BLUF: iBonds do provide a safe bond that provides inflation protected income. However, with their buying limitations and short term illiquidity you do need to understand their limitations.

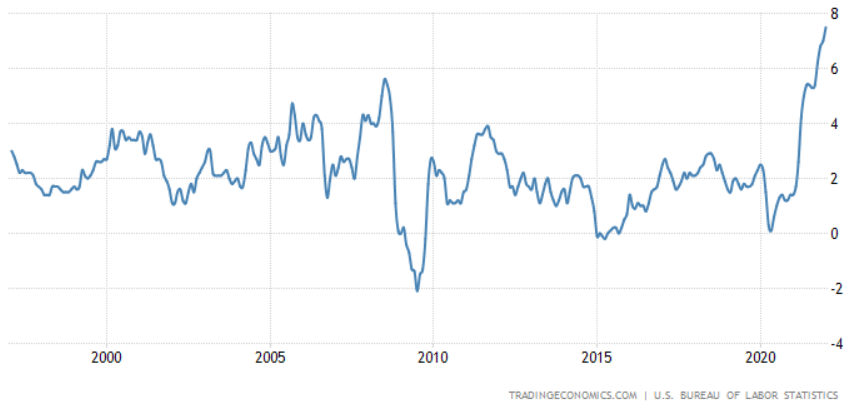

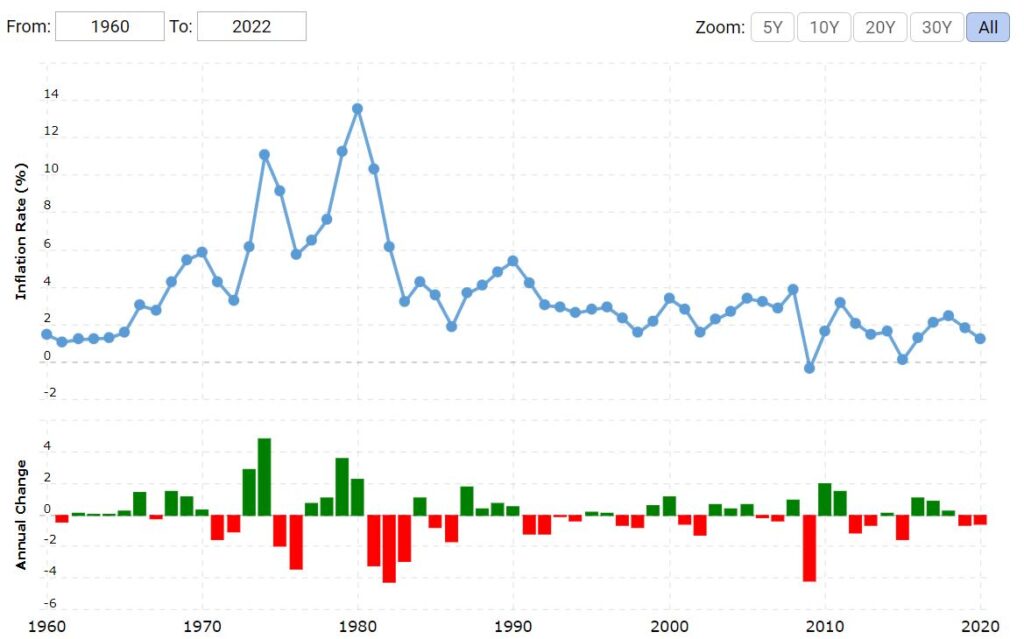

It’s always interesting to me when something in the world changes and all of sudden you start hearing about something “new” for the first time. In 2021 and 2022 that something in the world changing was the jump in US inflation rates for the first time in decades.

