BLUF: Thanks to our highest ever income and intentionality we saved the most ever and spent the least in 2021 while still doing all the things that we wanted to do.

Year end wrap-ups like this are one of my favorite things to do. We’ve spent the year working, tracking, budgeting, investing and living so a wrap up is a way to step back and see the results. I am an engineer and finance nerd so I love to dig into the numbers.

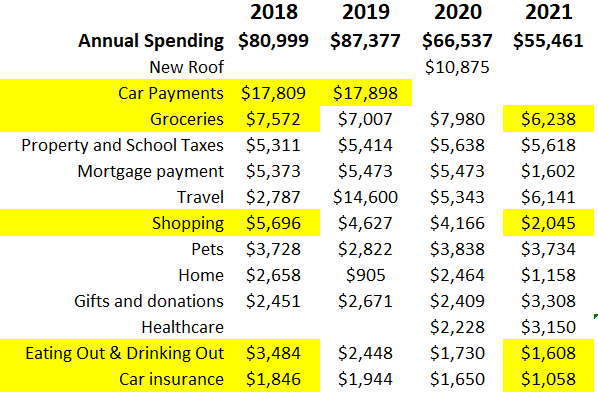

In 2018 I started compiling an annual spreadsheet overview of our income, savings and expenses so we could see how well we did for that year. It’s morphed a little over time in how I categorize and track things. After a year of blogging I’m taking a step that I never thought that I’d take. Making it public.

My goal here is not to brag. After all, for most out there this is anonymous and they don’t know who I or Mrs. MFI are in person. In 2022 I intend to be more open and transparent about our numbers and where we are on this path to FI. I know some people want to see the numbers and details because it helps them assess their own situation.

Personally, it’s helpful for me to review and talk through each component because sometimes I realize that there are parts of my plan that I need to change. Am I spending too much or too little? Am I saving and investing in the right mix of tax diverse buckets?

If you’re new to the blog, Mrs. MFI and I are a couple of 40 something dual income no kids (DINK) professionals who do our best to spend intentionally so that we can save aggressively for our future. Neither one of us feels like we live a deprived life at all.

With that, lets dive into the numbers.

Financial Overview

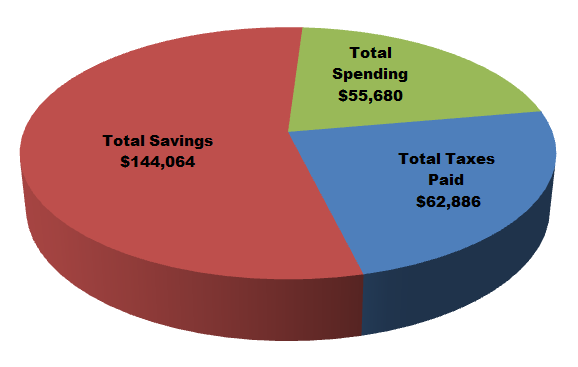

We made $262,631 in total compensation in 2021 which I’m thrilled about. That income was then taxed, saved and spent in the following high level breakdown.

Income: $262,631

I’m disclosing a lot in this blog post but I’m not going to break down the exact split of this income. I will give you the different sources that contribute to this number. This is the most money that Mrs. MFI and I have ever made in a single year.

- Mr. MFI W2 Income

- Mrs. MFI W2 Income

- Mr. + Mrs. MFI W2 Bonuses

- Mr. + Mrs. MFI company 401k matching contributions

- Miscellaneous Income ($2k) – Selling stuff on Ebay, selling stuff on FB marketplace, credit card rewards cash back.

Income Taxes: $62,886

This includes all payroll taxes for both of us. Federal income tax, state income tax, social security tax and Medicare tax.

Some people like to include these as expenses in their budget breakdown but I like to keep them separate. Being W2 employees without a business, aside from taking advantage of all the tax advantaged savings funds there isn’t much we can do to control our taxation.

We currently do maximize all these options to reduce our taxable income like contribute to traditional 401ks and HSA’s. In the future we max give up some tax efficiency to contribute to a Roth 401k but at the moment we’re staying the course.

Savings: $144,064

For savings I’m going to break things down into sub-categories that I’ll define as we go along. Now, some people are not going to agree with some things that are included in my savings number and that’s okay. Personal finance is personal.

