BLUF: A mega backdoor Roth rollover is a powerful way to get a boatload of money into a Roth account for those that have a 401k/403b/457 plan that allows it. You can go well beyond the $6k limit in 2021 up to as much as $38.5k extra a year.

Why I Wrote this Article

The Mega Backdoor Roth, or MBR for short since we’ll use that phrase a lot, is not a new invention. I can’t find an exact “discovery” date but people in the personal finance and FI communities have been talking about it at least since 2014. However, like many people, I didn’t know what I didn’t know until I read an article telling me about the MBR and I realized the power of it.

What I didn’t find, though, was a detailed article showing me step by step how to figure out if it my 401k made the MBR possible, how to contribute to the after tax 401k and then how to execute the rollover. This article provides a detailed example of how with Fidelity and Vanguard I was able get $20k+ (a partial year) into my Roth and will continue to do so over the next few years. I’ll show how I researched that the MBR was possible with my company 401k plan, what accounts I needed to open and how I got the money into the right accounts.

What is a Roth IRA, Backdoor Roth and Mega Backdoor Roth?

Roth IRA

A Roth IRA is a fantastic option for many as a part of their retirement plan. It allows you to contribute after tax money into the account that then grows tax free until you’re ready to use it. The biggest downside for most is the low contribution limit of $6k in 2021 or $7k if you’re 50 and over. Not exactly enough to retire early on unless you’re a special private investing wizard like Peter Thiel who ended up with $5B in his.

Backdoor Roth IRA Contribution

A backdoor Roth is really a shortened name for a backdoor Roth IRA conversion. Contributing directly to a Roth IRA is the front door and this is a backdoor option to get around pesky income limitation of a Roth IRA. You see, the government doesn’t think you should be allowed to contribute to a Roth if you make too much money. In 2021 you can only contribute the full amount if a single filer has a modified AGI of less than $125k and a married filer is less than $198k1. Above those income levels the amount you can contribute reduces until it phases out complete.

A backdoor Roth conversion is a way for people with incomes above the previously mentioned limits to still get money into a Roth. They can contribute directly to a traditional IRA with the same contribution limits as a Roth IRA, convert those funds into a Roth IRA and pay the taxes owed. Aren’t loopholes fun?

Mega Backdoor Roth (MBR)

If a backdoor Roth is a cool loophole to contribute to a Roth when you otherwise couldn’t then a MBR contribution must be downright badass, right? Only if you think being able to put $38,500 a year into your Roth is badass. The MBR is essentially the company sponsored version of the backdoor Roth contribution as it only applies to people that have 401k or 403b plans through their employer.

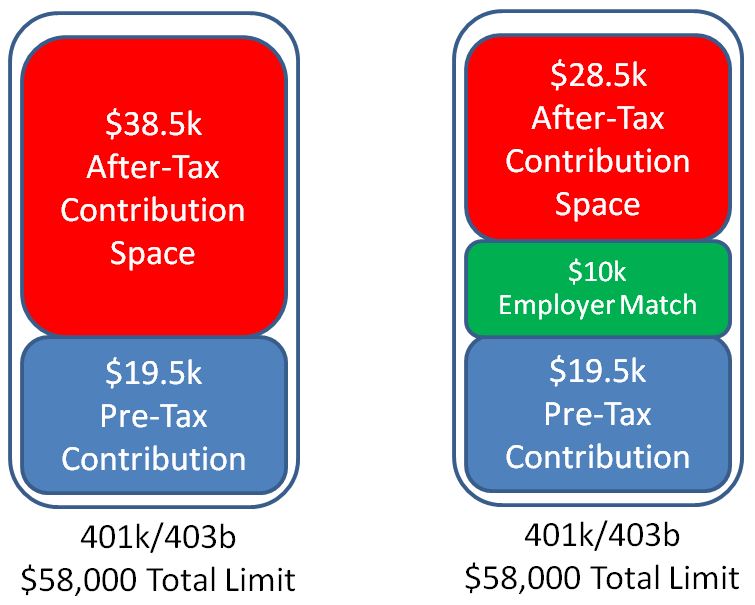

How is that possible? Well there are multiple annual contribution limits on a 401k. The employee contribution is capped at $19,500 for 2021. However, there’s also a much higher annual limit of $58,000 on total contributions between you, any employer matching and after tax contributions. Similar to retirement account contributions there’s a higher total limit of $64,500 if you’re 50 and older. In the future you can find the current limits with the IRS here.

