Time flies when life is happening. It’s beautiful here now that it’s summertime in upstate New York. Between work, vacation, trail running and generally trying to get outside as much as possible I’ve been writing a little less.

It feels like just yesterday I posted my first quarterly update ever for Q1 2022. Upon reflection I realized that I foolishly called it a “FI progress” post without actually stating how the numbers were stacking up against our rough FI number of $2M. Oops. Hope you’ll forgive me.

I decided that the FI journey is a slow one and updates against an FI number are probably better off in an annual wrap up. So, I changed the post name and I’ll worry about FI progress at the end of the year.

2022 Q2 Portfolio Update:

And we’re back with another quarterly update. This month my focus will be on showing you how much money we lost to help you feel better about your own losses. Well, losing money is never the goal but it happens some years none the less. We’re all in this together.

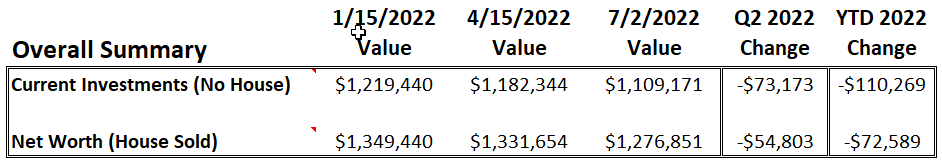

Q2 Total Investment Account (-$73,173) Value Changes:

Here’s an overview of my contributions, as broken down by the retirement tax triangle.

Q2 Account Contribution Summary (+$33,317):

- Taxable (+$6,465)

- Tax Free (+$1,825)

- Tax Deferred (+$25,027)

In Q1 our overall investment accounts were down $73k after $33k in contributions. It’s understandable that some people feel that this feels like lighting dollar bills on fire. I put money in, and less money comes out! This investing stuff is dumb, I quit.

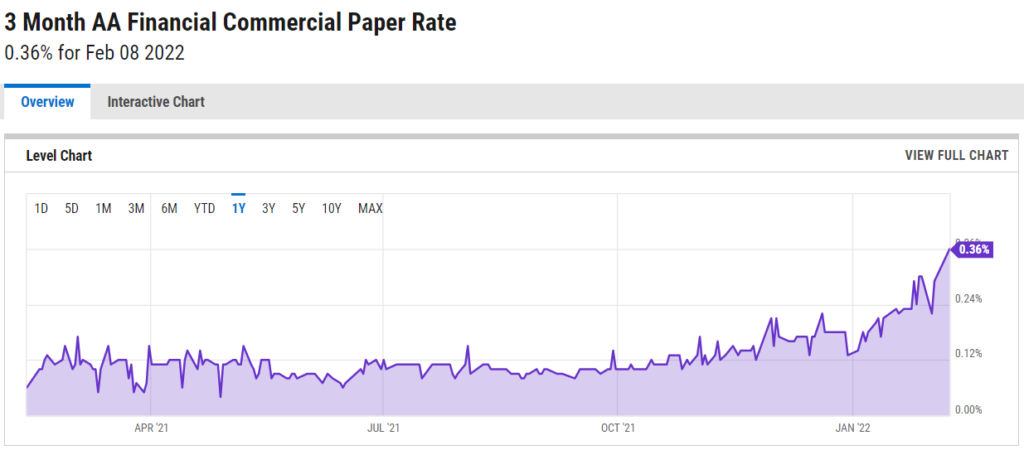

That’s how it goes though. The total stock market ETF VTI peaked at $243/share this year. Now it costs $191/share. At that peak I could have purchased 41 shares for $10,000 but now I’m buying 52 shares for the same $10,000. When it returns to the peak, our 52 shares will be worth $12,600.

The key is that you stay the course and don’t radically change your plan. I know that can be challenging emotionally. That’s why I gave people some ideas to avoid mistakes during a bear market.

Q2 Net Worth (-$54,803) Value Changes:

The crazy housing market continues to make me shake my head. I thought it was crazy that our home value went up 10% in Q1. Well, it did it again in Q2 up another 10% by $19,300 to $225,200.

We live in an area where this is highly unusual. With rising mortgage rates I can see this trend slowing way down and reversing.