In future blog posts we’ll go deeper into what securities we’re actually invested in but in general it’s index funds in some form or another.

Tax Deferred -$50,919

Tax deferred are traditional pre-tax savings accounts that lower your taxable income. In the future when we withdraw that money for use it will be taxed as ordinary income when our overall income is much lower. In our case these are both employer 401k plans. Being in the 24% tax bracket we maximize these to try and lower our adjustable gross income (AGI).

- Mr. MFI 401k Contributions – $19,500

- Mrs. MFI 401k Contributions – $19,500

- Employer 401k matching contributions – $11,919

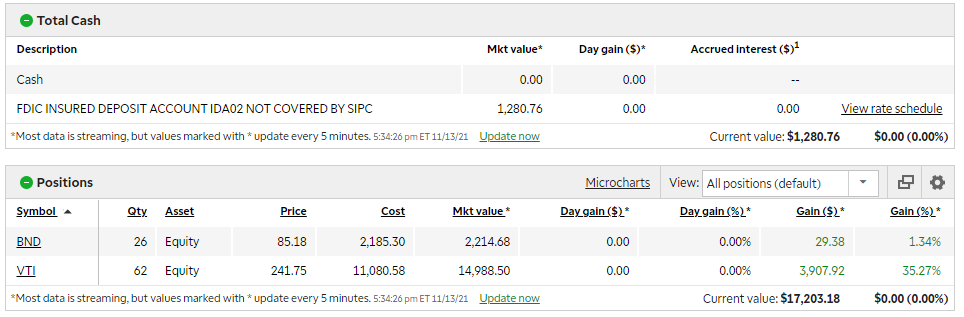

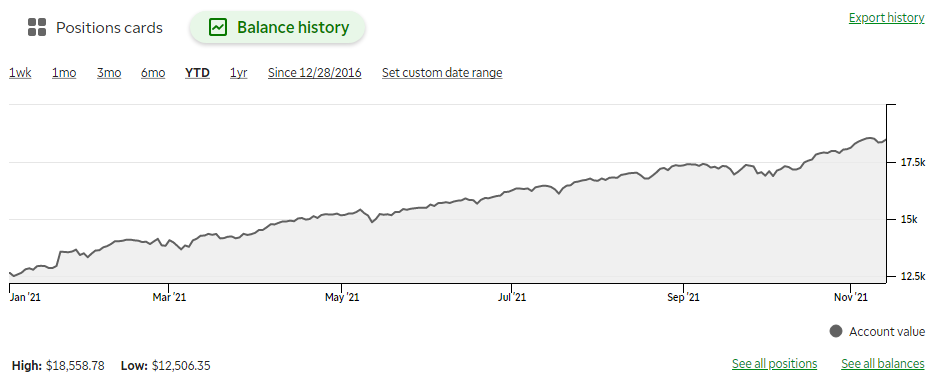

Tax Free – $45,059

Tax free are accounts where taxes have already been paid before the contribution and are therefore tax free in the future. This is the case for our Roth contributions as well as my mega backdoor Roth contribution. Read here for a step by step guide to see if the mega backdoor Roth is something that you can do.

