BLUF: When investors let emotions drive their decisions, they often lose money. Use these tips to help you stick to your plan and avoid making “in the moment” investing mistakes.

Market movement of all kinds can cause a wide range of emotions in us. Those emotions can very easily translate into investor behaviors that can cause long term damage to their portfolios. Selling investments to cash, borrowing to recoup losses and making huge changes to asset allocations are just a few examples of bad behaviors.

We’re going to explore how investing creates emotions and how that can influence bad decisions. We’ll discuss ways that you can minimize those emotions and prevent them from causing actual investing mistakes.

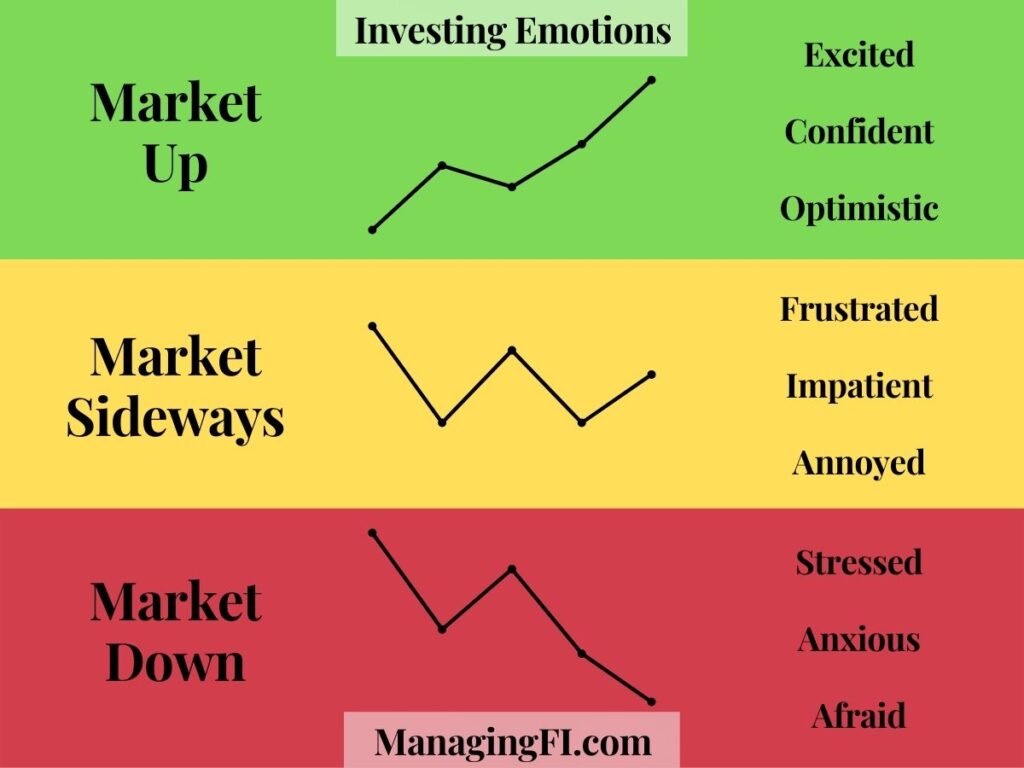

Investing Emotions

Investing is really hard. It would be much easier if we were unemotional robots that only used data and logic to make sound decisions. But being human and not robots, we’re complex, easily triggered balls of emotion that can go from zero to irrational very quickly at times.

With our hard earned money accumulated over many years or decades on the line, investing drives a lot of emotions. We often focus on the negative emotions that occur when markets are drop. However, there are emotions that can be triggered in a variety of market conditions that are both good, neutral or bad.

These emotions can create little talk tracks in our brain to get us all sorts of spun up.

Market Up: I’m so good at this investing thing. I’m going to be rich. I’m going to retire early at this rate.

Market Sideways: This is such a waste, my money is going nowhere. How do people make money investing?

Market Down: Why am I investing when it keeps losing me money? I should move to cash to stop losing money. I’m never going to be able to retire.

Not only does market movement create powerful emotions, but losing money in the market generates a pain response in our body. Studies show that investors feel the pain of losing money twice as powerfully as the joy of the equivalent gain. In other words, if you lose $10,000 the pain you feel is twice the level of joy you feel from winning $10,000.