Due to the bear stock market I completely stopped overpaying our 3.65% mortgage despite that being the prior plan. Stocks are getting cheaper so I think it’s a prudent tactical move. I ran the numbers on pre-paying my mortgage vs. invest in this article.

Taxable Accounts Value Change (-$27,472):

Here are our contributions to these accounts this quarter.

Q2 Taxable Account Contributions: +$6,465

- Brokerage – Added $4,360 to the account.

- iBonds – No added contributions. I still have $8,500 in “space” to buy more this year. However, it takes a lot of money to max our after tax 401k contributions for a future mega backdoor Roth contribution. I’ve been prioritizing buying stock funds in the brokerage account with extra money that I have.

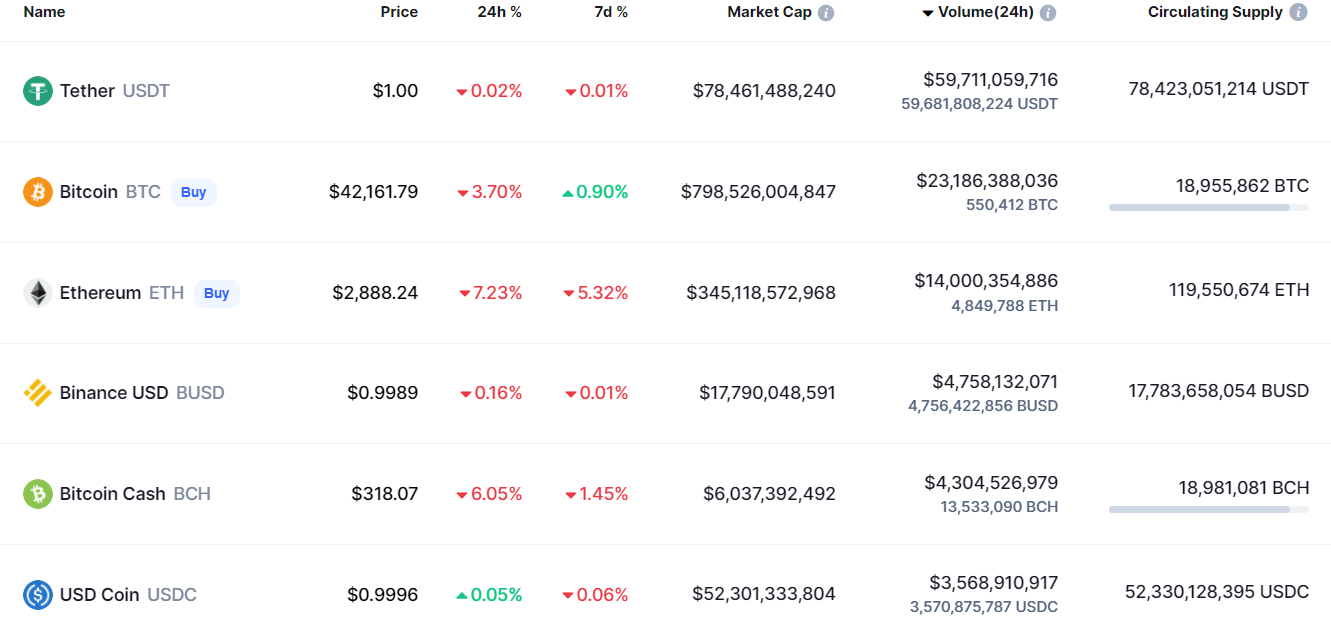

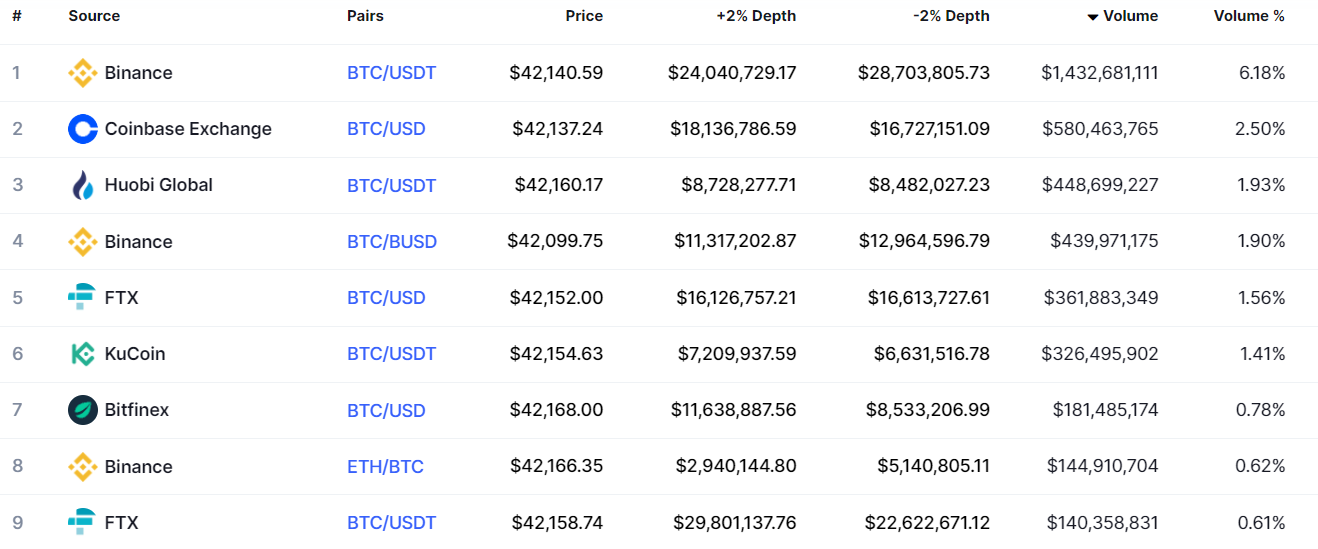

- Crypto – Bought $2,105 in BTC and ETH. I also sold my GUSD stablecoins and purchased BTC and ETH with that money.

We contributed $6,465 to our accounts and still saw our taxable accounts go down by $27k. The current bear market in both US stocks and crypto. The brokerage account is currently 100% stock so it’s highly volatile.

BTC is where we hold most of our crypto and that dropped 57% in Q2 alone. Yikes! This is why it’s important to be diversified and invest according to what level of risk you can handle.

I can sleep fine at night losing $7k. If that was a 57% drop in 3 months on a $1M portfolio pushing it down to $430,000 that would be terrifying.

