I’m a big fan of experimenting and trying new things so I’m going to try something new for this latest post. Earlier this year I became more transparent on the blog in posting how we crossed over the 7 figure investment account number and saving over $100,000 last year.

Recently, I wrote about keeping a cool head and on track when the markets start getting volatile (in the downward direction). I’ve noticed a lot of people struggling in this aspect. New investors worried about losing money in the market and stressed by their account balances going down even when they’re actively adding to them!

This post is going to be the start of quarterly updates to our financial situation including the change in account balances. Hopefully it gives some people comfort to know that they’re not alone and the encouragement to stay the course investing in their future.

I’m also going to use this post to talk about some additional small topics. Updates on topics that I’ve previously written about and have taken action on. Things going on in the financial world. Things that are on my financial mind.

2022 Q1 Financial Update:

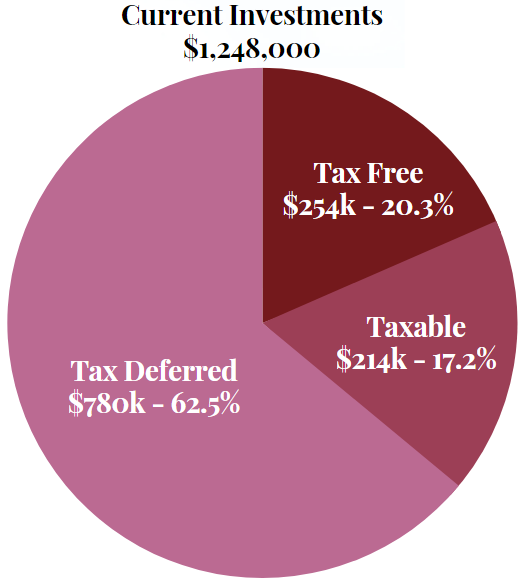

In my article about the retirement tax triangle, I talked about the benefits of investing in all three of the retirement account types: taxable, tax free and tax deferred. I “eat my own cooking” so to speak, and actually do track my accounts in that way. You’ll see the breakdown of our finances into those account types.

Q1 Total Investment Account (-$37,100) Value Changes:

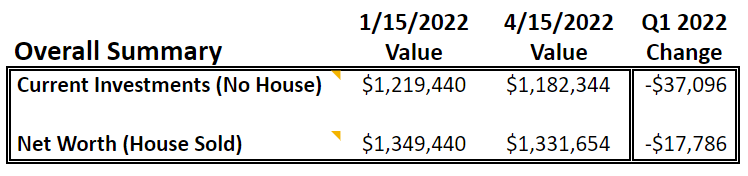

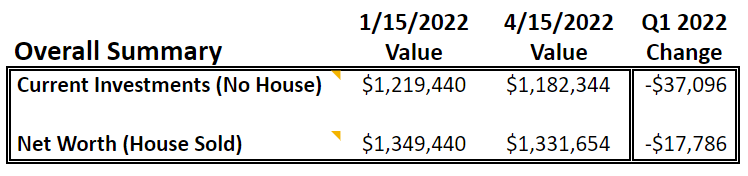

I like to start at the high level and go deeper into detail so here’s the overall change in value. Current investments is all our invested assets.

Net worth includes our house but assumes that it’s sold. Why? I haven’t written about this yet but right now we’re aspiring to one day to sell everything and tour the US in an RV for potential relocation spots.

Q1 Account Contribution Summary (+$41,985):

- Taxable (+$16,700)

- Tax Free (+$4,754)

- Tax Deferred (+$15,585)

In Q1 our overall investment accounts were -$37,000. Ouch. And that’s AFTER contributing $42,000 into them. In other words a net -$79,000. That’s more than the average US household makes in a year.

That $42k was aided significantly by an annual bonus received in March so that won’t be the norm for Q2-Q4.

That’s how it goes sometimes with being an investor. Losing money, even if on paper, generates pain and emotions. Those can be pretty intense when you’re early in your investing career and not used to them.

