12/16/21 Update: Build Back Better Bill Senate voting pushed until early 2022. Backdoor Roths are safe for now! Check out my Mega Backdoor guide here.

11/19/21 Update: Build Back Better Bill passed the House with the changes to remove the backdoor Roth. We’ll have to wait and see if it can get through the senate. Personally, I’ve completed my MBR for the 2021 year and backdoor Roth conversions for both Mrs. MFI and I just to be safe.

11/8/21 Update: I jumped the gun a little with this article. It’s far from a done deal yet that these backdoors go away but still possible. I still think it’s prudent to take steps now to plan as if the backdoors do go away.

BLUF: Pending legislation would close the backdoor Roth and mega backdoor Roth contribution loopholes. There’s still time to take action for 2021 and good options for wealth building in 2022 and beyond.

There’s an old proverb that says that “all good things much come to an end.” I hate that proverb. Who wants something good to come to an end?

Unfortunately in this case one thing proposed to come to an end are the beloved backdoor Roth and mega backdoor Roth contributions.

If you’ve followed the blog you’ve read my extensive Mega Backdoor Roth article and know that I love and use that loophole.

I don’t read or watch the news as a practice to keep myself happier. However, being a personal finance nerd I did start to pay attention to the Build Back Better Bill discussion once they started talking about a variety of changes to the current retirement savings system that many of us use. We’ll know more soon but there likely won’t be much time to act if this bill passes.

What’s in there? What could come to an end are two sweet loopholes that allowed people to get money into Roth IRAs despite making too much income to contribute to them directly (the front door). In 2021 a single filer needed a MAGI of less than $140,000 and a married filing joint less than $208,000 to contribute to a Roth. What were these backdoor options?

Backdoor Roth IRA Contributions

The standard backdoor Roth IRA contribution was a two step way to bypass these income restrictions.

- Contribute to a traditional IRA (tIRA) with after tax money.

- Convert the tIRA money to a Roth account

Just that simple. Anyone can contribute to a tIRA regardless of income level, you just don’t get a tax break at a point. Since the money went into the tIRA after tax there’s no tax owed when that money is converted to a Roth account. The pro-rata rule made this impractical if you had other tIRAs with large pre-tax amounts in them but this was still a nice option for many that were otherwise locked out.

Mega Backdoor Roth IRA Contributions

The regular backdoor was great and all, but with contributions limited to $6k under 50 and $7k over 50 years old, it had limited savings potential. The mega backdoor however, blew the doors off of the regular backdoor.

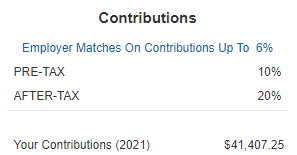

If you had an employer retirement plan (401k/403b/TSP) that allowed after tax contributions and some other features then you could get $38,500 extra into your Roth. A year. It’s how I’ve been able to personally put $41,407 into my company 401k so far this year which is a combined total of pre-tax and after tax contributions. About $25,000 of that is after tax contributions ready to be rolled into a Roth via the mega backdoor.

If you want to read the fine details of how the mega backdoor Roth works you can read them here in my step by step guide.