The crypto portfolio has dropped so much that even with contributions it’s falling way below my target allocation of 1% of our total portfolio. I’ll keep adding to it slowly to try and get it back to $10-12k by the end of the year.

Tax Free Accounts Value Change (-$24,101):

Q2 Tax Free Account Contributions: +$1,825

- Cash – No substantial changes. Normal ebb and flow.

- Roth IRA – No changes. Already maxed for the year.

- HSA – Added ~$1825 in contributions. Normal quarterly max out.

Our Roth accounts are invested in an 80/20 stock/bond portfolio so those took a good hit. The downside of maxing these out in Q1 is that there’s no ability to DCA into these accounts as they drop in value.

HSA’s dropped substantially on a percentage basis since they’re invested 100% in stock. That’s because they’re our retirement healthcare fund.

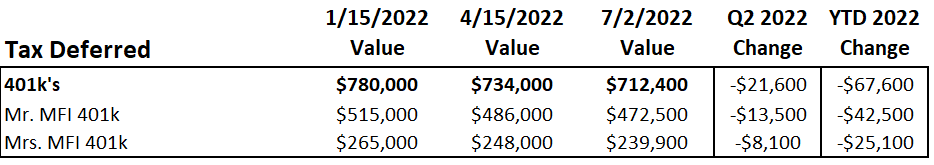

Tax Deferred Accounts Value Change (-$21,600):

The tax deferred account balances weren’t down as much in Q2 but unfortunately that was partly because we contributed a LOT more. We put in $25k and the account was still down $21.6k. That’s okay, those dollars will buy even more shares when they get put to work in the Roth at the end of the year.

Q2 Tax Deferred Account Contributions (+$25,027):

- Mr. MFI 401k – $17,045* in my contributions. $2,857 in company contributions.

- Mrs. MFI 401k – $5,125 in her contributions.