I know it’s not what you want to hear, but you have to really experience that pain and control your emotions if you want to grow as an investor. You can’t learn about it in a book or from a story that someone tells you. You need to feel it yourself.

How do you stay the course when it feels like investing is just lighting dollar bills on fire? Look at history to remind you. The S&P500 has gone through periods of tough times but over the long haul, it has always had positive returns over 15+ year periods.

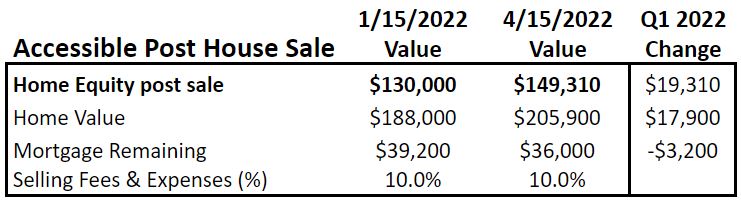

Q1 Net Worth (-$17,800) Value Changes:

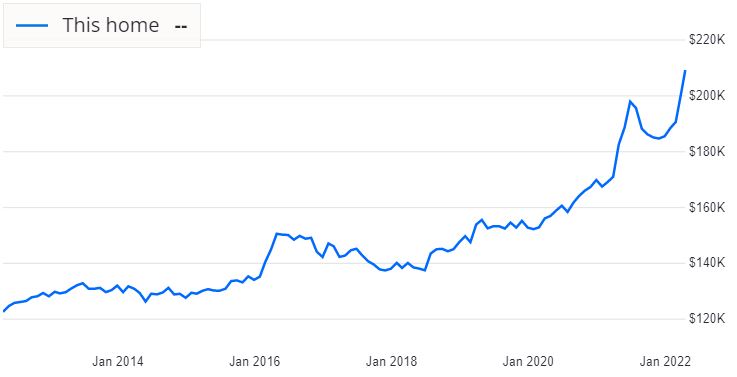

News flash – the housing market is still bananas. We own a very modest 1,500 square foot “starter home” in a moderate cost of living location. Our housing prices here in western NY state generally don’t boom or crash but they’re resumed their insanity since the start of 2022.

Our home value went up almost $18k and we paid down $3,200 of our mortgage. I had been overpaying more on the mortgage in Q1 but now that the market has had some more substantial drops will back off that. I’ll invest more in our taxable investment account instead. I ran the numbers on pre-paying my mortgage vs. invest in this article.

The Zillow Zestimate change over the last 3 months has been an $18,000 increase or over 10%! Crazy. Rising mortgage interest rates is really pushing people to try and get into a house is what I’m guessing.

At some point the increased mortgage rates will make buying at elevated prices unaffordable and I think prices will come back down to earth a bit. A 30 year mortgage at 6% has a monthly payment that’s about 40% higher than a mortgage at 3%.

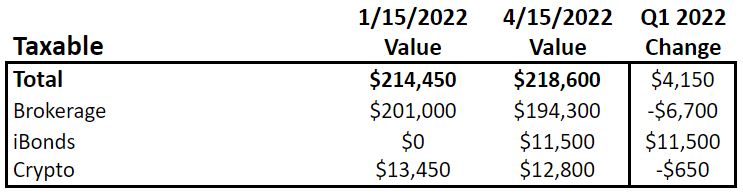

Taxable Accounts Value Change (+$4,150):

Here are our contributions to these accounts this quarter.

Q1 Taxable Account Contributions: +$16,700

- Brokerage – Added $5,500 to the account.