Build Back Better Act – Slamming Shut The Backdoor

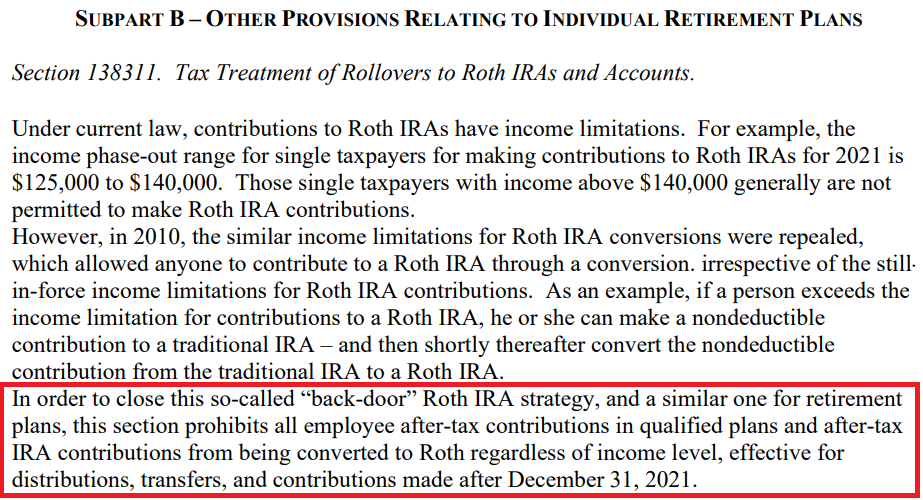

It’s amazing how much good you can undo with one simple sentence. As you can see below, the act kills the backdoor options by preventing after tax contributions to your qualified plans (401k, 403b, TSP, etc) from being converted to a Roth.

It also prohibits any after tax money in IRAs from being converted to a Roth. You can still contribute after tax money to IRAs (which now would make no sense) but the money can’t go to a Roth. All of this becomes effective on December 31st, 2021.

The wording seems unclear to me on exactly what they’re going to enforce. For example, are after tax contributions made in 2021 able to be converted to a Roth in 2022? Seems like I could interpret that in either way to allow them or not allow them.

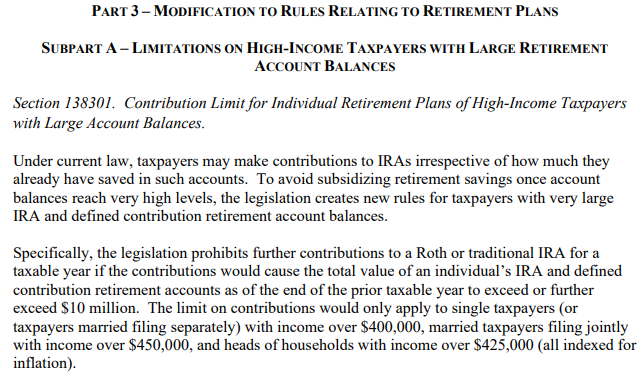

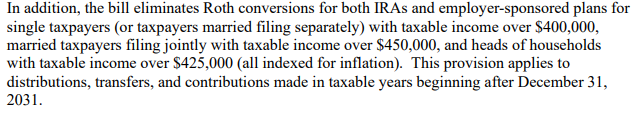

Other retirement changes that are less likely to impact the less affluent investors:

- In 2032 single filers over $400k in income and married filers over $450k in income won’t be able to do Roth conversions.

- $10M cap on all retirement accounts. If the cap is exceeded the money in excess of $10M needs to come out.

- You can’t contribute to a Roth or traditional IRA if your retirement account balances exceed $10M.

If you’d like to see it for yourself you can read the summary here. If you want to read the actual bill text you can find it here. Warning, it’s painful to interpret.

2021 Isn’t Over Yet – Take Advantage Of The Backdoor Roth Options

All of these backdoor benefits seem to go away at the end of the year but there’s still almost two months to go. As previously stated, it doesn’t seem clear to me if you’ll be able to convert 2021 after tax contributions over to a Roth in 2022 so I’m assuming for now that you can’t.

There’s still time to take one last advantage of these backdoors before they go away. Here are some options to consider if you have these backdoor options in process or available to you:

Do a Backdoor Roth Contribution from Scratch

There’s still time to do a backdoor Roth even if you haven’t done a thing this year. The basic steps:

- Open up a tIRA account immediately.

- Contribute the max ($6k or $7k depending on your age) to the tIRA.

- Wait a little bit of time. There’s no hard and fast rule here and it might not matter anymore but I would wait at least 2 weeks. This is to avoid the step transaction doctrine although I’m not sure how much that’s ever been enforced for backdoor contributions.