Any space left between the total limit of $58k, what you contribute to the plan and what your employer contributes is an opportunity to use the MBR. In that extra space you can contribute after tax funds into a separate part of your 401k/403b. That money will eventually be rolled out of your 401k/403b and into a Roth IRA.

In the images below you can see a couple of examples of this. On the left, if you max out your 401k and don’t get an employer match then you have the red area of $38.5k available to contribute to after tax. On the right, the same scenario except with a $10k employer matching contribution. That eats into the $58k limit and you have $28.5k left to contribute after tax.

How Does a Mega Backdoor Roth Work?

Let’s get into the details of whole this MBR process works. However, before we get to deep let’s see what is required to do it.

Is the Mega Backdoor Roth Possible for You?

Before you get too excited at the prospect of this mind blowing option, time for some real talk. Unfortunately there are some requirements to be able to take advantage of the MBR and not everyone can take advantage of this.

- You must have a 401k or 403b account.

- After tax contributions must be allowed by the plan administrators of that account – This doesn’t mean a Roth 401k, this is a special separate bucket that gets contributed to post-tax. It’s really no different then getting your paycheck and depositing it into a brokerage account only that it happens automatically from your paycheck.

- In-service withdrawals must be allowed by the plan administrators of that account – This means that your plan must let you get the money out of the 401k while you’re still working (in service). You technically could do the MBR without this but as you’ll see in a bit a little bit of the value goes away.

More details below on how you figure out if your plan allows it when we get into the step by step portion.

How does the Mega Backdoor Roth Work?

So what is the process for executing a MBR? At a high level:

- Turn on after-tax contributions for your 401k/403b. You usually choose a percentage of your gross paycheck that you’d like to contribute.

- Money is then taken out of your paycheck and invested in funds of your choosing but in a special after tax bucket that is separate from your tax advantaged money. You should have the same investment options to invest the money in as you would in your pre-tax 401k account.