Experienced investors will often use the line that “stocks are on sale” when markets drop and inexperienced investors ask if they should sell. While in theory stocks are cheaper, it’s really a bad comparison to buying an item on sale at a store. There’s no financial pain of loss felt by a consumer that’s considering buying a new TV that’s dropped in price.

Logic Or Emotions: Which One Controls Our Decisions?

But I’m a logical person! This concern about emotions getting in the way of investing decisions clearly is for more emotional people and not me. Right? Wrong. There’s more to decision making than just unemotional logic and reason.

In the book Switch by the Health Brothers they discuss two different decision making forces inside of us as complicated human beings: the thinking brain and the feeling brain.

The thinking brain is the logical, rational part of our brains. It’s the part running calculations and spreadsheet to determine how much house we can afford based on our budget, down payment, interest rate…etc. It’s the part of the brain at the grocery store buying the cheaper tuna fish based on unit price.

The feeling brain is emotional and is making decisions based on how we feel about the decision. It’s the part that walks into an open house for a home that you can’t afford and makes you say: “screw the budget, this feels like home.” It’s the part that sees that shiny black corvette on the car lot and now all you can think about is how awesome it will feel to drive that each day.

A wonderful metaphor for the power scale of these two decision making forces is an elephant with a human rider on top. The feeling brain is actually the massive, powerful elephant while the thinking brain is the puny rider on top.

That thinking brain rider may believe that they’re in control because the elephant often listens to their commands. However, when the elephant doesn’t agree with the command the rider quickly learns who’s in control and they’re just along for the ride. The feeling brain elephant is in control and if there’s a conflict between the two it’s going to win. Every. Single. Time.

We often falsely associate being a logical person with making our decisions using logic all the time. The truth is that our emotions and feeling brain hold the power and are the driving force in most of our decision making.

How You Can Avoid Investing Mistakes

Now that we understand that our logical brain is smart but along for the ride, and our emotional brain is unpredictable and in control, the way to avoid investing mistakes should become clear. We need to make our investing decisions when in a logical, unemotional state and then avoid any substantial decisions when emotions are involved.

Stop Watching The Markets

Ever heard the phrase “out of sight, out of mind”? If you don’t see something in front of you, you are less likely to think about it. This rings true when it comes to the stock market.

Stocks are volatile by nature. If you have the habit of looking at the market performance daily, or even many times a day, you’re going to see that volatility.

The financial media knows this and loves to feed off of our emotions. Ever watch Jim Cramer?

People like him and the main stream medio love to sensationalize when markets drop. They’re pretty quiet though when markets slowly march upward over time.

A big up event for a market or asset that you don’t own could give you FOMO and an impulse to buy something that you otherwise wouldn’t. A big up day for an asset that you do own could make you pile in more.

A drop for a market or asset that you own could drive the pain of loss making you consider more radical actions like selling all of a particular asset to cash. At a minimum it’s likely to create some level of stress and anxiety that wouldn’t be there if you weren’t aware that it was happening.

In full disclosure, I’ve gotten into the bad habit over the years of watching the markets daily. Pulling open my phone multiple times a day to see what the markets are doing somehow became a habit along the way. Probably from my days trading futures and FOREX where the market trades 24 hours a day from Sunday night to Friday evening EST.

I watch the US market that I own, but also have highly volatile individual stocks on my watch list that I don’t own or have any plan to own. I watch bitcoin, gold and oil whether I plan to invest in them or not.

It doesn’t drive me to change my asset allocation drastically but a big drop on occasion will have me pull from a sinking fund to buy more of something in my plan.

I don’t think of myself as very emotional but I can still feel something inside me as an initial reaction to a big market move. It’s not healthy and I need to break this habit.

So, I’m going to break the habit. I haven’t look at the markets for the few days now and it’s been really hard to resist the urge. But, that will get easier with time. Not looking at them has made it easier to avoid any tactical urges because I just don’t know what’s going on. I’ll have to come up with a healthier cadence but for now let’s go cold turkey for a while.

Have An Investing Plan

An investing plan maps out a strategy to get from where you are today to and endpoint that achieves a short or long term financial goal. It gives you some guidelines to work within so that you can resist the urge to do spontaneous things.