*Includes after tax contributions for a future mega backdoor Roth contribution.

Financial Topics On My Mind:

Each quarter I like to discuss some topics that are on my mind. They could be based on current financial events. They could be ideas based on thought provoking things that I’ve read. They could changes or ideas that I’m looking at implementing in our own portfolios.

Bear Markets

A bear market represents a 20% or more drop in the value of a market from the peak to the current value. We saw a bear market not long ago during the COVID crash of March 2020 when the S&P dropped 30%+. However, it was so short lived and recovered so quickly that it felt different than this. That along with the fact that at that time we were all more worried about dying than our portfolios.

Well, here we are again in early 2022 and we recently hit bear market territory for the S&P500 index. With a peak around 4800, anything below 3840 would be bear market territory. We hit that in June and at the time of this writing it’s recovered slightly above that but who knows how long that will last for.

What does that mean? Well, it does mean that stocks have started to drop from their sky high valuations to something more reasonable. If you’re far from retirement and still working this is a great opportunity to pick up shares for cheaper.

However, bear markets can be very difficult to deal with mentally. Especially if you haven’t been through one before. If you track your net worth you were flying high at the end of 2021. Our invested assets topped $1.2M and it felt amazing.

Then, a bear market hits and portfolios start dropping. If not for our very high savings rate continuously investing during the drop we’d be down over $200,000 and would have dropped out of the 7 figure club. I don’t care how experienced you are, that still sucks.

What to do? Well, stay the course, of course. If you have an investment plan now is the time to stick to that plan. Keep investing as you have been.

Avoid making drastic changes based on these short term events. Remember, you’re a long term investor and bear markets are typically 1-3 year events. More tips here for how to avoid investing mistakes when markets get crazy.

When markets get volatile your investments can get out of whack so be sure to review them every 6-12 months at a minimum to rebalance. Remember that rebalancing is effectively selling the high priced stuff and buying the low priced stuff.

Tactically, one thing that we changed is to stop overpaying on our mortgage. A while back I decided to pay an extra $500/mo towards our mortgage principle instead of investing that money. The goal being to pay off the mortgage a little faster.

With the market dropping and having a 3.65%, 30 year mortgage with only 7 years left on it with normal payments, we decided to stop the overpayments. Instead, that $500 is being invested in stock indexes in our brokerage account.

Crypto Winter

Brrr, crypto winter is upon us! Crypto values are tanking, stable coins are failing and some crypto companies are going out of business. In other words, shit is getting real in the crypto space after a couple years of euphoria.