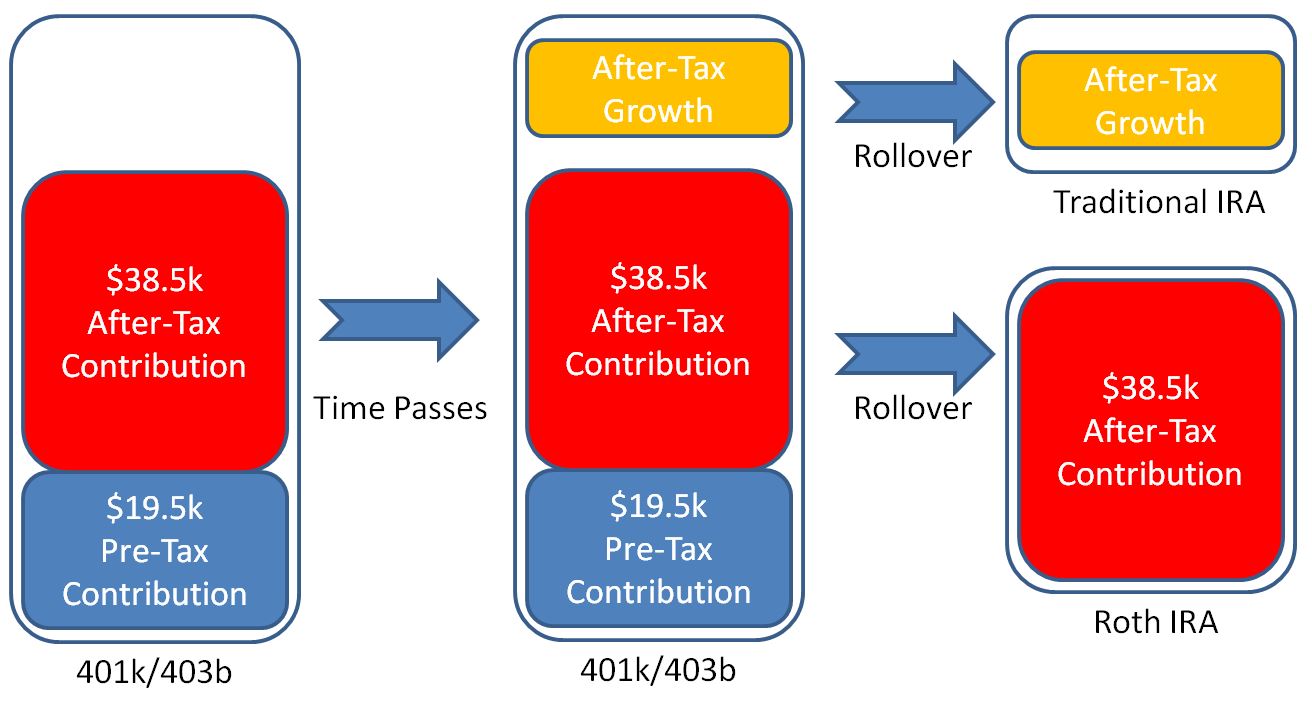

- After some amount time you do an in-service withdrawal rollover the after tax funds from your 401k to separate Roth and traditional (tIRA) accounts. Your after-tax contributions roll directly to the Roth. Any growth of your after-tax investments (gains) have to be rolled into a tIRA.

Step three is where the magic happens. You’ve taken this huge chunk of money ($38.5k in the above example) and rolled it into a Roth IRA. That $38.5k is on top of the normal $6k that you’re allowed to contribute.

Technically you could contribute zero or very little to the pre-tax 401k and use up all of that $58k space for a MBR but I can’t think of many instances when you’d want to do that. Perhaps someone approaching early retirement that has all their money tied up pre-tax and needs to pump up their Roth fast.

Notice that the growth needs to go to a separate tIRA account. This is a little odd since technically you took money that was already taxed, it grew, and now it’s going into a tIRA where it is treated as pre-tax. Meaning that it will be taxed as ordinary income when withdrawn in the future. Double taxation? No thank you.

It’s for that reason that it’s advantageous to get the after tax money out of your 401k as fast as possible before it can grow if you’re doing a MBR. Unfortunately your ability to do this is very plan specific. In my 401k plan if I do an in-service withdrawal then I’m locked out from contributing OR making another withdrawal for 3 months. As such, I’m going it once a year. Some people have the ability to do in-service withdrawals with every paycheck. You need to read your plan documentation to how it works for you.

Executing a Mega Backdoor Roth – My Step By Step

Time to walk through each step of what is required to figure out what you can do with your plan and execute a MBR rollover.

Step 1: Do you have a 401k or 403b plan?

Hopefully you’ve figured out by this point that this strategy only applies to 401k and 403b accounts. Sorry, but you’re out of luck on this loophole if you don’t have one of those accounts.

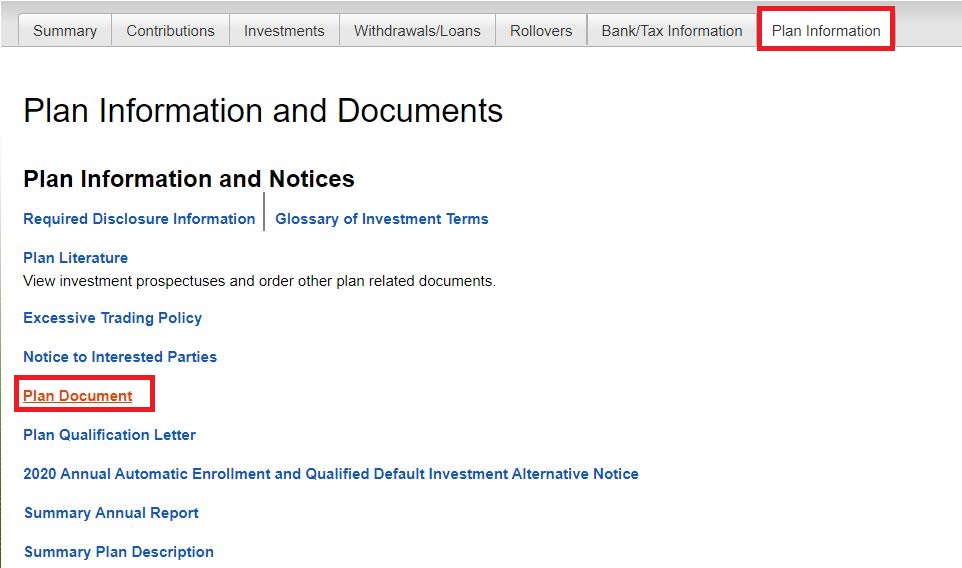

Step 2: Download your plan documentation

Yes, it’s dry, boring and is written like a legal document but your plan document is the final word on what you can and cannot do with your 401k.