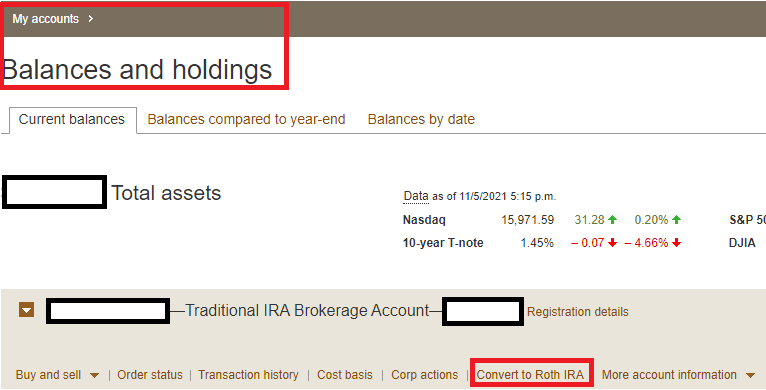

- Convert the tIRA money over to your Roth IRA.

Vanguard makes this conversion process very simple as they have “Convert to Roth IRA” link right on the balances and holdings webpage.

Complete Backdoor Roth Contributions

Same situation as above but perhaps you’ve made only some of your intended tIRA contributions for the year or you haven’t done the conversion step.

Complete Mega Backdoor Roth Contributions

You’ve got after tax money in your qualified retirement plan, get it into your Roth! Per the language in bill summary it says that after-tax contributions made after December 31, 2021 can’t be converted to a Roth. That implies that you might be able to complete the mega backdoor transfer in 2022 (or beyond) on those older 2021 and early after-tax contributions.

Personally, I’m not going to screw around with it and will be completely my mega contribution before the end of the year. The language seems open to interpretation and I don’t want to risk that money getting stuck because of it.

Follow my step by step guide if you aren’t sure how to do that.

Backdoor Roth and Mega backdoor Roth are Closed – Now What Do You Do?

Hopefully you’ve had a chance to breath deeply, calm yourself. Let the rage subside. Or…

I’m all about trying to stay level headed and focusing on what you can control. The bill has passed and what’s done is done. With those options closed, what options do we have to save and invest wisely towards FI? Let’s explore that once you buy a new keyboard and monitor.

Turn Off After Tax Contributions

This could apply to both your qualified plans (401k, etc) or your IRA but make sure that if you have some auto deductions / transfers in place that you turn them off by December 31st.

It sounds like these after tax contributions to retirement accounts will still be allowed in 2022 but I’m not sure why you’d want to do that. You have no tax advantages (after tax), your money is stuck in a retirement account (harder to access) and you can’t get it into a Roth.

It’s stuck there until you pull it out of your IRA one day (likely after 59.5 years old) where it’s going to be subject to the pro-rata rule. Any gains on your after-tax investments are considered pre-tax and are taxed as ordinary income.

Are Normal Roth Contributions (“Front Door”) Really Shut For You?

Nobody really calls regular contributions directly into a Roth as the front door method but that’s effectively what it is in relation to the backdoor options. To contribute directly to a Roth you need to have earned income and overall income that’s under the income limits.

For 2022 the income limits have been raised for those that want to make a standard Roth contribution:

- Single Filer: Can contribute fully to a Roth at $129k or less of MAGI, fully phased out at $144k

- Married Filing Jointly: Can contribute fully to a Roth at $204k or less of MAGI, fully phased out at $214k.

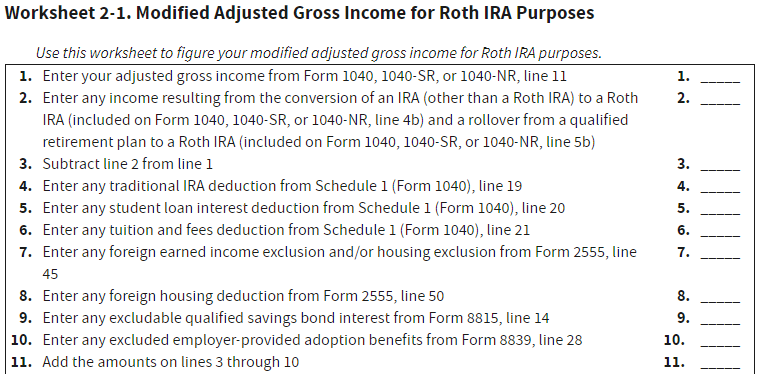

The important nuance here is that these limits are based on Roth Modified Adjusted Gross Income (MAGI) specifically. This gets very confusing because there are multiple formulas for determining MAGI so make sure you use the one specifically for the Roth.