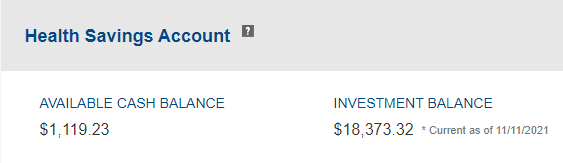

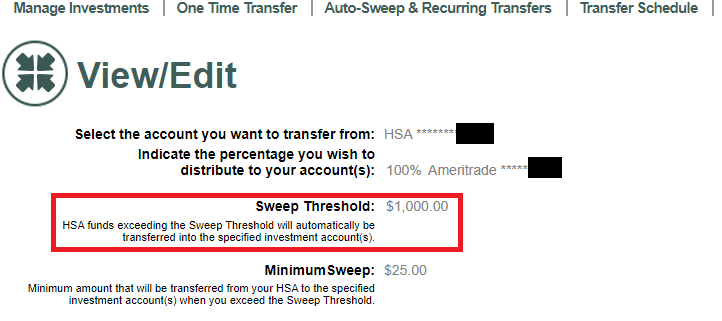

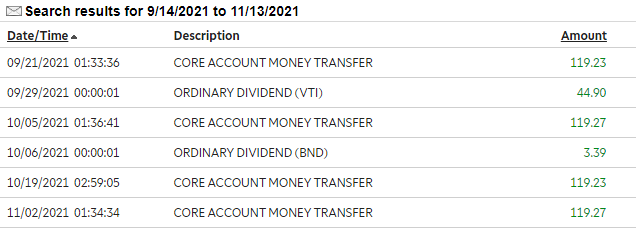

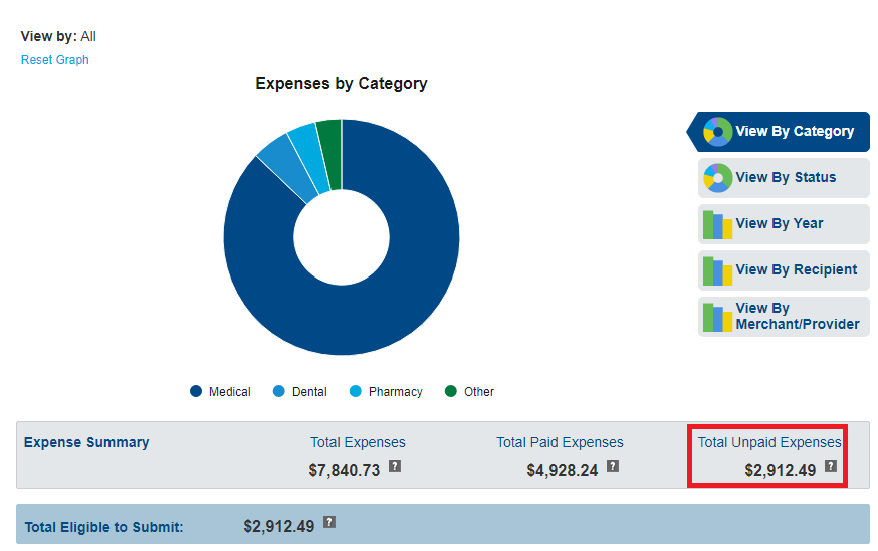

One thing that might surprise you is me including our HSA contributions here. These are pre-tax contributions but because of how awesome the HSA is the money is tax free for use with medical expenses. Since we intend to use this money exclusively for medical expenses in retirement I keep it here.

- Mr. MFI Roth Contribution (backdoor) – $6,000

- Mrs. MFI Roth Contribution (backdoor) – $6,000

- Mr. MFI Roth Contribution (Mega backdoor) – $25,859

- Mr. MFI HSA Contribution – $3,600

- Mrs. MFI HSA Contribution – $3,600

Taxable – $25,916

Taxable accounts are your typical brokerage accounts and crypto accounts where all investments that are sold are a taxable event. If investments are held for at least a year and a day then they get special long term capital gains treatment.

This year I got off the sidelines and am making a concerted effort to get 1-2% of our investable savings into crypto. Mostly Bitcoin and Ether but I’m going to toss some play money into metaverse associated coins.

- Brokerage Account Contributions – $18,202

- Crypto Account Contributions – $7,714

Mortgage Principle Paydown – $7,146

The home that you live in is an asset that historically will maintain it’s value and grow in value at roughly the inflation rate. For that reason I expect to get that principle back out of the house when we sell it and therefore consider that savings. The mortgage interest portion of the monthly payment shows up in our expenses.

- Monthly Mortgage Payment Principle Paydown – $3,871

- Extra Principle Payments – $3,275

Cash Account Value Increases – $15,025

This is the delta increase in our various traditional savings account balances. Some is increasing the value of our emergency fund. Some is money that Mrs. MFI has saved but we haven’t gotten over to our investment accounts (a little bit of a project).