Have insomnia? Read your plan document and you’ll be snoring in no time. No counting sheep required.

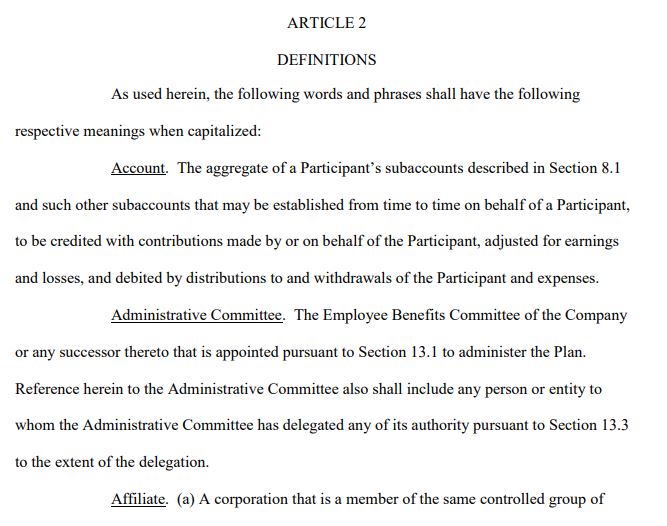

Step 3: Does your plan allow after tax contributions?

It was pretty explicit in my document that after tax contributions are allowed as it shows up clearly in its own section.

Step 4: Does your plan allow in-service distributions?

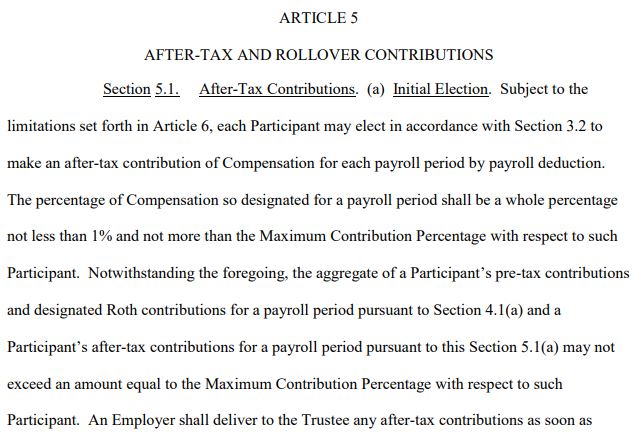

This is key to know including any details about how often you can make a distribution or withdrawal. I found a nice table in other plan documentation that laid out the details. In my case, yes they are permitted but only once every 3 months.

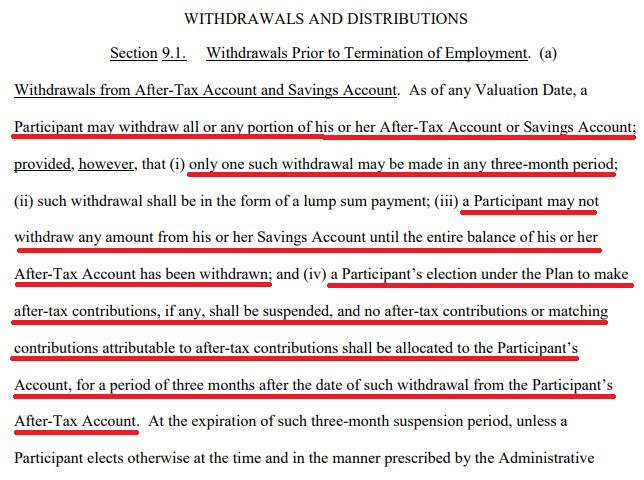

However, when you look into the fine print in the plan document you find out that there are a couple of caveats:

- If you withdraw after tax money then you need to take it all out. No big deal for me and I can’t think of when this could cause an issue.