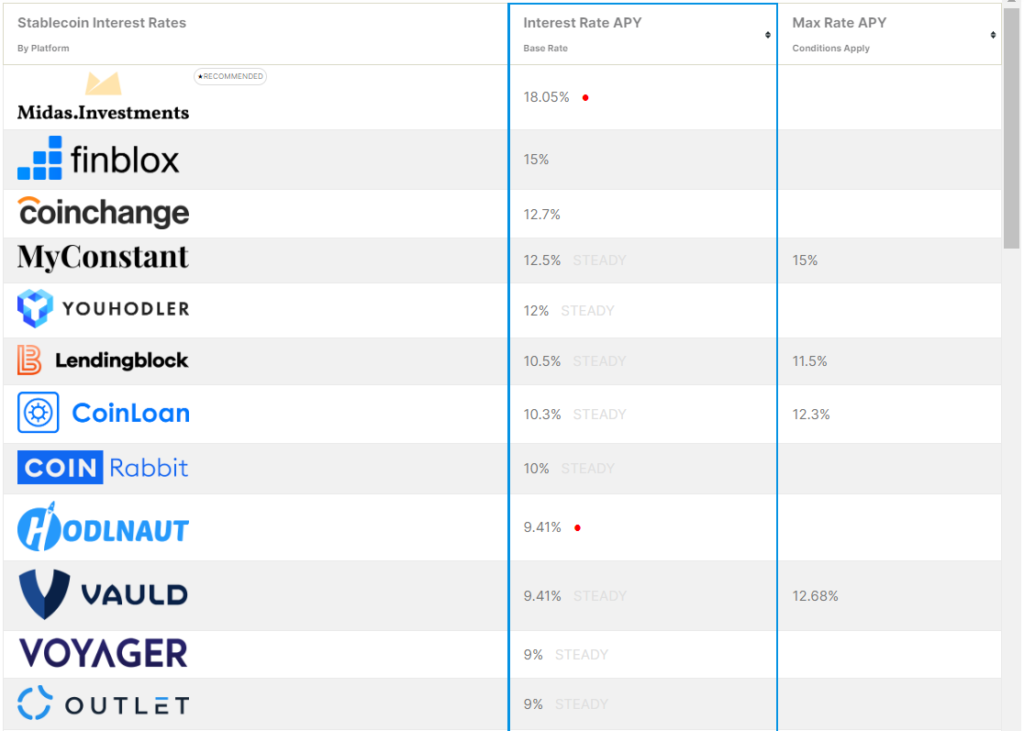

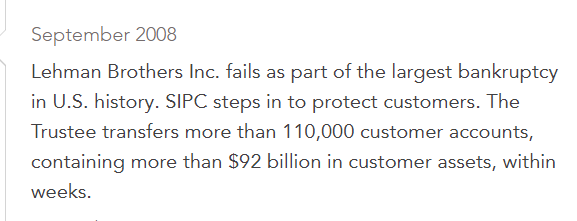

I recently wrote about the risks of stablecoins. In there I spoke about counterparty risk as being a large one. One, we’re seeing that play out in multiple places. The stable coin UST lost its peg and its partner coin Luna went to zero.

If that wasn’t enough, Celsius and Voyager stopped allowing customer withdrawals. We found out that they were both loaning out large sums of money to others like 3 Arrows Capital (3AC) that were taking large risks with that money.

They’re halting customer withdrawals due to having “liquidity problems” which has many investors angry and worried. Its likely that they will lose some of their money and in the worst case they could lose it all. This is the problem with crypto companies that are unregulated. You don’t really know what risks they might be taking with your money.

All of that has put cryptocurrency prices into a free fall since they peaked in late 2021. Bitcoin, generally the most stable of all is down 68% from its peak!

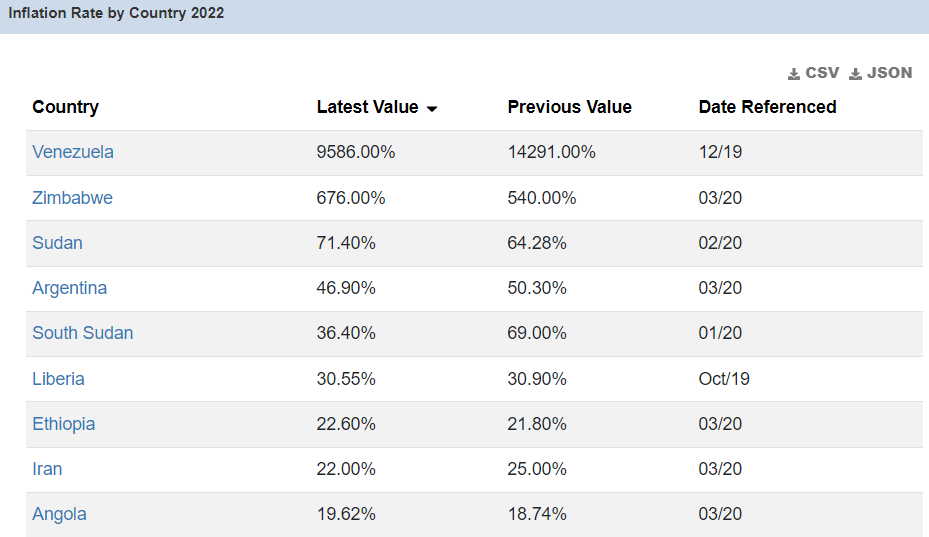

There isn’t a market index to judge a crypto bear market but here is how much some popular coins have dropped from their peaks:

- Bitcoin – 68%

- Ethereum – 75%

- Dogecoin – 80%

- Luna – 100%

I have my crypto assets at Gemini which fortunately has been one of the safer platforms. That said, I’m still spooked by the possibility of their failure causing me to lose my money.