- Cash for our emergency fund – $1,125

- Cash for future investment – $8,000

- Cash accumulated in sinking funds for future expenses – $5,900

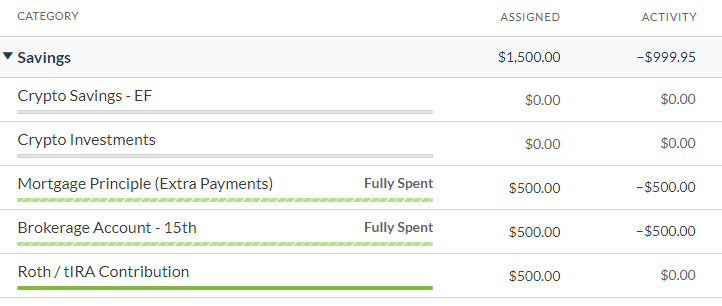

The last bullet referring to sinking funds is cash that has accumulated in my checking account while saving up for future bills. YNAB makes this simple to set aside this money. The values on the far right (ignore the colors) are the dollar amounts sitting in my checking account waiting for a future bill or car repair. For example, I have $326.82 for future car repairs. I have $2,660.46 already set aside in cash for my property taxes due in February.

I still include this in our savings because none of these sinking funds are for some big, one time purchase. They’re there when we need them but when they’re depleted we’re going to save them back up to where there were before.

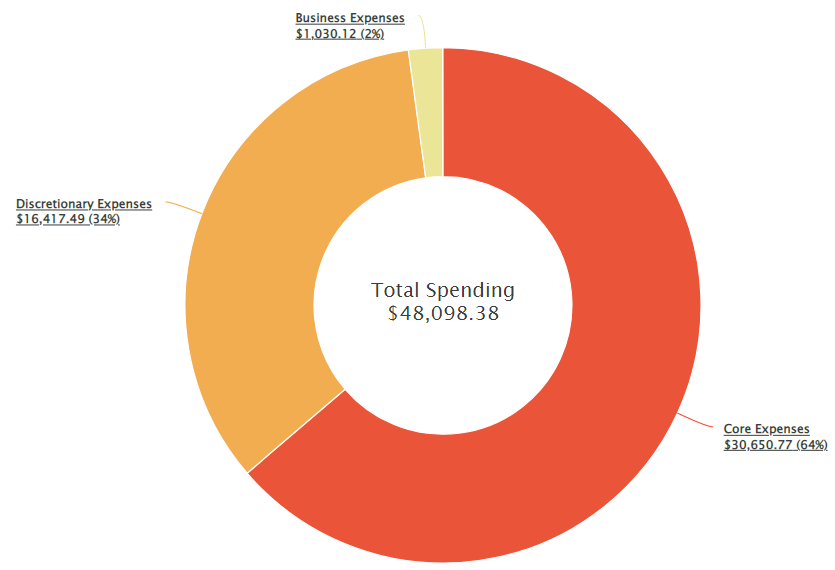

Expenses: $55,680

There are two main blocks of expenses. There’s everything that I pay for and track via YNAB and then there’s Mrs. MFI’s own spending. I’ve approximated her spending at $6k for the year which goes across a number of categories but isn’t included in the pretty YNAB charts.

- Household bills and Mr. MFI spending (YNAB tracked) – $48,098

- Mr. MFI Direct Paycheck Healthcare Insurance Premiums – $1,190

- Mr. MFI Direct Paycheck Charity Contributions – $1,392

- Mrs. MFI spending – $5,000

If you read my articles on expense tracking and budgeting then this breakdown will look familiar. Core expenses are those bills that you need to spend money on to live monthly. It’s what we would keep paying if we lost our income. Discretionary are the fun adders in life like travel, eating out and shopping. Business are blog related costs and expenses from selling stuff on eBay.