- You are locked out of after tax contributions for 3 months after the withdrawal.

#1 is no big deal. #2 does impact me. With a 3 month lockout period I can’t do a withdrawal too often so I chose to do it yearly. It also means that I need to contribute all my after tax funds for the year into a 9 month window since I’ll be locked out of contributing for the other 3 months.

Step 5: Setting up after tax contributions

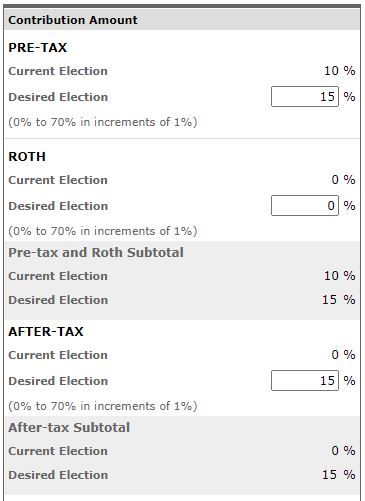

Fidelity makes the contribution selection very straightforward and breaks it out into pre-tax and after-tax buckets. The percentage selected for the after-tax contributions is still based on my gross income. For example, if you make $100k a year gross then if you select a 15% after tax contribution then you’ll have $15k / year taken out.

Figuring out how much to take out per paycheck was a little trickier in my case because my plan locks out contributions for 3 months after an in-service withdrawal. Because of that, I needed to fit all contributions into a 9 month window, not a 12 month window.

To contribute $20k from a $100k salary over a 9 months window you need to contribute ($20k/$100k)*(12mo/9mo) = 26.67% of your gross salary.

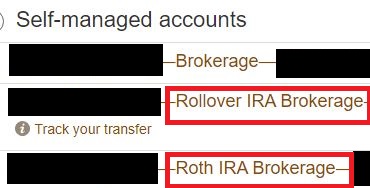

Step 6: Making sure the destination accounts are created

In my case at Vanguard I already had a Roth IRA so I opened up a separate tIRA.

Step 6: Making the in-service withdrawal

This had to be done by phone since my 401k is with Fidelity and the rollover was going to accounts with another company. I found out that if my Roth IRA and tIRA had also been with Fidelity that this rollover could have been done electronically although over the phone was very easy. The agents know what this MBR is (although it’s not called it) so it was easy to do. Fidelity charges $20 for each withdrawal.

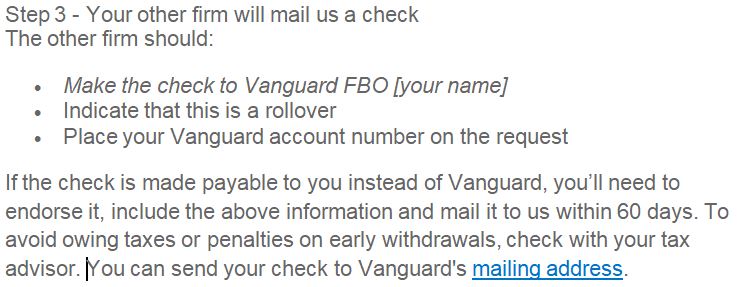

Since the money is going to two different accounts they physically send two different checks. When you call to do the in-service withdrawal it’s important to label the checks with whatever information the receiving institution (Vanguard in my case) wants. On their website they mention what they’d like the Vanguard account number on the check but Fidelity refused to do that for security reasons.

Not having the account number didn’t cause any issues and I was able to use mobile check depositing with the Vanguard app to deposit both checks fine.

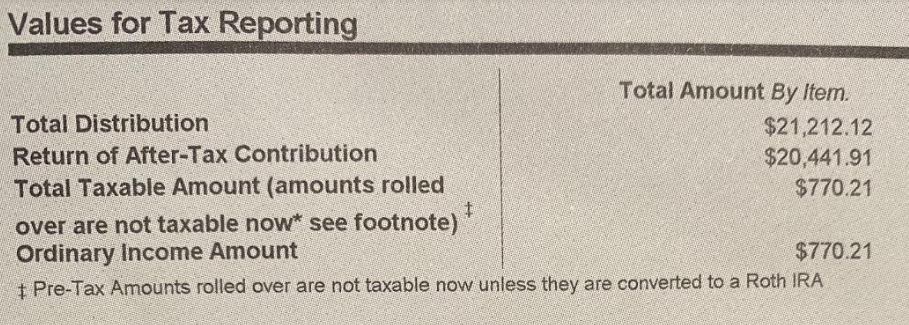

Below you can see the details of what was distributed to me by Fidelity. In my case my after tax contributions, check #1 for $20,441.91, went to the Vanguard Roth IRA. Check #2 for $770.21, the after tax gains, went to the Vanguard IRA account as pre-tax income. No taxes are required to be paid until the future when I withdraw the money from the tIRA.

