.

Avoid Target Date Fund For Non-Retirement Goals

An important feature of target date funds is that they automatically adjust the asset allocation over time towards a retirement date. If the goal of the money is not actually retirement then the fund allocation might not align well with the goals that you have such as inheritance.

A better option in those situations might be to choose a fixed asset allocation of 2-3 index mutual funds based on that goal and your risk tolerance.

Action Steps:

- Look up the details of your target date fund. What does it hold? What percentage of it is in stocks and bonds? What is the expense ratio? If > 0.5% then you might want to look for individual funds instead.

- If you aren’t sure how much risk you can handle, consider taking an investment questionnaire. This is the MAX risk you can handle. Make sure that the target date fund asset allocation isn’t more aggressive (high percentage of stocks) than what the questionnaire said.

- Check what accounts are holding your target date funds. Are you holding them in a brokerage account? If so, think about whether you’d like to keep doing that going forward. Keep an eye on the taxes you pay each year. Decide if you want to keep using them or replicate a target fund using individual index funds instead.

Have financial questions that you need help with? I’m opening up my mailbox to answer questions! I will keep all submitters anonymous and will post up answers on the blog for the benefit of everyone. To submit questions please e-mail me @ contact@managingFI.com.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.