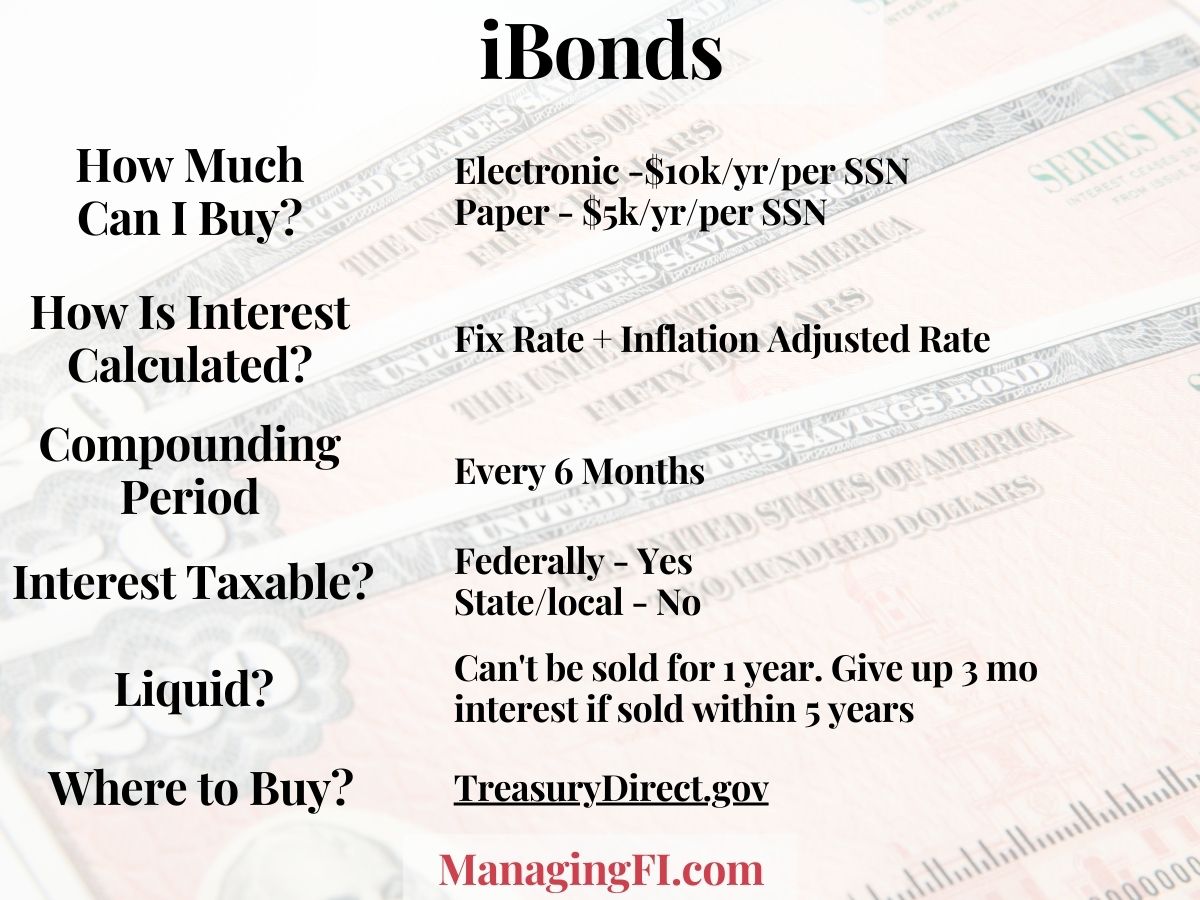

- iBonds – Bought $11,500 between funds that had been sitting in cash and from new income.

- Crypto – removed $5,300 from Stable coins to put back into HYSA’s for our travel fund and part of our emergency fund. Added $5,000 to BTC and ETH.