Focusing on what I can control in this situation, I’ve purchased a Trezor Model One hardware wallet. This allows me to transfer our crypto off of Gemini and hold it in cold storage. In plain English, it means that our crypto is in our possession and nothing happens to it if Gemini were to go bankrupt. They have no ownership of the asset.

With such a risk hanging out there, why did it take myself and so many others so long to consider becoming their own crypto custodian?

- Having a “hot wallet” on an exchange is just easier.

- There’s a lot more responsibility, complication and different risks in self custody.

- The risk of crypto companies freezing withdrawals and you possibly losing your assets is hard to gauge. Many assumed that it was a low probability risk.

Having now setup my own hardware wallet I can confirm that this NOT for the everyday person. There are so many ways that you can screw this up and lose your crypto. Long wallet addresses that must be correct, recovery seed words that must not be lost and nobody to help you if you mess it up.

Recession Worries

A bear market is one thing, but a recession is a separate concern. A recession is when the country gross domestic product (GDP) decreases for two consecutive quarters. GDP being the value of the goods and services produced by the country over a quarter.

US GDP went down by 1.5% in Q1 2022. If it goes down in Q2 then we will be considered in a recession. Because we only know about it after the fact, a recession is a lagging indicator.

Why Is This Happening?

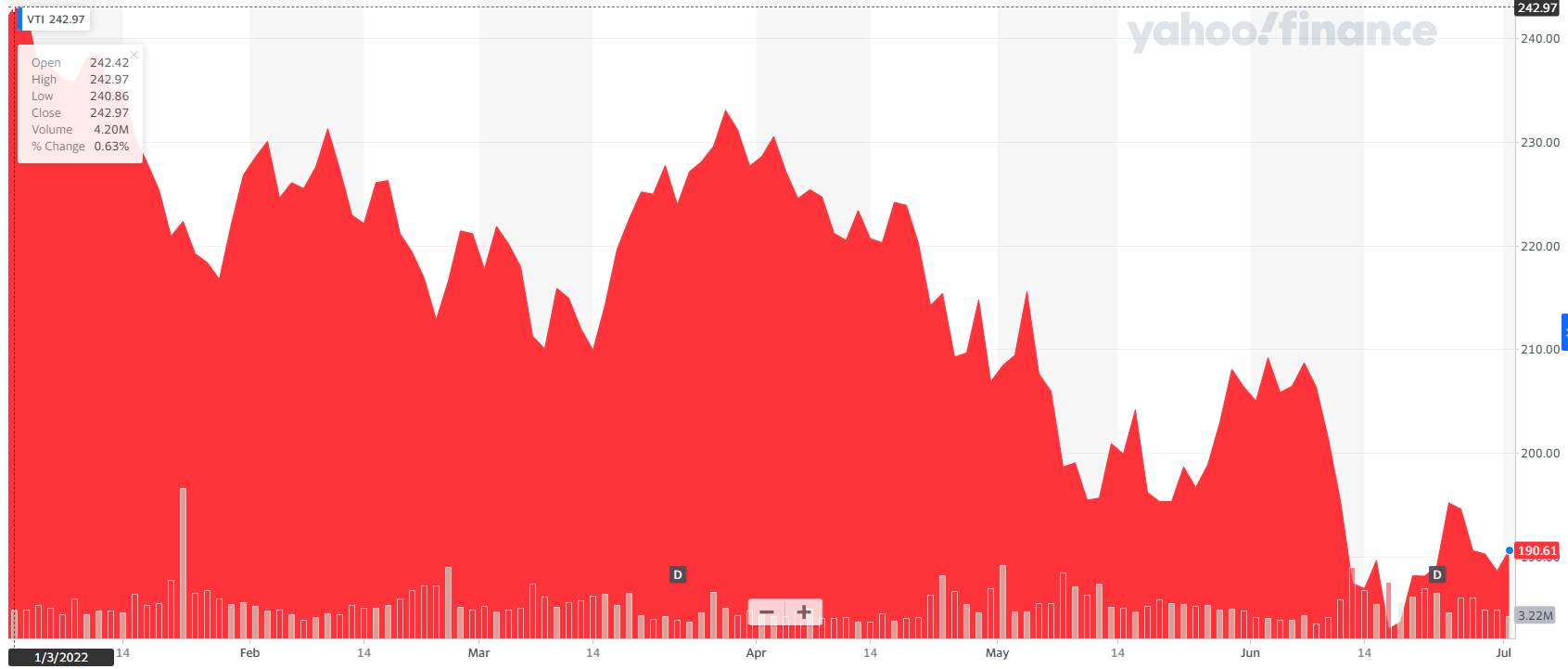

Inflation is increasing and to combat that the Fed is increasing interest rates. Inflation is making costs go up and interest rates going up makes it more expensive for businesses to borrow money. Additionally, low unemployment means wages are increasing further squeezing businesses that compete for talent.

This usually results in companies tightening their belts with layoffs or bad businesses going bankrupt. Even popular companies like Tesla are beginning to lay off staff in areas where they grew too quickly.