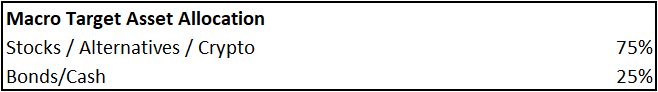

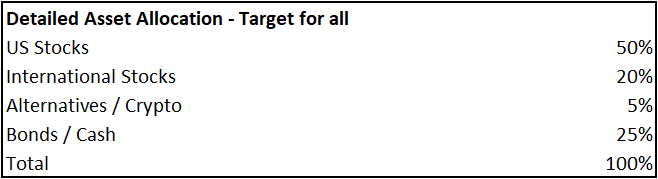

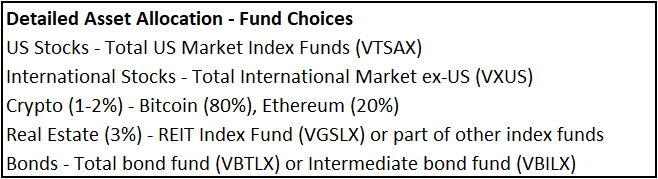

Here’s an example from my investing plan (there’s more to it). In the future I’ll go into more detail on how I arrived at all the details here. For this post, the key is that I have a macro asset allocation of 75%/25%. The 75% are all my higher risk assets – stocks, alternatives (real estate) and crypto. The 25% are my low risk assets mostly being bonds and cash.

I break this down into a more detailed asset allocation of US stocks, international stocks, alternatives and bonds/cash. In my case I then translated that into actual investments that I wanted to hold in my portfolio.

This isn’t the complete list because our 401k’s don’t quite have the same options but this gives you a general idea.

With percentages defined for each, and actual investments already chosen, you know how new money should be invested based on your plan.

Having an investing plan gives you a guide. It helps you stay the course and not make drastic changes that don’t align with the plan.

Automate Your Decision Making

A highly effective way to avoid emotional decision making is to avoid decision making altogether! If we setup automatic investing systems based on our plan we take ourselves right out of the regular decision making loop where we often mess things up.

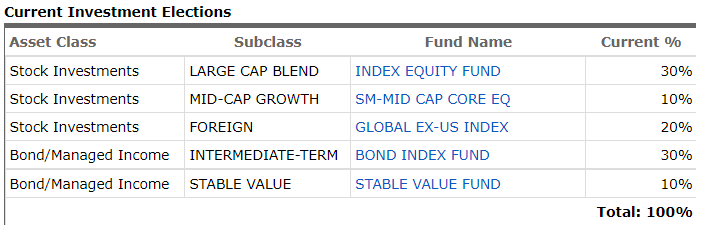

Fortunate for investors, it’s very easy to setup automatic investments. Here’s an example of automatic investments setup for my 401k.