Source: https://tradingeconomics.com/united-states/inflation-cpi

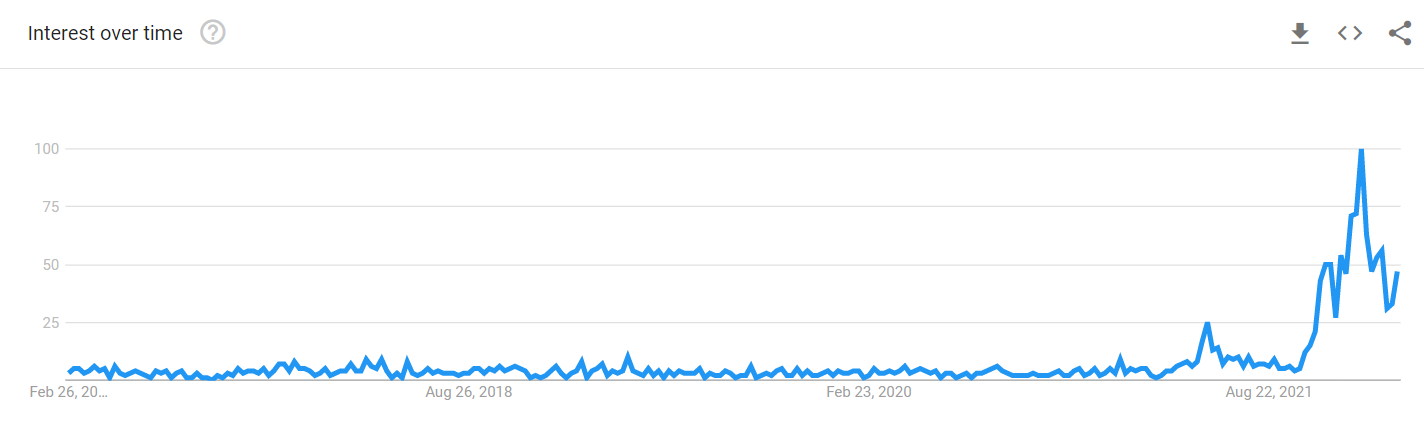

The hot “new” investing option that emerged in the news in November of 2021 was this thing called an iBond. They’ve been around since 1998 but since inflation has been fairly low they weren’t all that attractive of an investment option. You can see this peaking of interest in the google search trends.

Bonds decrease in value when interest rates go up and raising interest rates is a normal response to inflation. As such, people became worried about their bonds dropping in value with the threat of inflation.

What are these bonds that has everyone so interested? How do they work? When might iBonds make sense for you? I’m going to tackle all of these questions and more along the way.

What is an iBond?

This is a bond invented by Apple. Okay, not really. But if Apple did invent a bond it probably would have been called that.

This is a bond issued by the US government that not only pays a fixed rated of interest, but it also pays an inflation adjusted interest rate. There are many unique things about this bond though that make it quite different than individual bonds or bond funds that you might be used to buying.