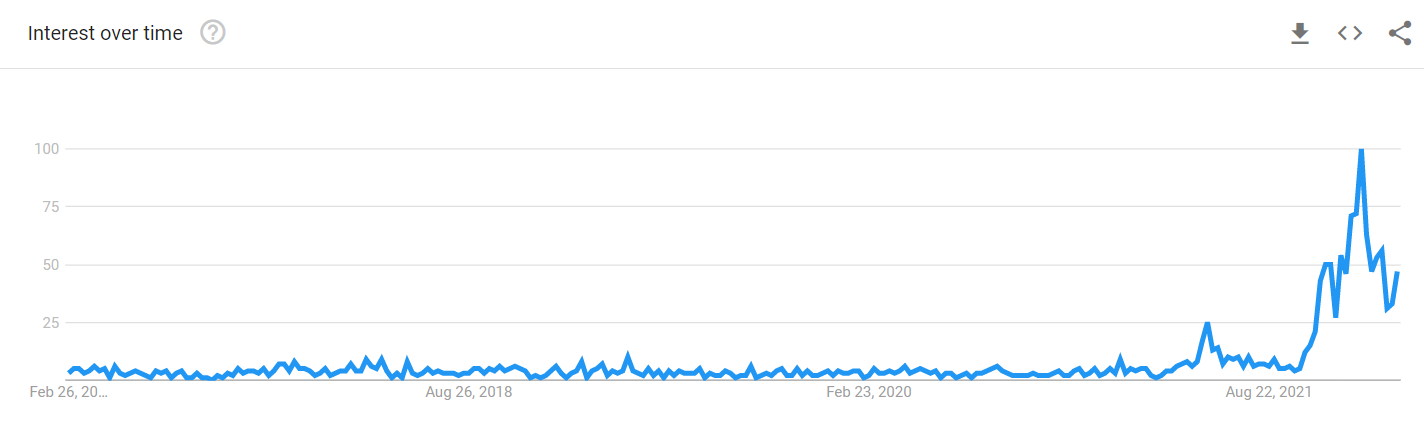

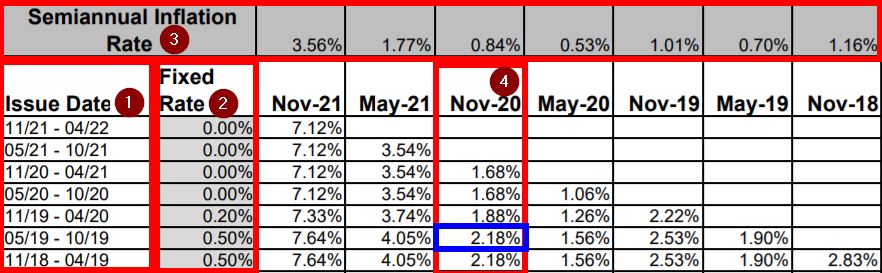

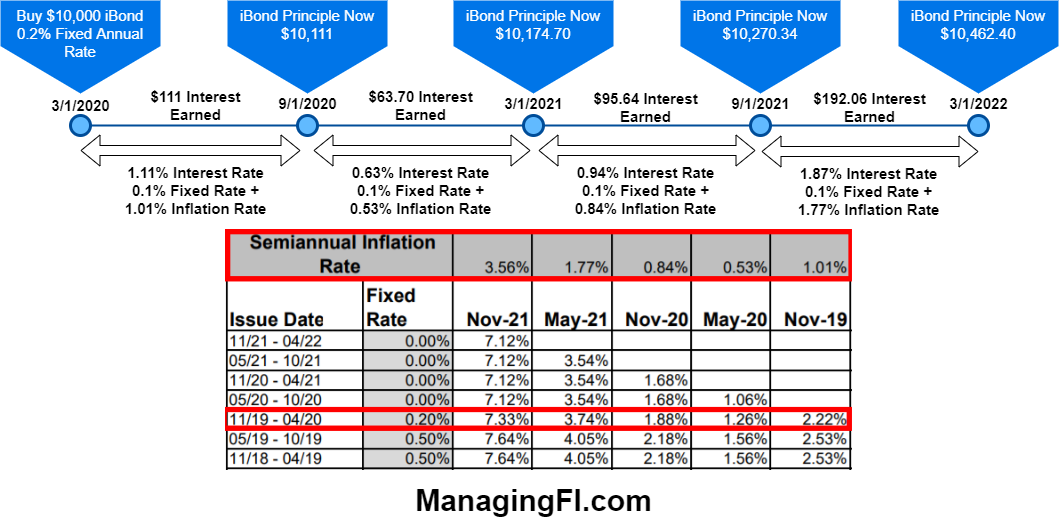

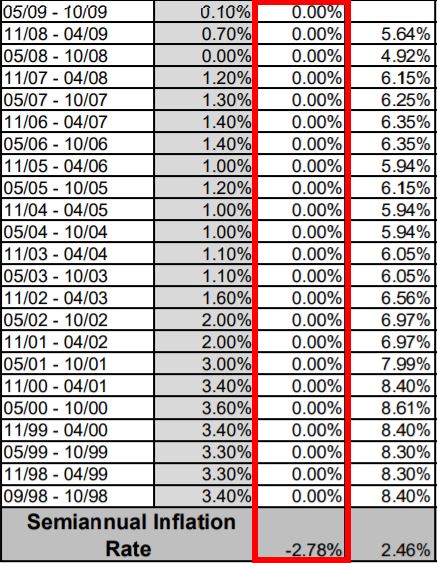

iBonds had been on my mind even before writing this detailed all about iBonds article. Mrs. MFI had some emergency fund cash sitting in a 0.01% savings account so we put that to work. We had more than enough EF cash if I were to lose my job so we were comfortable putting it into iBonds.

I decided to dial back the risk a little and take some of our sinking funds out of stable coins. I have a 75% written article on stable coins to discuss the level of risk there. They seem low risk in theory but just because you can’t see the risk, doesn’t mean that it isn’t there.

We contributed $16,700 and saw the overall taxable account values go up $4,150. Ouch.

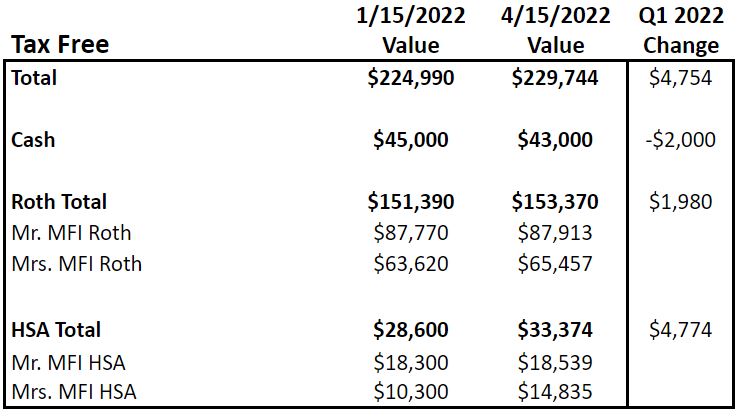

Tax Free Accounts Value Change (+$4,754):

Q1 Tax Free Account Contributions: +$9,700