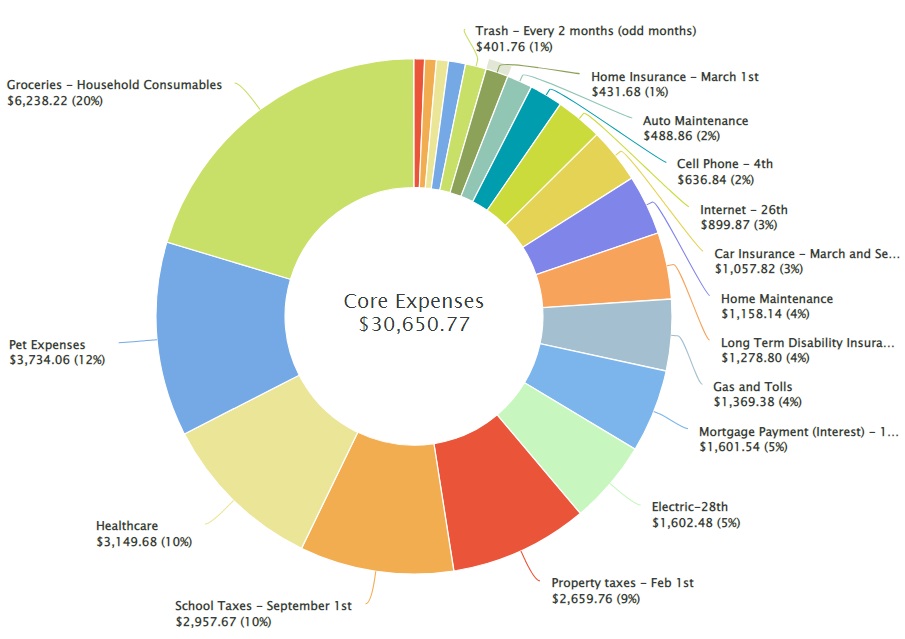

Core Expenses:

Here are a few notable things that impacted the major items in this area.

- Mortgage principle is up in savings so that $3,300 moved from last year.

- Groceries – switched to Aldi’s as our main store and saved $1,742 compared to last year!

- Pet expenses – lost our beloved black lab Oreo to cancer and adopted a new recue Evie. The vet bills, end of life services and adoption fees make up most of that $3,700.

Oreo, we miss you so! He gave us 12+ amazing years and gave me a permanent love for the lab breed.

Later this year we welcomed a new adoption to the family, Evie. A 4 year old rescue from Texas. She’s a sweetheart and a couch potato with a love of all the attention and pets that you’ll give her.

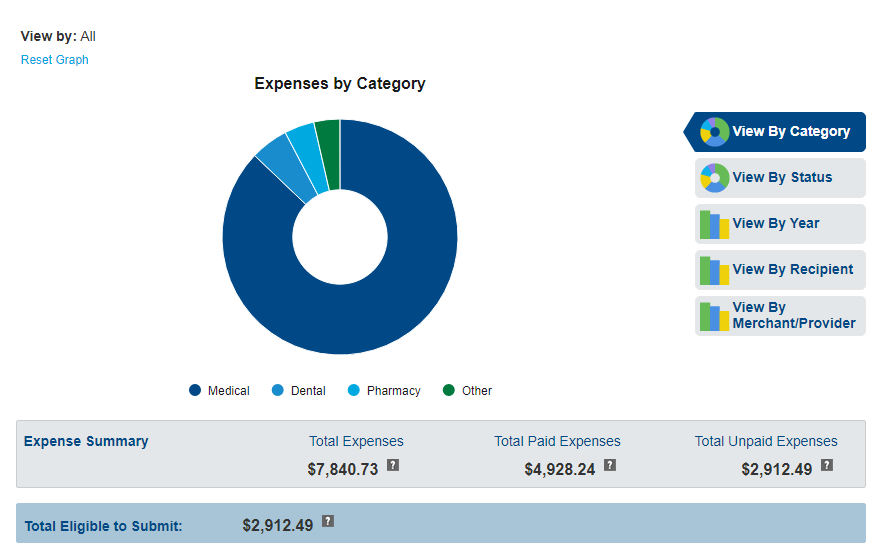

- Healthcare – I had a mysterious GI issue in May that landed me in the ER. That led to me getting almost every test under the sun in 2021 (endoscopy, colonoscopy, ultrasound, CAT scan). Cost a fair amount and hopefully won’t be repeated in 2022 as they fortunately didn’t find anything wrong.