Should You Be Worried?

Talking about recession may give you flashbacks to 2008 if you’re at least 35 years old. Should you be worried about a recession and the possibility of you losing your job?

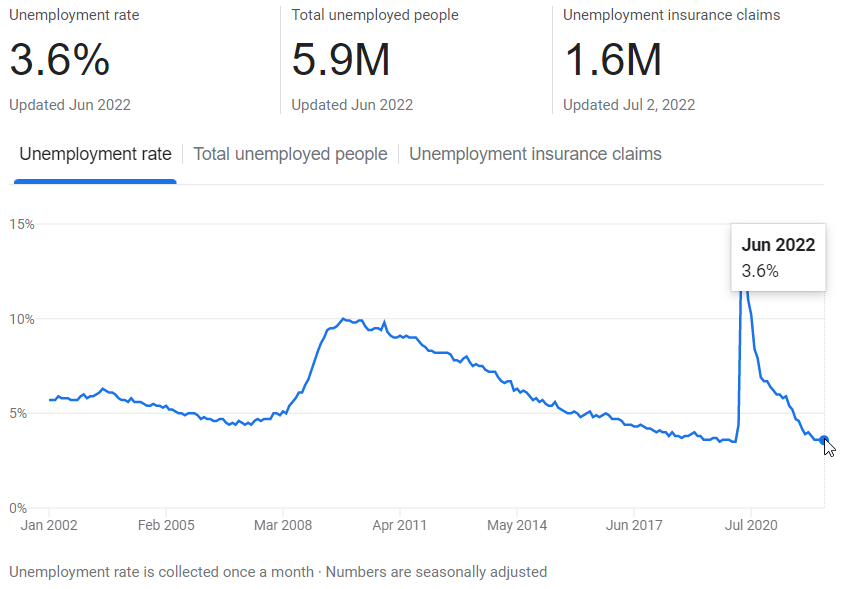

Maybe, but this recession will be a little different. Right now we’re still at record low unemployment of 3.6%. While that will likely go up, there is no massive housing bubble or financial crisis to go along with it.

I think everyone need to determine their own personal level of risk based on their jobs, businesses and income streams. Anytime there is a slowdown the companies in worse financial shape including new ones are the most vulnerable. As are usually businesses that rely on more discretionary spending.

What Am I Doing?

I’ve been fortunate throughout my career to have a fairly safe job in the defense industry. I’m not a middle manager with a higher salary so I do feel a little more vulnerable. However, like other companies I know we’re struggling to hire people to fill our gaps AND retain the people that we have.

I do feel fairly safe but there are some actions that I’m taking to set myself for success if I were to get laid off.

- Increasing our liquid emergency fund – We have a decent ~8 month EF not including unemployment if I were to lose my job. However, cash is king when you lose your income. If there’s no job loss then we’ll invest it as a lump sum.

- Making your value known at work – The best employees that contribute most to the revenue and success of the company are the ones most likely to be laid off last. Be valuable and you’ll reduce the risk of getting the ax.

- Updating my resume – It never hurts to have that up to date so that you aren’t scrambling to do that after an emotional layoff.

- Working on a side hustle – ManagingFI financial coaching! Yes, I’m taking my knowledge and using it to help others achieve their financial goals. Interested in being a client? Contact me at contact@managingFI.com and tell me what you need help with.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.