- Cash – Removed $10k to buy iBonds. Added $5k back into the “cash” category from stable coins as a part of our travel fund and emergency fund.

- Roth IRA – Added $12k. Executed back door contributions to max out both Roth accounts.

- HSA – Added ~$1825 in contributions. Also moved $2k that was stuck in Mrs. MFIs HSA bank account. We’re both setup to max our HSA contribution for a combined total of $7,300 for the year.

In total we added about $9k to this category but it’s only up $4,700. Because our HSA’s are our retirement healthcare fund, we don’t need them for 25 years so they’re invested 100% in stock indices (VTI and VXUS). The

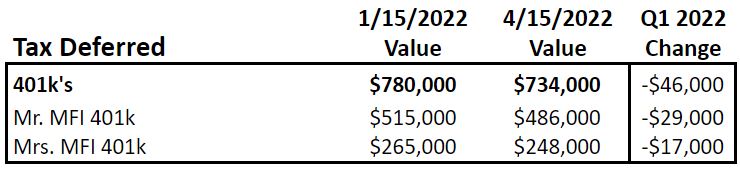

Tax Deferred Accounts Value Change (-$46,000):

One caveat to the tax deferred contributions. We are saving after tax dollars into the Mr. MFI 401k to perform a mega backdoor Roth contribution in 2022. That account will get more than $20,500 contributed to it but the after tax portion will get rolled out in November 2022.