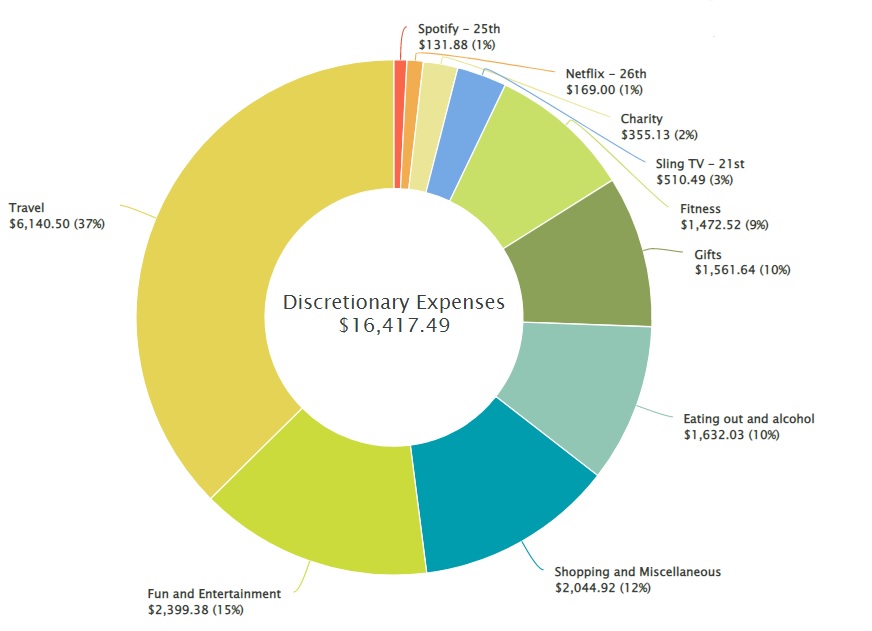

Discretionary Expenses:

- Travel

- Took an amazing 2 week trip to the Grand Teton National Park and Yellowstone National Park. Flights were free with travel hacking and one week of the rental car was free from saved up points.

No photoshop or editing. To say the Grand Tetons are spectacular would be an understatement.

Oh look, Bison out our front porch!

- Took a long weekend to Maryland to see an artist NF that I like in concert.

- Fun and Entertainment

- Took our first hot air balloon ride!

- Bought the most expensive concert tickets ever for us (~$800 for 2 tickets) – Elton John (for 2022)

- Went to Virginia to spend time with family and took a ride on this 3 mast schooner.

- Ran 1,500 miles including two ultramarathons. Here’s a gorgeous early morning view at the start of one.

- Shopping and Miscellaneous – A few larger purchases this year

- Dell Laptop ($800) – I wanted to blog and write without being chained indoors to a desktop so I purchased this laptop. It’s been great and has me writing a lot more than I otherwise would.

- Solo Stove ($230) – I wanted to spend more time outdoors and love a fire, yet we never used our fire pit in the backyard. Mrs. MFI didn’t like the smoke and this is supposed to smoke less so giving it a try. We’ve also moved the fire to the driveway as it’s more convenient. Jury is still out on whether this will be a good purchase.

How Do We Save This Much?

That info is great and all, but lets talk about the decisions and changes that allow us to save this much money. Hopefully some of these ideas resonate with you and you’re either already doing them (great!) or you can make a change to improve.

A Big Income

We’re obviously very fortunate to have the income that we do and this enables the level of saving that we have. Some additional information on the intentional steps that I’ve taken to increase my salary in a future post.