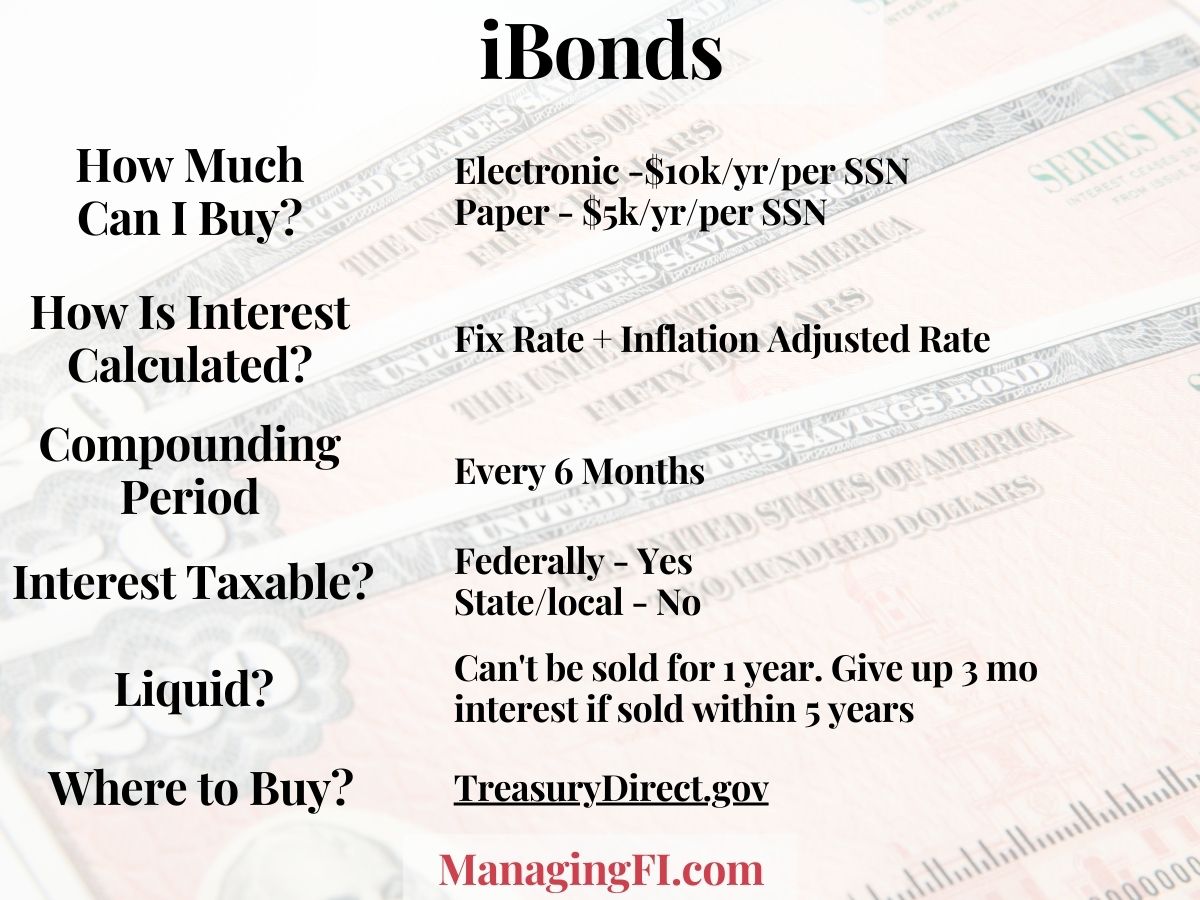

We’ll dive into the details of each area of iBonds but here is the high level summary of them.

How Much In iBonds Can I Buy?

iBonds are unusual in that there’s a limit to how much of them you can buy. They’re sold as electronic bonds with a $10,000 per social security number (SSN), per year limit. That means that you’re fairly limited on buying them.

You can buy them on behalf of your spouse or children to increase the amount you can buy. For example, if you were married with 2 kids then you could buy $40,000 / year. An adult needs to open the kids account and then link the kids account to the adult.

Electronic iBonds are sold in any denomination down to the penny from $25 up to $10,000. You could be a $73.96 iBond if you really wanted to. Paper iBonds are only sold in denominations of $50, $100, $200, $500 and $1,000.

How Is iBond Interest Earned?

Things get a little tricky when it comes to calculating the actual interest that you earn on your iBonds. Lets step through the details slowly.

There are two interest rates that make up an iBond.

Fixed Rate: The fixed rate is an annualized rate of interest on your iBond. It’s set when the iBond is issued and never changes over the life of the bond (up to 30 years if you don’t sell it).

Inflation Rate: The inflation rate is the 6 month (semiannual) rate of interest earned on that bond. This is updated every 6 months and usually changes.

Your bond returns are a combination of the annual fixed rate + semiannual inflation rate.

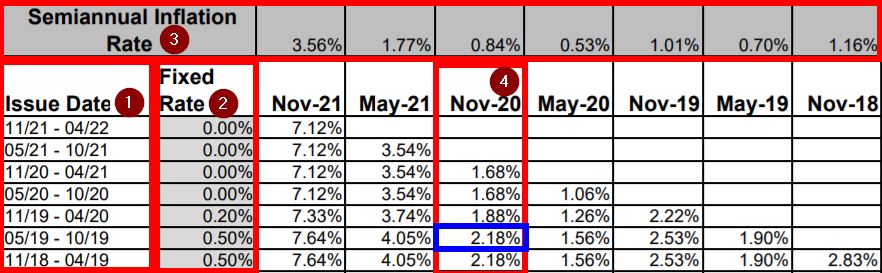

All of these rates can be found here at the TreasuryDirect site.

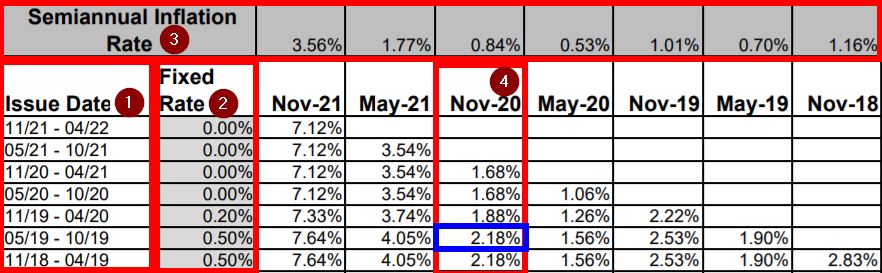

That interest rate chart is a little confusing without some explanation. Refer to the picture below where I’ve marked up part of the TreasuryDirect interest rate chart to explain what’s going on.

- Issue Date: Your iBond will fall into one of these 6 month windows depending on the purchase date. These windows run November 1st to April 30th and May 1st to October 31st.

- Fixed Rate: The fixed rate is an annualized rate of interest on your iBond. This is set for the life of the iBond.

- Semiannual Inflation rate: The inflation rate is a 6 month (semiannual) rate of interest on your iBond. It is updated every May and November using the CPI-U (Consumer Price Index-Urban) metric.