Q1 Tax Deferred Account Contributions (+$15,585):

- Mr. MFI 401k – $6,750 in my contributions. $3,710 in company contributions.

- Mrs. MFI 401k – $5,125 in her contributions.

These accounts are a little heavier on bonds at a roughly 70% stock / 30% bond split. Both got hit hard and dropped in value.

Financial Topics On My Mind:

Breaking My Addiction To Watching Markets Daily:

In a recent article I talked about methods for avoiding investing mistakes. One key method was to stop watching the markets every day. I personally struggled with this one a lot.

I got into the habit when I was trading futures and Forex. Futures trade 24 hours a day from Sunday at 6pm EST to Friday at 6pm EST in my markets.

Determined to fix this, I’ve successfully stopped my daily watching and have now fallen back to looking at the market on the weekend when they’re closed.

Yes, I still have the urge to check during the week if I catch a piece of financial news. Yes, I’ve had a couple of slip ups. But, it’s a vast improvement from the 4-5 times a day that I was routinely looking at the market.

Roth 401k vs. Traditional 401k:

Mrs. MFI and I are both currently maxing out our 401k accounts with traditional 401k contributions. We both have the option to contribute some percentage as a 401k if we choose.

In my tax triangle article I noted that I was considering flipping over some or all of our contributions over to Roth since we were heavy in our traditional 401k accounts.

Right now any contribution that I changed from traditional to Roth 401k would be taxed at 24% given our highest marginal tax bracket. We’re piling money into a Roth due to the mega backdoor but with $50k+ being contributed to our tax deferred accounts annually it won’t make up any ground.

My thinking at the time was that in 2026 the tax brackets will reset higher so better to take the tax hit now with a Roth 401k and in 2026 I could flip those back to t401k. I don’t like to do these types of changes without more analysis though so I’m staying the course for now.

I’ll do the analysis in a future article but I think we’ll have plenty of low income years between age 55 and 67/70 to draw down those tax deferred accounts while keeping our effective tax rate low.

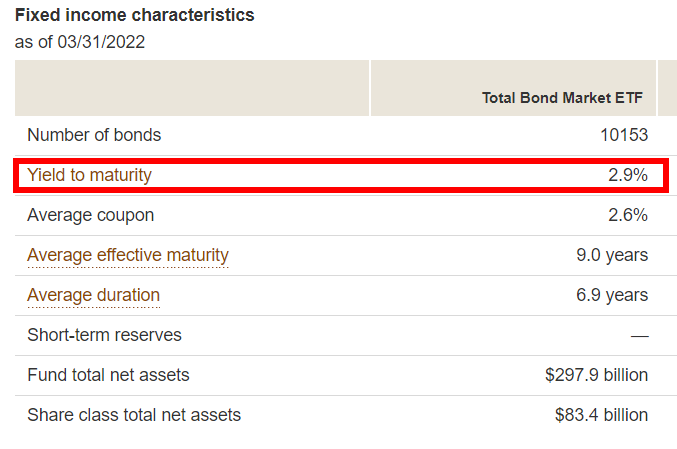

Inflation, Interest Rates and Bonds:

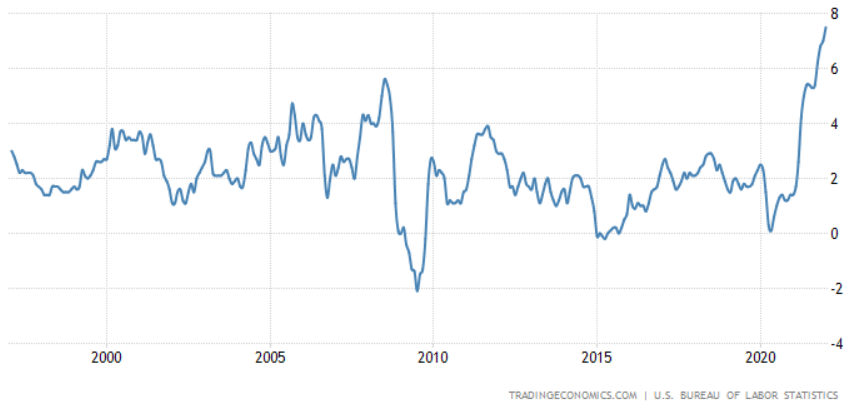

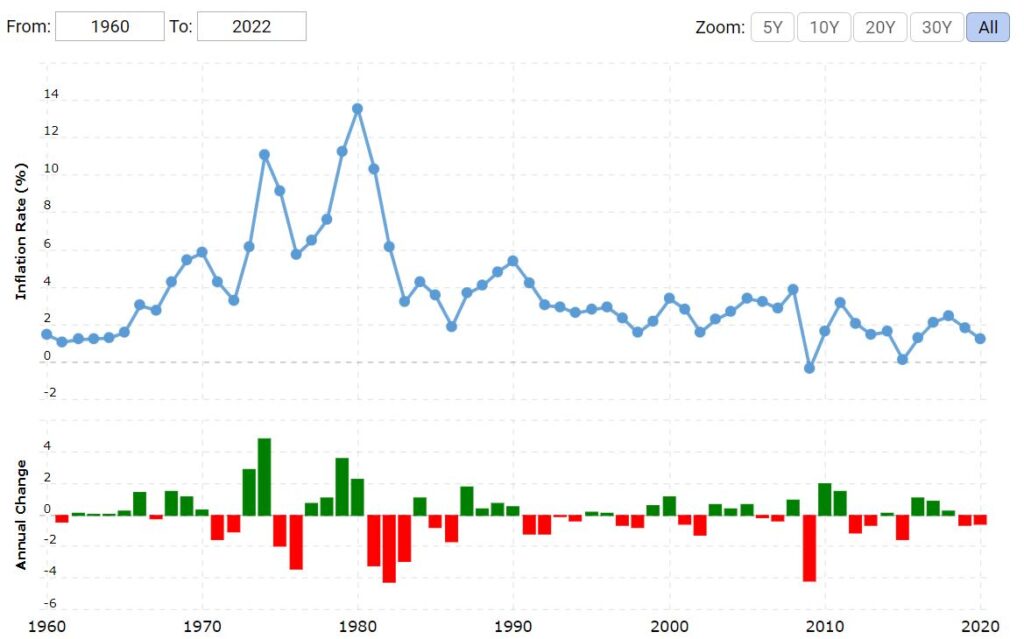

Inflation. Everywhere you read in 2022 everyone is talking about inflation. They just released the April 2022 CPI report and it showed 8.5% annual inflation increase.

The stock market is going down so people don’t want to put money there. Interest rates are rising so intermediate term and long term bonds are getting crushed. People have discovered iBonds once again so they’re becoming very popular with a May 2022 annualized rate of 9.62% but they have low purchasing limits at $10k/person/year.

This period is indeed painful, but it will get better. The beauty of bond funds is that they constantly have bonds hitting maturity with new bonds being purchased at the new, higher interest rate. Over time, the yield to maturity will get higher and higher until interest rates level off and eventually drop.

If you need bonds for stability because of your risk tolerance and timeline, then hold bonds. Don’t let short term interest rates influence your asset allocation. Don’t let the interest rate risk tail wag the dog.

Taxable Account – Stay with Vanguard, Move to Fidelity, Move to M1 Finance with ETF’s

In my most recent article about mutual funds and ETFs, I contemplated the idea of moving to ETF’s to avoid the risk of taxes after the Vanguard target date fund incident of 2021. That kills my ability to automate my investments though with Vanguard since they’re pretty behind the times technology wise.

Since I only invest in passive index based mutual funds I think the risk is low of some special tax bomb event. Vanguard does let you flip from mutual funds to equivalent ETFs without selling your holdings.

So, the plan for me is to stay with mutual funds for now so I can keep auto-investing. When we get closer to switching from accumulation to drawing down I’ll likely migrate that account to ETFs and then move it to Fidelity for simplicity. We’ll likely collect all our funds there for ease of management.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.