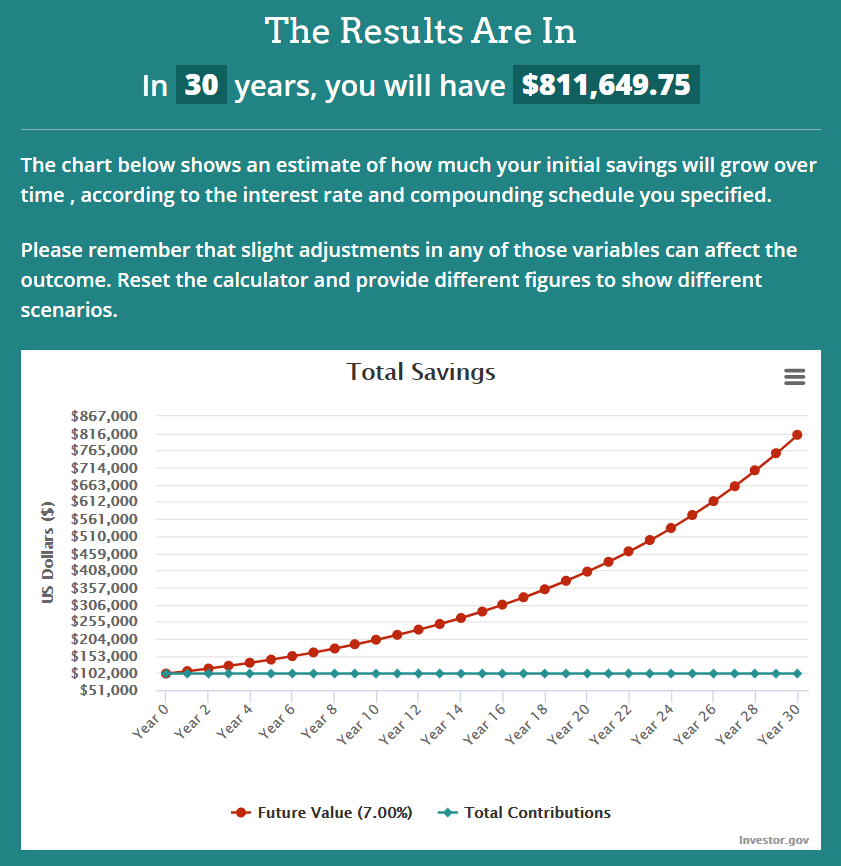

Maximizing Tax Advantaged Accounts

We max out all of our pre-tax saving options using a 401k and an HSA. This lowers our tax advantaged income by $46,200 ($19,500+$19,500+$3,600+$3,600) which in the 24% tax bracket is over $11,000/year more going into our savings than to the IRS.

Using backdoor Roth and Mega Backdoor Roth options, we’re able to save $37,859 this year into Roth accounts that now will grow tax free forever.

Automated Saving

It’s important to get your brain out of the decision to save and pay yourself first through automation. We use this method through our 401k plans, brokerage account and Roth accounts. When it isn’t automated I still budget for it in YNAB.

Living Within Our Means / Value Based Spending

Housing: Our house is a 1,500sq/ft, 3 bedroom, 2 bathroom house worth $180,000. It has no granite countertops. I has no on suite master bathroom. We don’t value big fancy houses and have a $456/month mortgage payment ($100k, 30 year) and low utility and maintenance costs as a result of it.

Cars: We own 2014 and 2016 Mazda’s that are paid off. I simplified my life years back selling my Corvette and reducing our deductibles to lower our insurance. As such our car costs dropped substantially.

Food: We went from $11,000/yr to $7,800/yr between groceries and eating out. Changed to shopping at a discount grocer Aldi’s instead of Wegmans for everything. We still eat out but we don’t default to it so much. It’s consciously chosen as a special thing to do. I also bring my lunch to work every day.

Shopping: I used to buy all sorts of crap on Amazon. A lot of supplements to go with working out. A lot of stuff on a whim. Now I’m a lot more intentional with my spending there because I don’t want more “stuff” to deal with in the house as we have been trying to get rid of stuff.

Detailed Expense Tracking and Budgeting

I know many are resistant to the idea of tracking what they spend. They’re even more resistant to the idea of making a budget. Both have been important to seeing where our money is going so that we can decide if we like what we’re doing. How can you know if your money is going towards things that you value if you don’t know where it goes?

I use YNAB for all of the above to track my spending and zero base budget. It’s been empowering to know exactly where my money goes and it takes very little time each week. As a side benefit I quickly see any fraudulent charges that I’m not expecting. I hate looking at my credit card statements across multiple cards so this lets me sidestep that.

Working As A Team With My Wife

5am Joel has a great chapter in the book Money Mastermind about this topic. Have you ever seen a plane with one jet thrusting forward and the other in reverse? Of course not, it would spin in circles.

It’s really important that you and your spouse are working together towards whatever goals you have. If Mrs. MFI saved diligently and I spent frivolously there would be friction and we wouldn’t save how we do. Have you talked about your goals with your spouse recently?

Mrs. MFI and I are both on the same page with what our goals are and how we live. We review the finances together at least quarterly and talk openly about money. We discuss big purchases with each other before making them. We focus our spending on what makes us happy.

Key Takeaways:

- Saved a lot of money and did a good job of investing it in a diverse group of tax advantaged locations.

- Despite having our lowest expenses ever over the last 4 years of tracking we had plenty of fun and didn’t say no to anything that we wanted to do. We’ve cut down expenses on all the main areas that we don’t enjoy and we spend lavishly on the stuff that makes us happy (travel, experiences).

- Some very intentional choices and actions over the last year and beyond set us up for this level of saving and spending. This all pushes us closer to our FI goal.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.