After my In-service Withdrawal

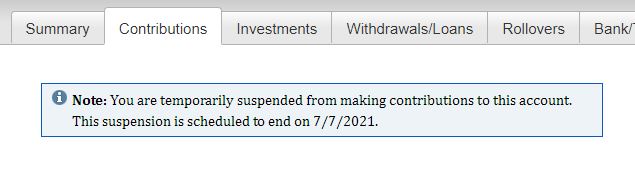

One thing to be aware of was that in my plan, after I did my in-service distribution two things happened:

- My after tax contributions stopped for 3 months per plan rules.

- I couldn’t change my contribution amounts for 3 months. The message below is misleading because my pre-tax contributions kept going. Only my after tax contributions were stopped.

Your mileage may vary based on your plan rules.

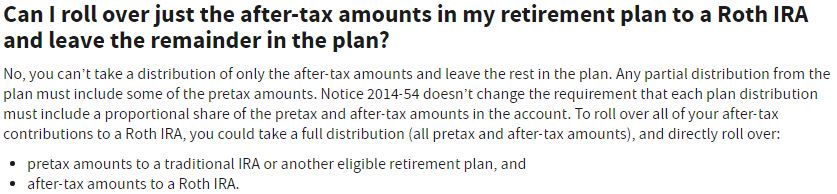

IRS Notice 2014-54 and the Pro Rata Rule

IRS Notice 2014-54 is a clarification that formally OK’d that plan administrators could do what’s described here and cut separate checks for pre / after tax amounts and let you roll them over into the desired accounts.

That notice, though, doesn’t provide any clear exceptions to the pro rata rule to let you distribute only the after tax money as is the case with the MBR. This IRS website actually addresses this question directly.

On the surface, it seems like the MBR shouldn’t work unless you roll over your entire account which isn’t possible while still in service. However, a well respected financial expert, Michael Kitces, has weighed in on this exact topic in this article.

Now, one partial exception to this rule is that if the plan separately accounts for the after-tax contributions and associated growth, it is possible to distribute and roll over just the after-tax and its associated growth but not the rest of the plan. In this case, the pro-rata rule would only apply to the separate accounting share.

Michael Kitces, Ongoing Roth Conversions Of In-Service Distributions From A 401(k) Plan To A Roth IRA

He’s stating that if your plan keeps that after tax money separate then the pro rata rule is still being applied, but only to the after tax portion of the account. That’s exactly what the MBR is doing when it splits off the after tax contributions to a Roth and the after tax growth to an IRA. You’re applying the pro rata rule to the after tax part of the account.

I can’t find any official IRS documentation that backs up what Michael is saying but our tax code is very complicated and I could have missed it. Anecdotally, many people have used the MBR and have not been hit with surprise tax bills courtesy of the pro rata rule.

Other things to note:

Some Plans have Better MBR Options

Some readers have also reminded me that they some plans have even better options for the MBR. For example, some plans will let you take your after tax contributions after every paycheck and automatically roll them into a Roth. Wow, that’s a sweet deal. In that situation you never have gains to worry about and you can avoid the two check approach outlined in this article.

MBR Rollover Money is Accessible Right Away

This MBR rollover is not a conversion like the Roth conversion ladder where there is a 5 year waiting period before the money can be touched. It’s a rollover of contributions so the money can be withdrawn tax free at any time.

Action Steps:

- Review your 401k / 403b /457 plan documentation and see if the MBR applies to you.

- If so, consider doing it! While a brokerage account is also very flexible and tax free at low income levels the Roth has tax free growth at any income level.

Like the content? Click here to subscribe to the e-mail list and have the articles delivered to your inbox.