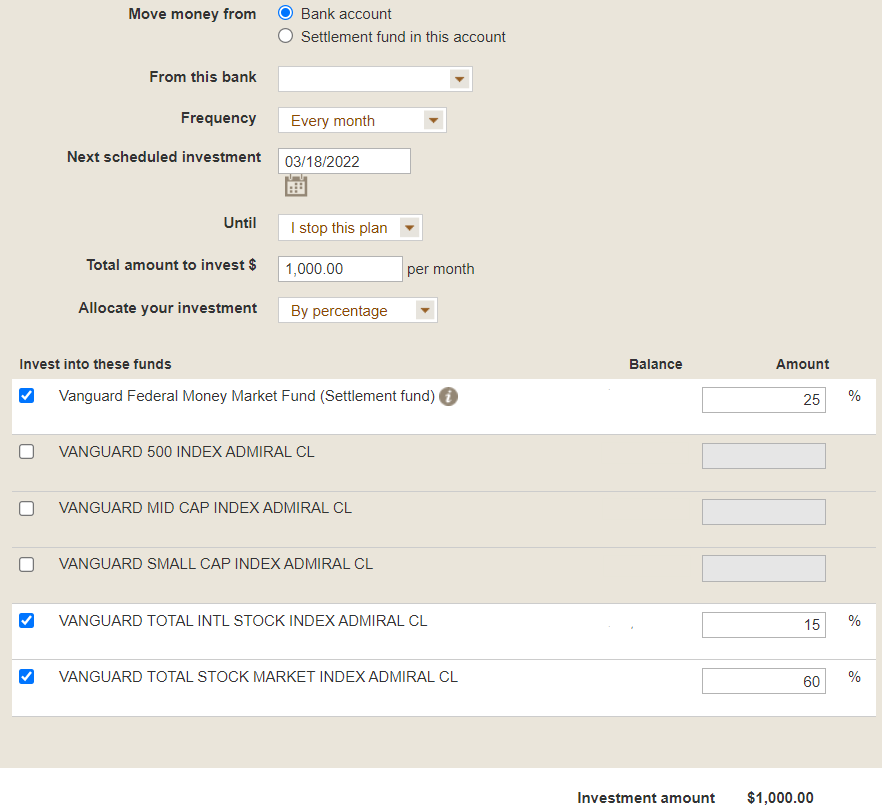

Vanguard, whose main issue is their antiquated user interfaces and systems has automatic investing although it’s only available for their mutual funds at the moment (not ETFs). Here’s an example from one of our accounts.

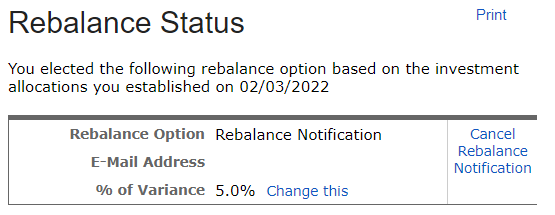

Some brokers offer automatic rebalancing to a target asset allocation. Or, at a minimum, notification that your asset allocation is X% off from the target so that you can go in and fix it.

Avoid Big Changes To Your Plan

Have you ever been in a car where someone treats the gas and brake pedals like an on/off switch? It’s terrifying. Racing to the next light then braking hard.

It’s also terrifying in investing when you treat your investing decisions as all or nothing like that on/off switch of a cars gas pedal. My stocks are killing it so I should sell all my bonds and go 100% stocks. Oh no, stocks are “high”, inflation is here and the market is correcting. I better sell all my stocks and go to 100% cash.

In the near term, none of us knows what the market is going to do. However, when people talk about making extreme changes to their plan it’s because they all of a sudden “know” what’s going to happen. Stocks are expensive, a big crash is coming. Interest rates are going to skyrocket in the future so bonds are going to get crushed and cash is trash.

This is often fueled by someone in financial media that speaks confidently about knowing the future. They don’t know for sure. The smart ones are making educated guesses. The not so smart ones are making wild predictions and often trying to sell you something off of the fear that they create.

That’s why you come up with an investing plan that’s broadly diversified. If you make adjustments to the larger plan it should be in response to your investing timeline changing, your situation or your risk tolerance. Not external stimuli like geopolitical events, inflation or the movement of the market.

If you do want to make a change, it should be something that’s well thought out over a period of time and a small percentage change compared with your overall portfolio. Make sure that you understand the reasons for the change and that they’re driven by your situation, not external events.

72 Hour Rule For Investing

The Frugalwoods have a great concept called the 72 hour rule to help you control your impulsive purchases. The concept is simple: if you want to make a non-essential purchase, you have to give yourself a 72 hour “cooling off period” to think about the purchase and make sure that you really need it.

I think this same concept can be applied to long term investing decisions. If you’re in this for the long term then there’s no change that’s must be implemented TODAY. I’m talking about changes to your plan, asset allocation or individual investment selections. Not normal investment actions that are inline with your current plan.

Instead, after you come up with a change to your investing plan or a tactical move that you want to make, sit on that change for at least 72 hours. That gives you time to ensure that emotions are not influencing your decisions and allows you to reflect on the new plan. If after that period you think the change makes sense, then go for it.

Your investing life will go on just fine if you think through any investing decision for at least 72 hours before going ahead and implementing it. You come up with an idea on Saturday and then think about it until at least Tuesday. The bigger the change, the more time that should be devoted to thinking through the decision.

Key Takeaways

- Investing generates a wide range of emotions that will encourage you to take action.

- Your emotional brain is more powerful than your logical brain opening the door for irrational decision making during times of high emotion.

- Removing or reducing emotions from the decision making process can help you avoid investing mistakes. Not watching the markets, having a plan, automating the plan and having a cooling off period are all ways to avoid mistakes.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.