- Nov-2020 Column: Annualized rate of return for an iBond based on that 6 month inflation period beginning November 1st, 2020. The inflation rate is the same for the period but then it’s combined with the fixed rate of each row to get the cell cotents.

For the blue box, the 2.18% is the annualized rate for an iBond issued between 5/2019 and 10/2020. Annualized inflation rate (0.84% * 2) + fixed rate (0.50%) = 2.18%.

This is confusing, though, because that inflation rate changes every 6 months. Lets show how this interest is calculated in a real world example.

iBond Interest Calculation Example

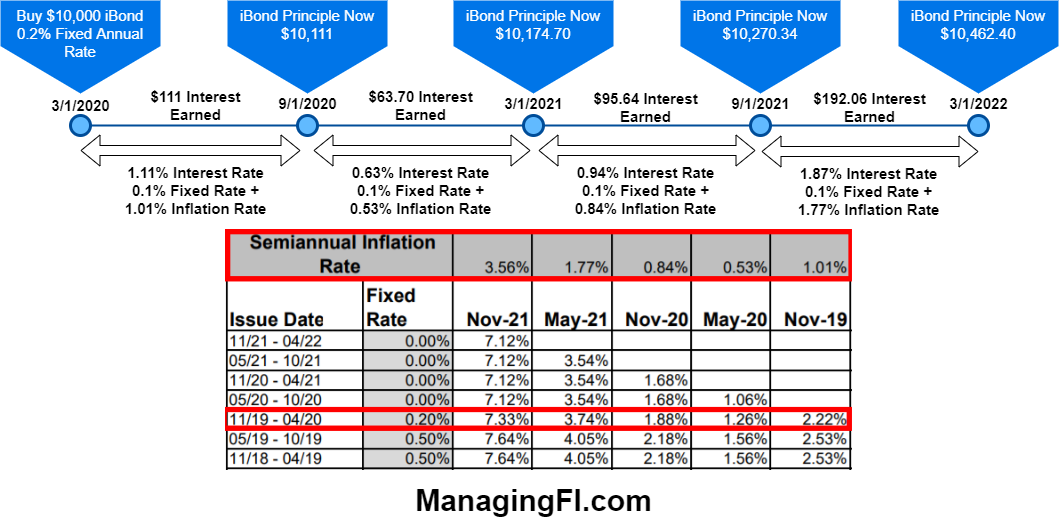

Say you bought a $10,000 iBond on March 1st, 2020 which has a fixed rate of 0.2% annualized. You can see the interest rates for that iBond row highlighted in red below.

Over the next 6 months you would get a combined 1.11% interest rate (0.1% fixed + 1.01% inflation). That would pay you $111 in interest which then gets added to the principle starting on 9/1/2020. That’s because the compounding period for an iBond is 6 months.

Inflation dropped to 0.53% for the 6 month block starting on 9/1/2020 so the interest rate for that 6 month block dropped to 0.63%. Using a new principle amount of $10,111, that provides $63.70 in interest over that 6 month block.

This continues on until the iBond matures at 30 years or you sell it. There are no tax consequences while you hold the bond as none of that interest is being distributed to you.

Negative Interest Rates

What happens if inflation goes negative (deflation)? The composite interest rate (fixed + inflation) can never below zero where you’d be giving back interest each month to the government.

However, it is possible the inflation rate to go negative and nullify interest from the iBond’s fixed rate. For example, say you bought an iBond in January of 2019 with a 0.50% fixed rate. If the inflation rate when negative in November of 2022 at a rate of -0.6% then the bond would pay 0% interest for that 6 month period.

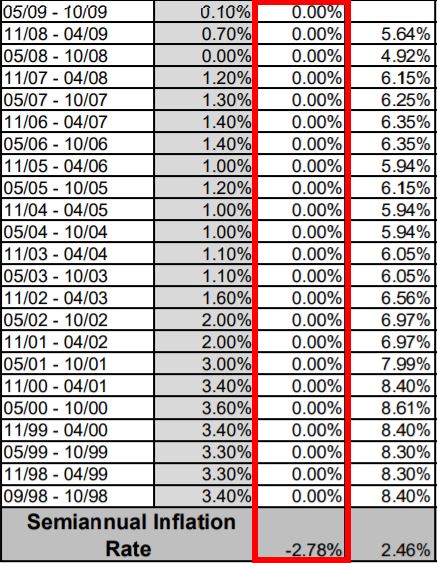

This happened in May 2009 when semiannual inflation went to -2.78%. It wiped out the fixed rate returns for even iBonds with the highest fixed rates.

How are iBonds Taxed?

iBonds are subject to ordinary income taxes at the federal level but not to state or local taxes.