The simplest ways to reduce your adjusted gross income and therefore your MAGI are to contribute to pre-tax savings accounts such as your qualified retirement account (401k, etc) and an HSA.

For example, for a married couple filing jointly in 2022 they’ll be able to contribute up to the following:

- $20,500/ea in their 401k/403b/TSP = $41,000

- $3,650/ea or $7,300 total as a family to HSAs

That means that they’d be able to make $252,300 together for 2022 and still be able to contribute the max each to a Roth IRA! $252,300 – $41,000 – $7,300 = $204,000 (Roth income limit). That’s the simple stuff. Capital losses can also reduce your AGI.

Looking at the Roth MAGI worksheet there are even more things that could reduce your income. Consult your tax professional if you need help planning and figuring out what’s possible for you.

Invest in a Roth 401k/403b/TSP Instead

If your long term goals involve getting a money into a Roth then you should look into whether your employer offers a Roth option to their retirement plans.

Some let you split the money between plan types so that you could do $8,000 in a traditional 401k and $12,500 in a Roth 401k in 2022, for example. That could be a nice compromise if you want to invest some pre-tax and some post-tax. A Roth 401k would still be able to be rolled into a Roth IRA in the future.

Invest Using A Traditional Brokerage Account

It’s easy to get excited about all the different retirement accounts with special tax treatment and forget about the humble brokerage account!

Brokerage accounts are after tax investment accounts that are offered by a variety of different companies. Vanguard, Schwab, and Fidelity are the big ones but there are plenty of smaller new players such as M1 Fiance, Robinhood and Webull.

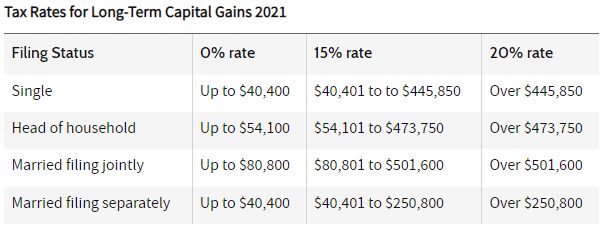

You invest in stocks, mutual funds, ETFs or crypto with your after tax money and when you sell those securities you pay taxes (booo). If you hold the security you buy for one year or less they are taxed as short term capital gains which are taxed as ordinary income. However, if you hold them for a year and a day or longer they get special long term capital gains tax treatment.

Magical Long Term Capital Gains

What’s magical you ask? Well if you’re married filling jointly it means that you can pay $0 in long term capital gains on all taxable income less than $80,800.

For example, let’s say that you invested through the years buying stock index funds for an average price of $100/share. Many years later you were able to sell those index funds for $500/share. That’s a $400/share capital gain when you sell it.

If you’re a married couple filling jointly with a standard deduction of $25,100 then how much in index funds could you sell and pay zero tax?

- $25,100 standard deduction is taxed at 0% for long term capital gains (LTCG)

- $80,800 is taxed at 0% for long term capital gains

- $105,900 of LTGC’s are tax free for this couple.

However, that’s not what goes into their bank account. If they wanted to sell as much as possible and pay no tax they would sell $105,900 / $400 (gains/share) = 264 shares.

264 shares @ $500 (current price) /share = $132,000. Tax free.

The other key is that brokerage account funds can be accessed at any time. No special steps required to use that money before 59.5 years old.

Action Steps:

- Make sure you take action on closing out any backdoor contributions for 2021.

- If necessary, stop auto contributions of after tax money into your qualified retirement accounts and IRAs.

- Check if you’re able to still contribute to a Roth directly.

- Invest in other after tax vehicles like a brokerage account or real estate.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.