It’s important to note that no taxes are due until the iBond is sold or reaches maturity. There are no income taxes to report on an annual basis unless you sold the iBond that year.

How Do I Buy iBonds?

You can only buy iBonds in two ways.

- Electronic iBonds – TreasuryDirect.gov sells them online. You are limited to $10k / SSN as previously mentioned.

- Paper iBonds – If you have a federal tax refund coming to you, you can file IRS form 8888 with your return and direct up to $5,000 in $50 increments to be bought in iBonds.

How Do I Sell iBonds?

Here’s another unique aspect of iBonds, their liquidity (or lack thereof). iBonds aren’t held in a brokerage or retirement account. There is no open market to buy or sell them with other market participants. It’s just you buying and selling them with the US Treasury department.

Just like buying the bonds, you do the selling of them through the treasury direct website.

Can’t Sell iBonds Within A Year

Unless you’re affected by a natural disaster you cannot sell your iBonds within the first year. Here is an iBond that I bought last month. See any sell button? Nope!

Interest Penalty If Sold Within 5 Years

If you sell an iBond within the first 5 years of holding it then you forfeit the previous 3 months worth of interest that you accrued.

How Useful Are These In Your Portfolio?

Time to get to the meat the of what you care about. Are these right for my portfolio?

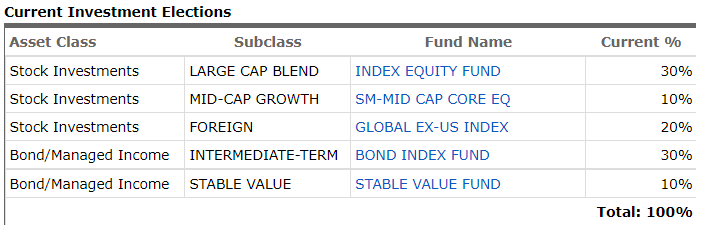

As we’ve previously covered, iBonds aren’t bought or sold like your other investments. You can’t buy them with a 401k, IRA or brokerage account. You need to create a special account. You can’t buy as many of them as you want due to the $10k/SSN/year limitation. Honestly, they’re kind of a hassle.

If you have a $1M 80/20 portfolio and you wanted to move your bonds to iBonds because of inflation concerns you would need to move $200,000 to iBonds. If you were married it would take you 10 years to make that happen! Not very practical.

You could of course do it slowly over many years where you invest $10-$20k/yr layered in over many years. If we were to have a similar situation as we did in the 1970’s where inflation was up for a decade then this could work out in your favor. You can always liquidate the bonds at any time after that first year. You may have some increased taxes to pay on the gains but that’s a better problem to have than a loss of purchasing power.

Should iBonds Be In Your Emergency Fund?

What’s the purpose of your emergency fund? It’s to provide cash to save your butt in the event of an emergency. iBonds are illiquid for the first year so you better not buy them using any money that you need to access for with a year. Store that money in a high yield savings account or you could consider a combination of options.

Therefore they aren’t appropriate for most 3-6 month emergency funds. If you had a 2-3 year cash bucket in retirement it would be more reasonable to buy iBonds. But it’s only going to work for a small percentage of that cash bucket to start and could take many years to get the full amount invested.

You’d have to work through your plan and see you wanted to use a combination of HYSA and iBonds to balance returns with liquidity. Just remember though, the purpose of holding cash is usually liquidity, safety and optionality. Not returns.

Holding iBonds In Your “Cash” Retirement Bucket?

The most logical time to consider iBonds would be if you’re going to be holding a fair amount of cash but don’t need to deploy that cash quickly.

If you had a 2-3 year cash bucket in retirement it would be more reasonable to buy iBonds for a portion of that money. But it’s only going to work for a small percentage of that cash bucket to start and could take many years to buy those iBonds depending on that bucket size.

You’d have to work through your plan and see you wanted to use a combination of HYSA and iBonds to balance returns with liquidity. Just remember though, the purpose of holding cash is usually liquidity, safety and optionality. Not returns.

Are iBonds Good Inflation Protection?

iBonds are actually excellent inflation protection for the cash that you are able to invest in them due to their purchasing limits. Inflation rising can often mean the risk of interest rates increasing which hurts bond returns.

iBonds have the unique characteristic of being a stable US backed bond, yet they don’t go down in value if interest rates go up (interest rate risk). Their fixed interest rates are low so the bulk of the return component is that inflation adjusted rate. In a rising interest rate environment of current 2022 (to battle inflation) iBonds get a stronger return from that increasing inflation.

As inflation decreases so do your iBond returns. However, they can never go negative on their interest rate so there’s a backstop on the downside.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.